BaFin, Germany's financial watchdog, names social media and finfluencers as leading market risks for 2026. The regulator shows that these channels push retail investors toward highly speculative crypto assets.

The annual risk outlook directly challenges brokers, as Germany's banking sector prepares to launch crypto trading services. The report directly warns: the main way to acquire crypto clients is now a top regulatory concern.

A Direct Link Between Social Media and Crypto Buying

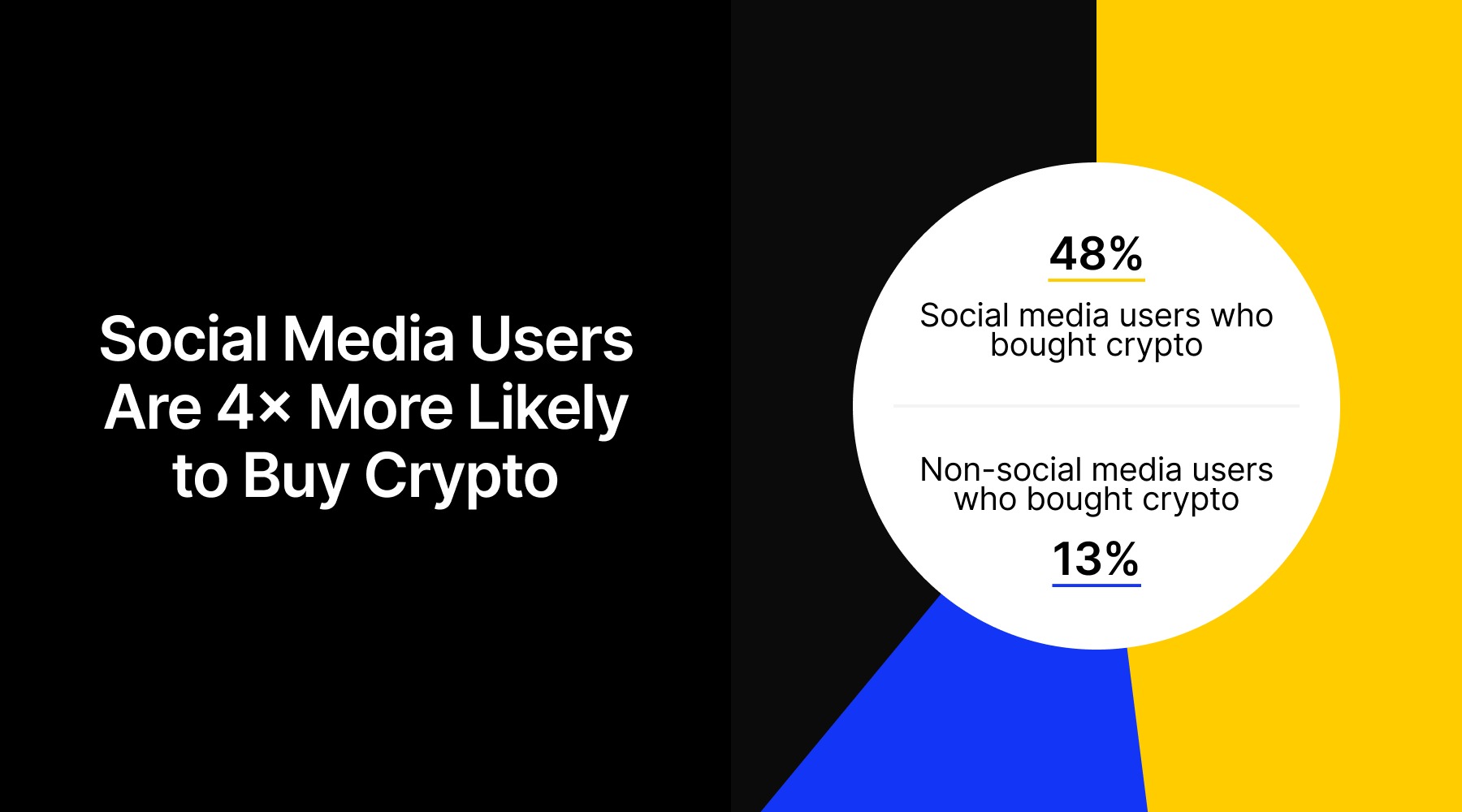

BaFin's consumer survey shows that social media use directly links to crypto investing among 18- to 45-year-olds. Investors who follow finfluencers are almost four times as likely to buy crypto assets as those who do not (48% vs. 13%). In private chat groups, half of the participants reported buying crypto.

Meanwhile, according to the report, "dubious finfluencers" can use hype around products like meme coins to "induce consumers to act hastily" by tapping into their "fear of missing out."

The regulator has tracked the link between social media and crypto for years. Its earlier report confirmed that social media users are much more likely to invest in crypto than non-users, highlighting the growing pull of online channels.

- N26 Appoints UBS Executive Mike Dargan as CEO amid Fresh BaFin Restrictions

- BaFin Warns of “Smarter Trading with Zero Spreads” Pitch That Could Cost You Everything

- Germany to Mandate CFD-Like Risk Warning for Turbos, Will Prohibit Bonuses

Caught Between Acquisition and Compliance

For brokers and banks, this is a major strategic dilemma. Data shows social media is the most effective way to reach the next generation of crypto-curious clients. However, using this channel means associating with the speculative behaviour and hype cycles that regulators are now actively flagging as a systemic risk.

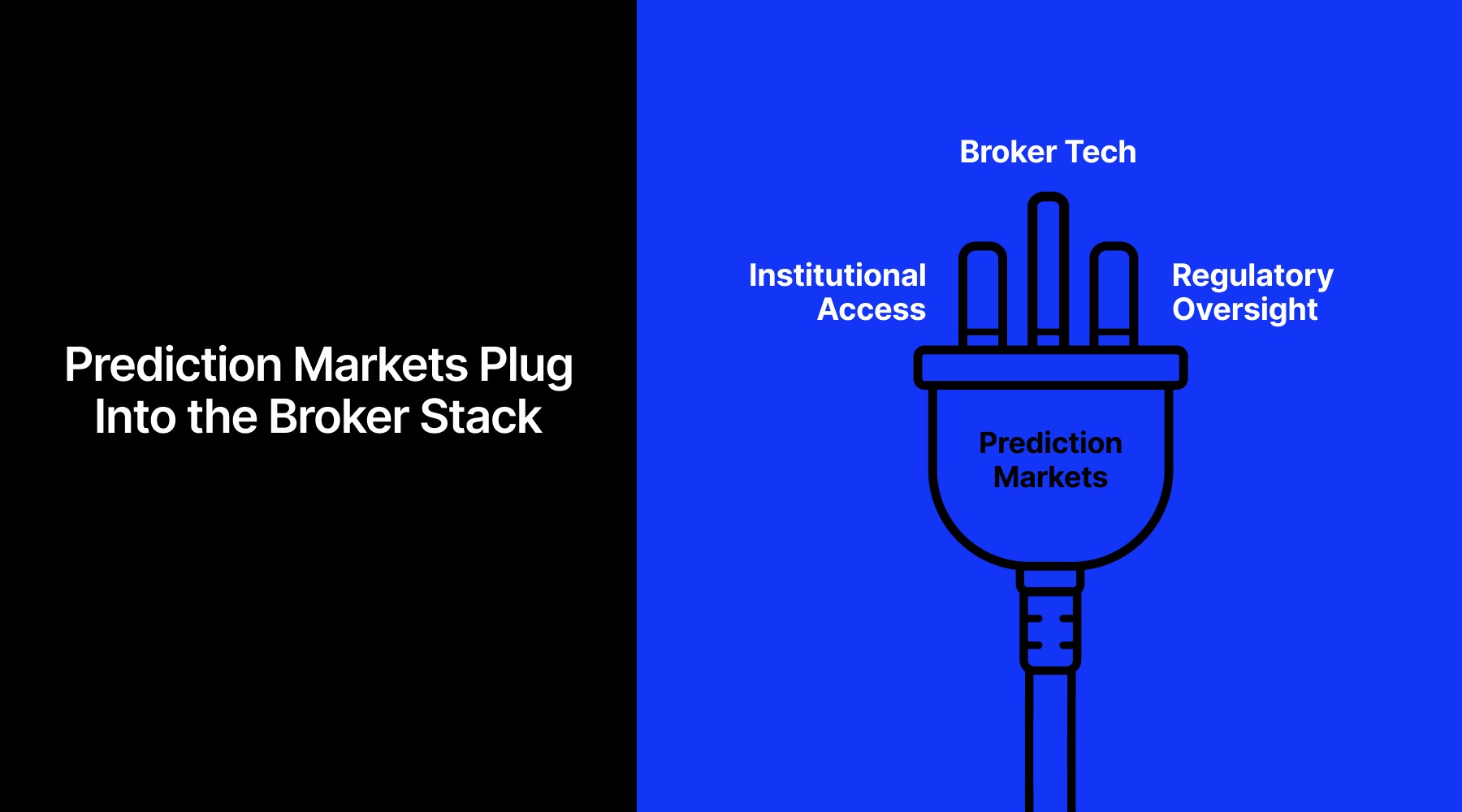

Germany's major savings and cooperative banks plan to offer crypto trading to clients in 2026, bringing digital assets into the mainstream. These institutions will have to navigate a marketing landscape dominated by unregulated influencers while adhering to BaFin's strict conduct rules.

The challenge grows as investor behaviour changes. Coinbase research shows that younger investors prefer to make their own decisions and consult digital channels, such as peers, rather than rely on traditional financial advisers. This shift explains why social media and influencer narratives are now powerful and hard for regulated firms to ignore.

At the EU level, supervisors clearly state that financial promotion on social media must meet the same investor-protection standards as traditional ads. The European Securities and Markets Authority warns that promoting financial products has real consequences. National regulators, including BaFin, AMF, and CONSOB, have issued stronger warnings about influencer-led investment content.

BaFin to Supervise the Firms, Not the Influencers

Finfluencers are not licensed, but regulated firms must take more responsibility for their marketing, especially when social media is the primary channel.

In its report, BaFin makes it clear that while it does not directly supervise finfluencers, it will hold the regulated firms accountable. The regulator stated that it will supervise all authorised Crypto-Asset Service Providers (CASPs) to ensure compliance with the rules of conduct and enforce market abuse rules under MiCA, which apply to "any person," including influencers.

BaFin's message is clear: brokers are not responsible for what finfluencers say, but they are responsible for the products they offer and the clients they onboard.

As crypto goes mainstream in Europe's largest economy, regulated firms are caught between the undeniable power of social media marketing and the watchful eye of a regulator growing increasingly concerned.