The UK subsidiary of one of the first retail foreign exchange brokers online, OANDA, has reported its bottom line for 2015 in a filing with the Companies House. The company has booked a loss on its operation in Europe totaling about $2.23 million (£1.54 million) due to the turmoil which the Swiss National Bank (SNB) caused on the foreign exchange market.

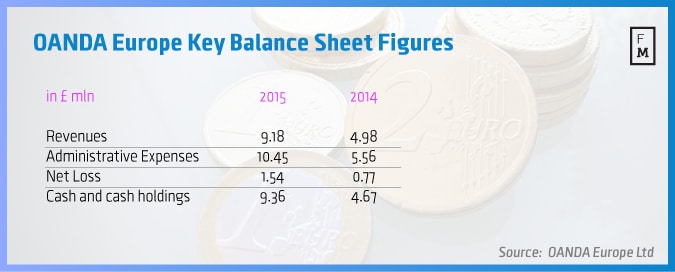

OANDA Europe’s bottom line for last year compares with a net loss of £779,000 ($1.12 million at current exchange rates) for the full year 2014. Total revenues for 2015 increased by 84 per cent when compared to 2014, amounting to $13.3 million (£9.18 million). The company has also issued a total of £2.3 million ($3.3 million) of new ordinary share capital to boost its coffers.

The brokerage was one of the companies in the industry that have executed the stop loss orders of its clients in CHF pairs at one of the highest rates in the industry. As a result, despite being a market maker, the company booked a net loss for 2015. Despite this, the prospects for the firm look positive as the company registered an increase in the number of active trading accounts and trading volumes.

Trading volumes have increased by 8 per cent to $154.7 billion, while the amount of active trading accounts has increased by 7 per cent to 9,739.

Throughout 2015 OANDA Europe continued its policy of additional investment in marketing and sales, which according to its annual report is the primary driver for the increase in key metrics. In addition the company states that OANDA Europe has marked an increase in license fees related to the use of OANDA Corporation’s Trading Platform .

New Trading Platform and Key Markets Targeting

OANDA intends to launch the next generation of its trading platform in the second quarter of 2016, aiming to revamp its solution and gain Leverage to attract more clients. The firm stated that it will remain focused on its key markets in Europe and in the Middle East via targeted PR, advertising and other promotional activities.

The European operation of OANDA is also aiming to increase its market share in the UK by the end of the year by between 2 and 5 per cent.

Recently, the company revamped its mobile trading solution and is the first retail brokerage to introduce support for the new 3D Touch interface found on the latest generation devices of Apple Inc - the iPhone 6s and the iPhone 6s Plus.