GO Markets, an Australian-based provider of FX and CFD trading services, has announced that the firm is branching out into offering gold bullion for investment, trading, storage and/or delivery purposes.

With spot gold prices dominating the attention of CFD traders, the underlying fundamental factors that drive gold demand are now most noticeable in the physical gold bullion market on which the derivatives parade of CFD/futures/forward products is based.

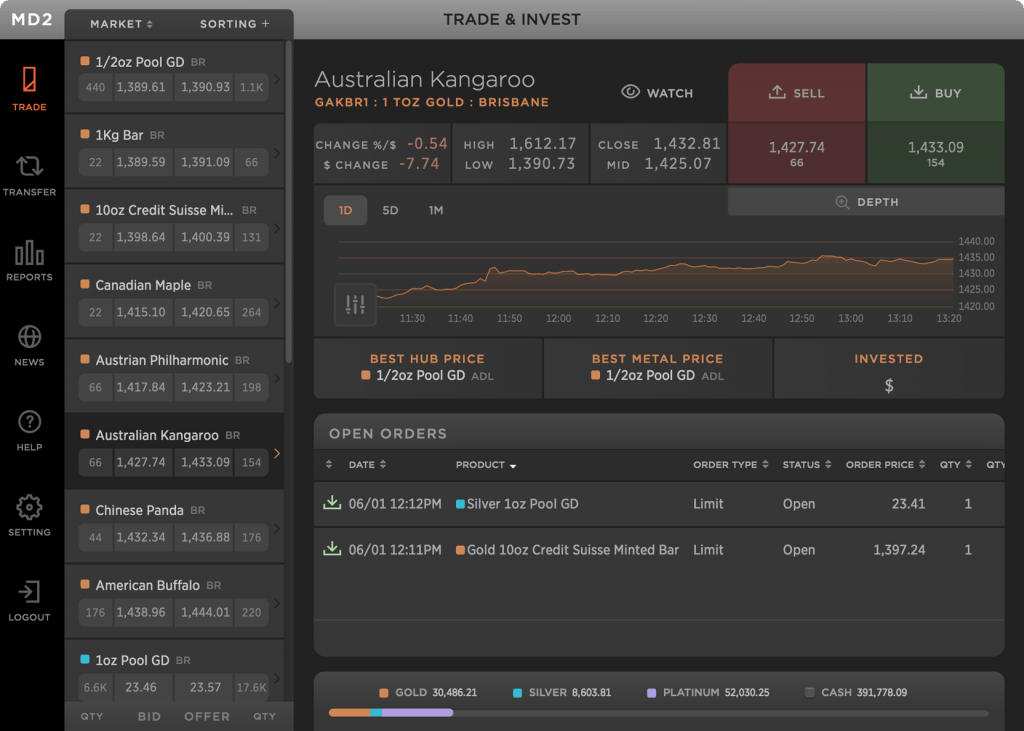

The newly launched service aims to complement the firm's existing product line up consisting of spot FX, commodities and equity index CFDs via MetaTrader 4. The company is headquartered in Melbourne, Australia, having been established in 2006. To hit the ground running, GO Markets will partner with a prominent name in the broking industry - Bullion Capital. The company specialises in secure physical bullion trading, storage and delivery via its proprietary Trading Platform , MetalDesk 2.

All bullion purchased through 'Physical Bullion' will be allocated and transacted as a tangible transaction with legal title remaining with the client at all times and changing hands each time a trade is made. Buyers can choose to securely store their gold holdings in secure storage facilities located around the globe in Australia (Sydney, Brisbane and Melbourne), Singapore, Shanghai, Hong Kong, Bangkok, Dubai, London, Zurich and New York. Clients are welcome to take delivery of any and all investments they make including kilogram bars and 1 oz coins with various printed motifs.

Complementary not Substitutionary

Christopher Gore, Director at GO Markets

In an interview with Forex Magnates, GO Markets Director, Christopher Gore said, "Although our focus remains on our CFD and Forex offerings, it’s clear the demand for physical gold is strong and likely to be sustained. While there’s a vast difference between metal derivatives and physical ownership, we see our new offering as complementary to our suite of CFD and FX instruments." Adding, “The premiums seen in the physical market is testament to robust underlying demand, and to offer a cost-effective outlet to deal in the physical is a real value add for our clients."

In addition to gold, GO Market clients have the opportunity to buy/sell silver and platinum for physical delivery as well. All three metals have been in focus as they are all correlated, act as strong stores of value but can be sensitive to global macro-economic changes, especially in the short-term. Mr. Gore considers physical gold bullion more as a "long-term investment" that helps customers diversify their existing short-term trading activities rather than a vehicle for speculative trading purposes.

MetalDesk 2

GO Markets offers a demo version of its new platform where users can experience the unique trading experience before committing actual funds. Once opening an account, clients are able to trade both the spot gold CFD price as derived from futures markets via GO Market's existing platform and trade physical gold bullion via its new offering.

The combination offers a unique set of trading opportunities for traders due to a prevailing 'disconnect' between paper spot gold prices and prices for physical bullion.