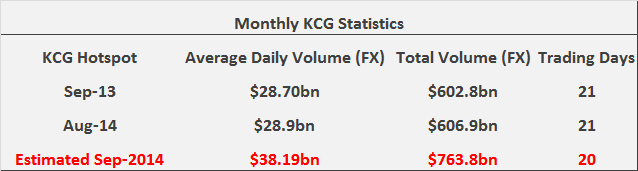

KCG Hotspot, a prominent FX trading venue, is on course to publish sharply higher FX trading volumes for both September and Q3 2014, if inferencing from statistics already available.

During the course of September 2014, KCG Hotpsot has been averaging $38.1bn in average daily trading volume (ADV). With only today (29th) and tomorrow (30th) open for trading, the trading month and quarter are almost complete. If the trading month of September ended today – KCG Hotspot is transacting 32% more trading volume compared to August 2014 and 33% higher than September 2013. The FX market has truly gotten back to work after the summer doldrums at KCG.

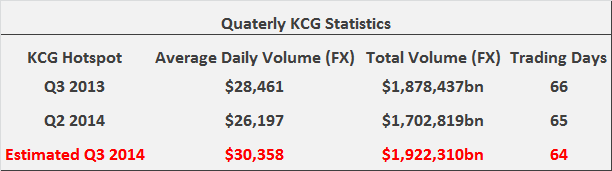

On a quarter-on-quarter basis, Forex Magnates estimates that the trading venue will publish in excess of a 16% rise in ADV compared to Q2 2014 and approximately a 7% rise versus Q3 2013, when official figures are posted in the first couple of weeks in October. It’s fairly likely that KCG Hotspot will surpass the $2 trillion barrier for total FX volume in the third quarter of 2014.

Adding Fuel to the Volumes Fire

To add fuel to the fire, the two remaining trading days are not likely to be on the tame side in terms of Volatility . Both key European and Asian macro-data will be released which are directly linked to key themes influencing the currency market i.e. European inflation and debt, as well as Asian growth sustainability.

On Monday, financial markets, including highly sensitive currencies, will respond to German and Spanish inflation data and an Italian 10-year bond auction. Both releases could have a profound effect on EUR valuations and increase FX trading volumes at venues across the board – including KCG Hotspot.

On Tuesday, late in the European trading session, Asian markets will be in focus as the Bank of Japan (BoJ) publishes its quarterly Tankan survey which estimates the relative level of general business conditions in Japan. Spikes in both JPY and Nikkei trading activity is expected.

Volumes for Q3 2014

Volumes data from a host of trading venues is expected to be published over the first couple of weeks of October, the start of the fourth quarter. Most venues are expected to show better figures compared to August for various reasons, including a surge in FX volatility due to central bank 'open-mouth' operations by the Fed, ECB and Bank of England. In addition, the Scottish independence vote speculation in particular, was a huge focus point for a considerable portion of Q3 2014.

Forex Magnates will bring readers the latest volume statistics for the third quarter from a broad range of trading venues over the coming weeks.