Following the crippling Fukushima nuclear disaster in 2011, Japan has undergone a tectonic shift in its energy policy. The earthquake and ensuing tsunami that killed almost 16,000 people and cost between $30-$50 billion in infrastructural damage, forced the closing of all of Japan's nuclear power stations for extended periods.

Filling the energy ‘gap’ has been a difficult challenge and a heavy cost to Japan’s economy, says Mitch Fulscher, President and CEO of FIA Japan. According the Mr. Fulscher, Japan’s recently approved ‘National Energy Plan’ will result in “liberalizing the existing energy market and broaden the sources of imported fuel to rationalize and reduce the huge costs being incurred."

Mitch Fulscher, President and CEO of FIA Japan

Led by the country’s Ministry of Economy, Trade and Industry (METI), Japan is tackling its dependency on imported oil and gas. The 2011 disaster led Japan to commit to long-term oil and gas contracts, but given the desperate times the country secured terms that do not seem so favourable almost 4 years down the line.

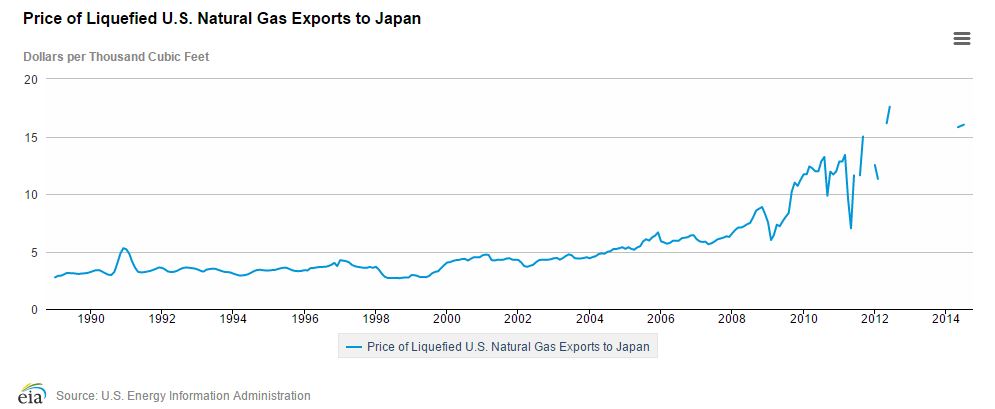

Part of Japan’s future energy policy is a clear focus on natural gas. In 2013, Japan became the world’s highest importer of Liquid Natural Gas (LNG). The total amount of LNG imports in 2013 alone was $69 billion. According to Mr. Fulscher, “Japan is now taking leadership to co-ordinate with India and discussing the formation of a ‘buyers association’ with Singapore,” as part of the attempt to reduce Japan’s high energy costs.

Click to enlarge

One of the major developments for the trading community is the looming creation of a fully-fledged LNG marketplace in Asia. METI already publishes government statistics on LNG spot trading transactions and the creation of a new OTC market organized by 'Tocom' and 'Ginga Energy', nicknamed the ‘Joe’ market, is expected soon. The long-term plan is to forge an “LNG price benchmark and to base price on supply and demand with transparency,” says Mr. Fulscher.

Tatsuya Terazawa, Director General of METI

Tatsuya Terazawa, Director General of METI says, “The establishment of an OTC market for LNG is considered the first step to build a comprehensive energy futures market." Adding, “We are at a stage where the movement has accelerated in various fields towards the establishment of an LNG futures market.”

The FIA postulates that Japanese policymakers could go even further and deregulate the entire Japanese energy market including electricity – for which a futures marketplace could also be created.

According to an industry report published in January 2014 by the Canadian Association of Petroleum Producers (CAPP), Asia is expected to generate the majority of future global demand for LNG. "China has recently emerged as a net importer of natural gas. With its almost insatiable demand for energy, it is expected to become a major importer of LNG." Regarding Japan, the CAPP report says, "Japan already accounts for over 35% of worldwide LNG consumption. Given the substantial damage to its nuclear power generating capacity in the March 2011 tsunami, LNG imports may grow to compensate."

As the LNG industry sees increasing investment and investor participation, traders in Asia could yet see additional sources of LNG products and Liquidity in the foreseeable future.