Monex Group Inc. has published finalised figures for the company's performance in Q2 and Q3 2014. As reported by Forex Magnates last week, the preliminary results showed a widespread year-on-year decline in revenue and operating income across all business units.

Monex revised its preliminary total operating revenue figure of ¥22,800 million up to ¥23,038 million (~$212 million). The company's costs and expenses were unchanged and the reported quarterly net loss of ¥304 million also remains unchanged.

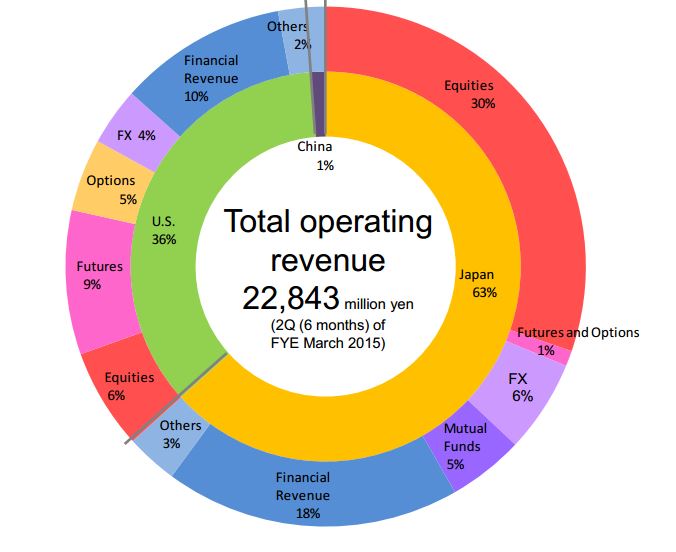

Regional Operating Revenue & Business Diversification: Source: Monex Group Inc

The sharp fall in the Group’s overall performance is also reflected in the results of Monex Inc. – the Japanese-based subsidiary offering retail FX trading services. The comparatively better performance of Monex Inc. compared to Monex Group means that Monex Inc. now accounts for approximately 65% of the company’s total revenue.

On the flip side, Monex reports higher levels of client deposits, segregated capital and monies held in trust accounts. Client deposits rose from ¥53,193 million to ¥62,590 million and segregated capital rose from ¥192,897 million to ¥221,792 million.

TradeStation

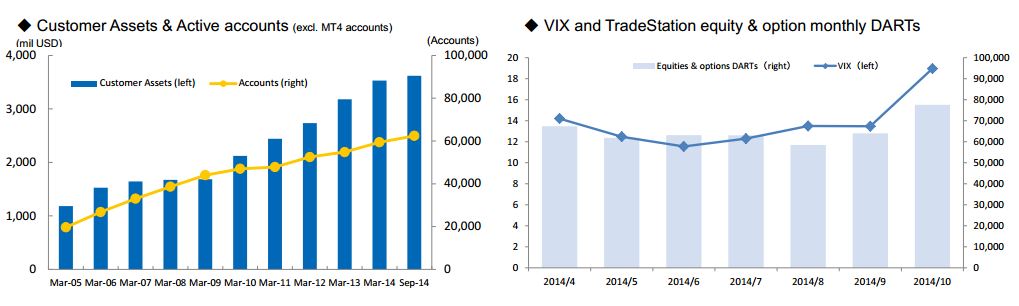

"With a steady increase in customer assets and the number of accounts, TradeStation

remains competitive," said Monex Inc in an investor presentation. Adding, "TradeStation regards its brokerage business primarily of Equities as its core revenue source, and plans to increase option trading, which has high profitability and strong potential for growth. Since October 2014 with the rise in market Volatility , TradeStation’s customer activity has

rapidly improved."

In an admission of tough retail FX times, Monex stated: "In the midst of lower currency volatility and excessive competition and concerns about future business profitability, we transferred MT4 retail accounts offered under the name of IBFX to FXCM Holdings, LLC and consolidated services onto TradeStation FX for greater competitiveness."

Global Vision

As part of the company's "Global Vision" initiative, Monex wants to "geographically expand business areas through Mergers and Acquisitions (M&A) in Hong Kong and the U.S." The initiative's broader goal is to deliver differentiated products and services among all Group companies to be offered to retail investors globally. Monex also hopes to diversify revenue sources by expanding its B2B business and offering white-label solutions to third party companies.

Assuming flat business conditions continue and a host of firms struggle with balancing costs with revenues, industry consolidation is a topic likely to be revisited many times in 2015.