Online foreign Exchange and CFDs brokerage FXCM has posted its third quarter results this morning. The firm’s trading revenue from continuing operations was $57.8 million, which is 3 percent higher than the $56.2 million for the same quarter last year (U.S. GAAP).

The company reported that the net revenues from continuing operations amounted to $61.4 million. The bottom line for FXCM during the third quarter of the year is a net loss of $35.8 million, which includes a $27.0 million non-cash net loss on derivative liabilities related to the agreements with Leucadia National.

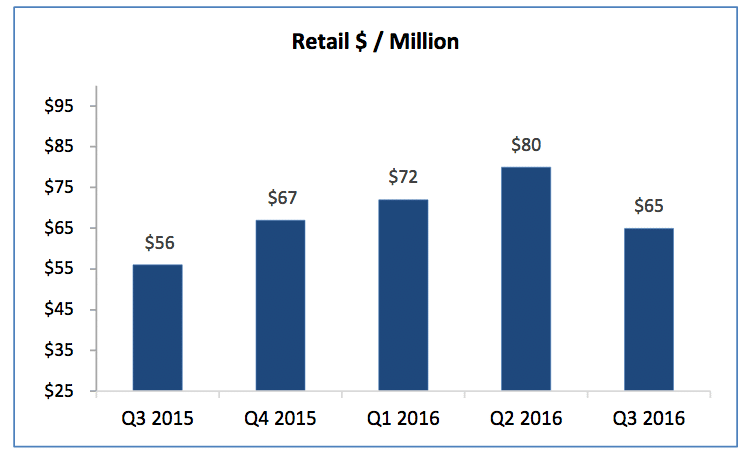

The company’s net revenues from discontinued operations totaled $8.8 million with a net loss of $3.3 million, or $0.59 per diluted share. During the third quarter the Retail Trading revenue per million (RPM) totaled to $65 per million traded. The figure is substantially higher than last year's Q3 number of $56 per million.

FXCM Retail Revenues per Million, Source: FXCM

FXCM Inc’s (NASDAQ:FXCM) adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) from continuing and discontinued operations totaled $6.4 million during the third quarter of 2016.

The company reported a substantial in client equity - a 10 percent increase when compared to the end of the second quarter was registered to $725 million. The figure is also higher by 6 percent when compared to December 31st, 2015.

FXCM maintained a very strong cash position of $227.6 million and reported a regulatory surplus of $90.9 million at the end of September 2016.

The brokerage reported a U.S. GAAP net loss from continuing operations totaling $35.8 million (which includes a $27.0 million net loss on derivative liabilities related to the Leucadia bailout deal). The figure compares to a net income of $64.3 million (including a $137.6 million net gain on derivative liabilities) for the same quarter last year.

Looking at the longer term, FXCM’s trading revenues for the first nine months of 2016 totaled $196.6 million, which is 6 percent higher than last year’s $184.7 million. The net income attributable to FXCM Inc. from continuing operations was $85.9 million when compared to a net loss os $427.9 million for the first nine months of 2015. The figures that into account a $200.4 million net gain on derivative liabilities related to the Leucadia deal for the nine months ended September 30, 2016 and a $254.7 million net loss for the nine months that ended in September 2015.