There is no successful trader in the world that does not have losing trades. There is no winning strategy in the world that does not take losing trades. These are truths that no one can argue with. Losing trades are a part of trading and that will never change. It is how we view them and use them that can make all of the difference to our whole trading experience.

Without the correct belief system in place you may come to doubt yourself and not take the next trade that presents itself

The aim of this article is to show you how to view losing trades in the correct way. It is my hope that this knowledge once internalized will change your whole trading experience to a much more relaxed one with fewer mistakes.

I am assuming in this article that you already have a trading plan and strategy in place which put the odds in your favor. The reason I am making this assumption is because if you do not have a strategy with a positive expectancy then having a losing trade does have meaning- it means you do not know what you are doing. Having a string of losing trades will just confirm that you do not know how to trade.

On the other hand, if you are trading a strategy that has a positive expectancy that you have tested and has proven itself over time, taking a losing trade has no meaning whatsoever.

How would you feel starting a new month with 6 losing trades in a row?

I will illustrate this with a number of examples based on flipping a coin. Say we have $10,000 and we flip a coin 20 times. If it lands on heads we lose $100 and if it lands on tails we gain $200. This strategy has a positive expectancy which will make you on average $50 every time you flip the coin [(200-100)/2 = 50]. It does not mean that you will not have losing periods. In fact you do not know how the results will be distributed as all. It is completely random. When training new traders I get each one to do this experiment and write down after every flip what they are thinking and feeling. This gives us some insight into how we view losing even when we know that the odds are in our favor and that we will come out on top in the end.

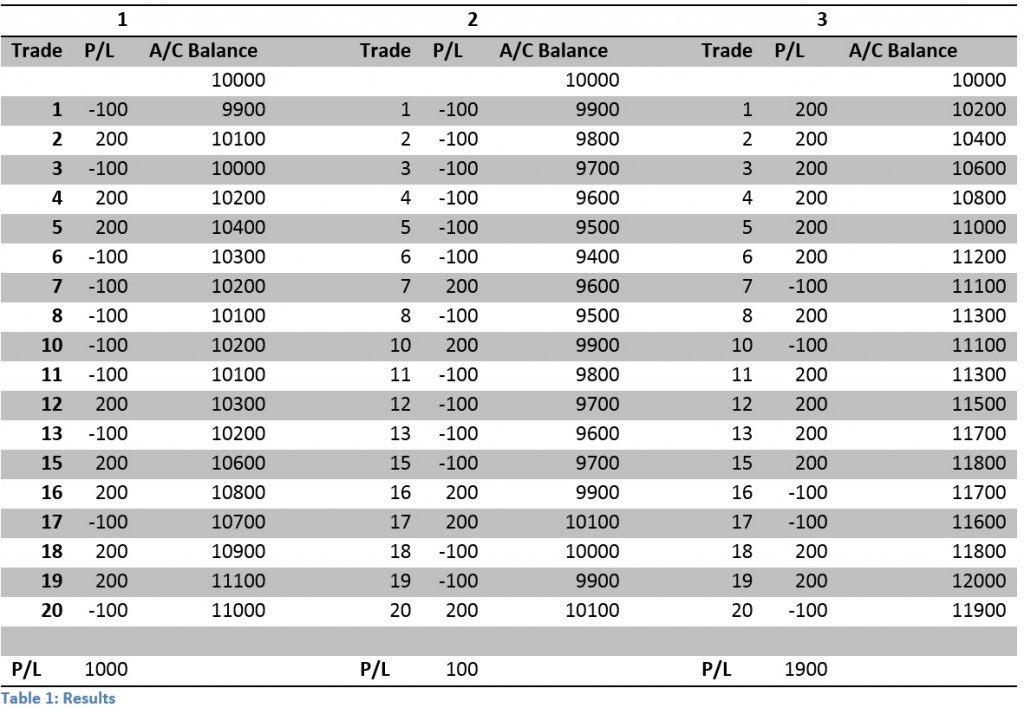

Please take a look at Table 1 below which shows 3 results of flipping a coin 20 times.

It is interesting to note that on result 1 we actually profited what we expected – 50 x 20 = $1000. Result 2 we only profited $100 and on result 3 we profited $1900. Over the 60 coin flips we actually profited $3000 which is in line with our expectations – 50 x 60 = $3000.

Now imagine you started your month trading with result 2. How would you feel starting a new month with 6 losing trades in a row? What most aspiring traders do is throw their hands up in the air and say that the strategy does not work and continue their search for the perfect strategy – which does not exist. For those aspiring traders it is a constant emotional roller coaster ride.

The correct response to a string of losing trades (when you are following a strategy that has been proven to have a positive expectancy over time) is to just continue trading your edge and over a large enough number of trades the odds will play themselves out in your favor. The only way to be able to do this without too much emotional stress is to internalize the concept that the result of any one trade or even a string of trades is meaningless. What counts is how you perform over the long run.

Over the 60 coin flips we actually profited $3000 which is in line with our expectations

Without the correct belief system in place you may come to doubt yourself and not take the next trade that presents itself and that was the trade that ended up being a big winner – which causes you more emotional pain.

Some trading months can be like result 1 – the average winning month, some can be small winning months like result 2 and some can end up being home run months like results 3 and some may end up being losing months. The point to remember is that we do not know how the results are going to be distributed. We have no control over the market but we do and should have control over ourselves.