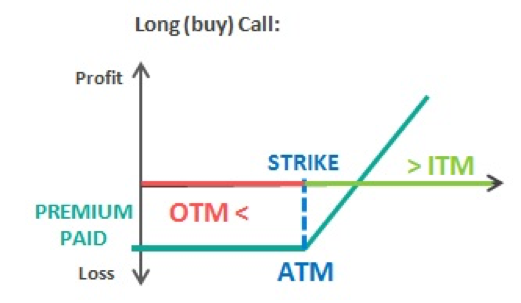

An option can be described as being in one of three states depending on the position of the market price with respect to the option's strike rate. If the market rate equals the strike, the option is at-the-money (ATM). If the market is better than the strike, the option is out-of-the-money (OTM). Finally, if the market is worse than the strike, the option is in-the-money (ITM).

Why does it matter? A key factor in determining an option's value is the market rate versus the strike. In-the-money (ITM) options are the most expensive and out-the-money (OTM) options are the cheapest. The more bullish you are when speculating the markets, the further out-of-the-money you can buy an option (and the cheaper it will be), which creates a highly-leveraged trade.

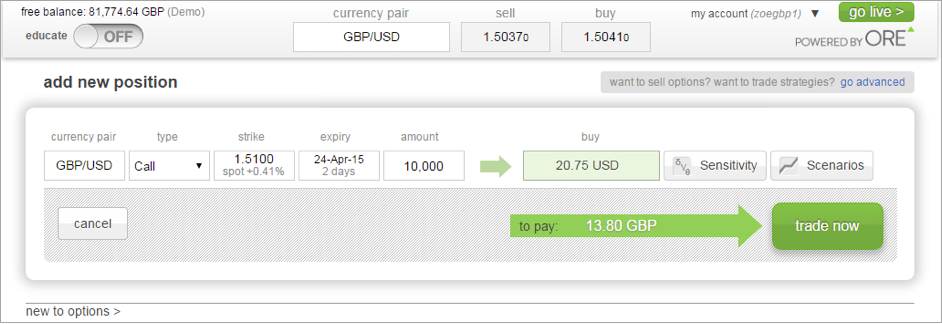

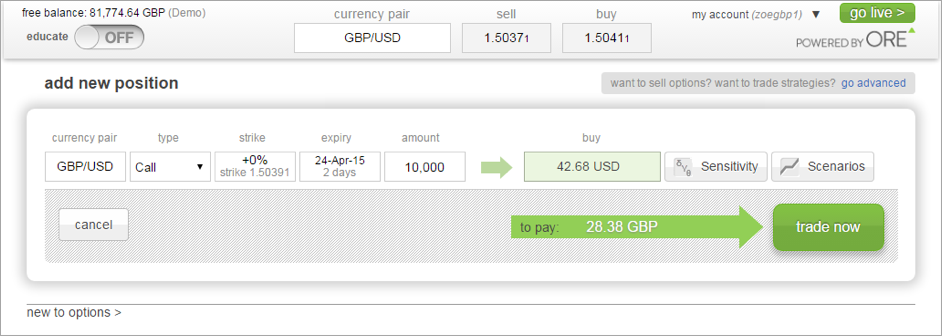

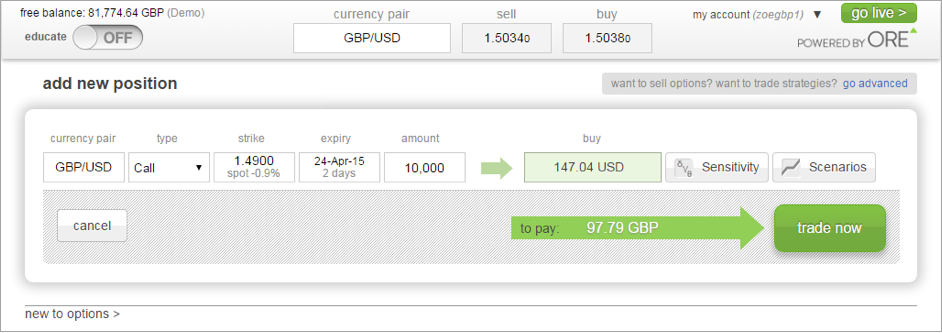

For example, below is a GBP/USD, 2-day call option in the amount of GBP 10,000 shown with three different strike rates. The underlying GBP/USD mid-rate was around 1.5040. Notice how the out-the-money (OTM) call with a 1.5100 strike is the cheapest option to buy at USD 20.75. However, for this option to payout by expiry, the GBP/USD market rate will need to rise more comparatively with the ATM and ITM options. The further away your strike, the further away your break-even point. However, you are risking less money in the trade.

OTM Option with strike rate = 1.5100 costs USD 20.75:

ATM Option with strike rate = 1.5039 (0% from market) costs USD 42.68:

ITM Option with strike rate = 1.4900 costs USD 147.04:

The state of an open option trade may change as the underlying market rate moves around. If you buy an at-the-money (ATM) call option and the market rises, then the call becomes in-the-money (ITM). Alternatively, if the market falls below the strike the call becomes out-the-money (OTM). The long call option payout graph below indicates the state of an option at different market rates.

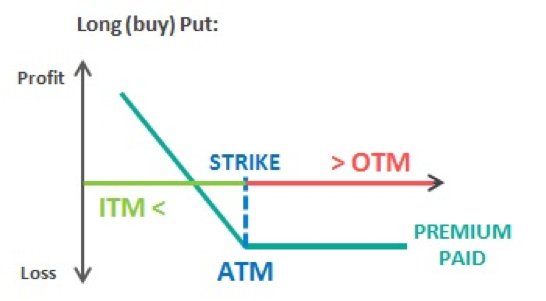

The state of Put options may also change as the market moves, but when you buy a Put you are positioned in the opposite direction compared with buying a call, i.e. if you hold a Put you want the market to fall. If you buy an at-the-money (ATM) Put and the market rises then the Put becomes out-the-money (OTM). But, if the market falls below the strike, the Put becomes in-the-money (ITM). The long Put option payout graph below indicates the state of an option at different market rates.

What happens at expiry? In the last article, Part 3 of the Options Game, we explained an option will only have value at expiry if its strike rate can 'beat' the market rate. If the strike is worse than or equal to the market, the option expires worthless. Hence, only ITM options will have value at expiry.

In Part 5 of The Options Game, Zoe Fiddes explains “The Time Value of an Option."

Previous articles: