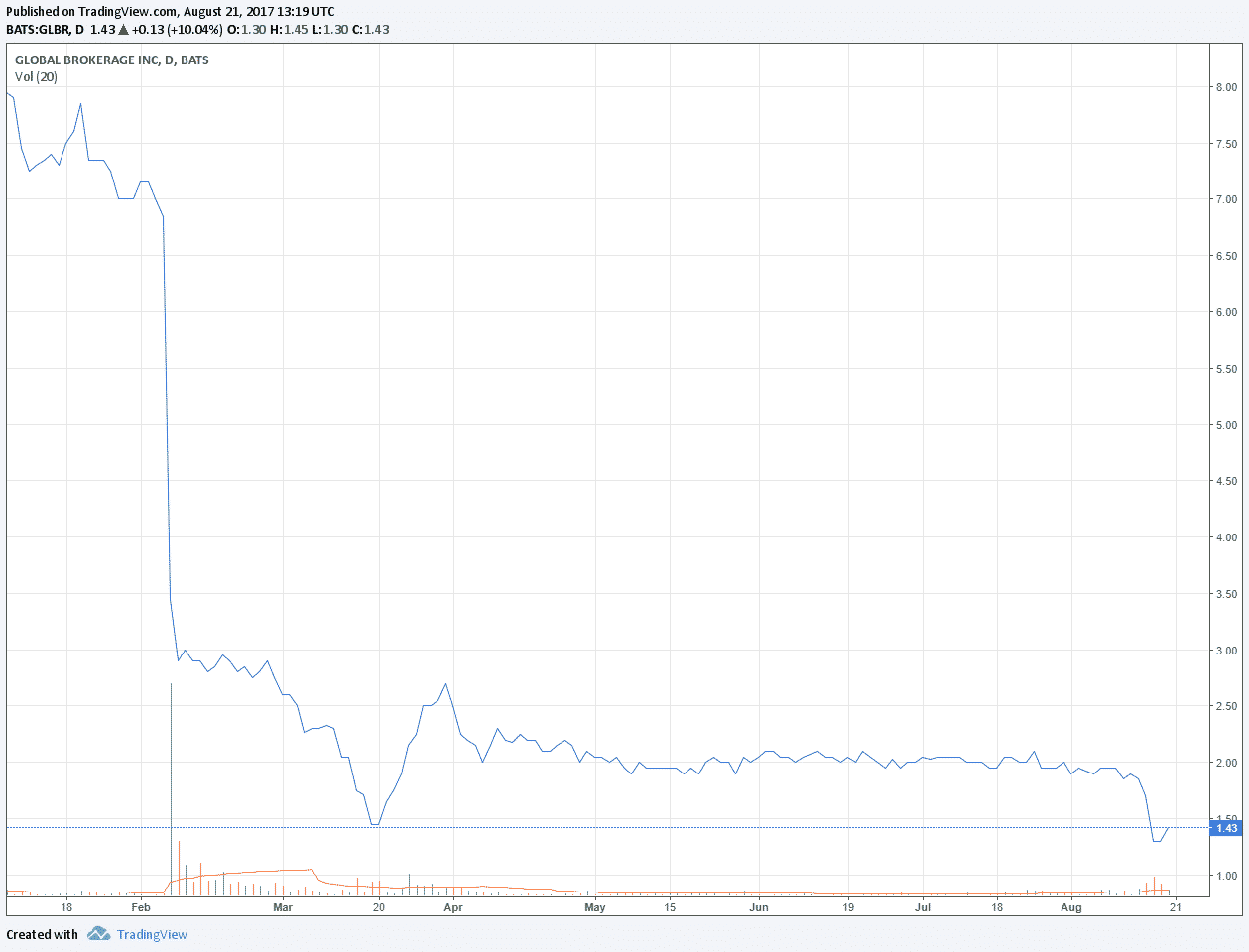

FXCM Group seems keen to protect its brand after the stock of its parent, Global Brokerage Inc (NASDAQ:GLBR), tumbled to a new record low earlier last week, and also after GLBR reiterated the possibly heavy consequences of the eventual delisting from the Nasdaq Stock Market due to the low market value of the firm.

FXCM today issued a corporate statement to clarify its relationship to Global Brokerage and also clarified some already known details about paying off its loan to Leucadia (NYSE:LUK).

[gptAdvertisement]

The company received $46.7 million for its stake in FastMatch last week, which now leaves $66.8 million outstanding on its original Leucadia loan from a couple years ago.

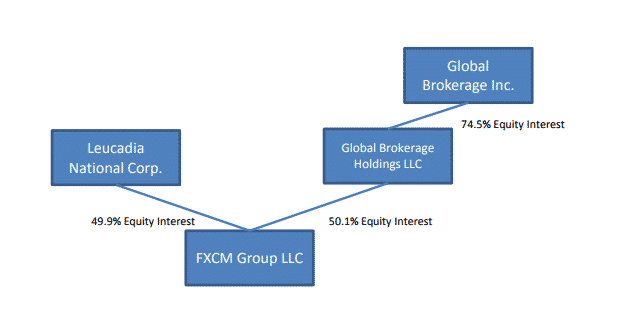

FXCM holding sturcture

Back to the statement, FXCM said that Leucadia currently holds a 49.9% equity interest and up to a 65% economic interest in FXCM. In addition, GLBR is a shareholder of FXCM with 50.1% equity ownership and a minority economic interest.

The most interesting point was FXCM claiming that any adverse developments at GLBR have no impact on the FX brokerage firm or its ability to service customers. More specifically, FXCM said that it has no responsibility for GLBR’s obligation and that its only debt is the loan to Leucadia, which it has recently taken one step closer to repaying with the sale of FastMatch.

GLBR Stock Feb-Today

Jimmy Hallac, Managing Director of Leucadia and Chairman of FXCM Group, commented: “Leucadia continues to work hand in hand with FXCM management. We are optimistic about what we can achieve together and re-affirm our long-term commitment. FXCM has had solid operating performance in a challenging market environment and has come a long way in reducing its debt and strengthening its balance sheet. Customers should feel confident trading with FXCM as their FX and CFD provider.”

Brendan Callan, Chief Executive Officer of FXCM Group, added: “FXCM is grateful for its partnership with Leucadia. Our customers, employees and stakeholders benefit greatly from the Leucadia affiliation, in particular our growing collaborative relationship with Jefferies.”