The latest Finance Magnates Intelligence Report for Q2 2025 reveals unprecedented trading metrics. The global retail FX/CFD industry recorded average monthly volumes exceeding $30 trillion last quarter.

This figure includes volumes from the Japanese market, which likely remains the largest single retail FX market in the world. Back in 2015, average monthly volumes across all countries were well below the $10 trillion mark.

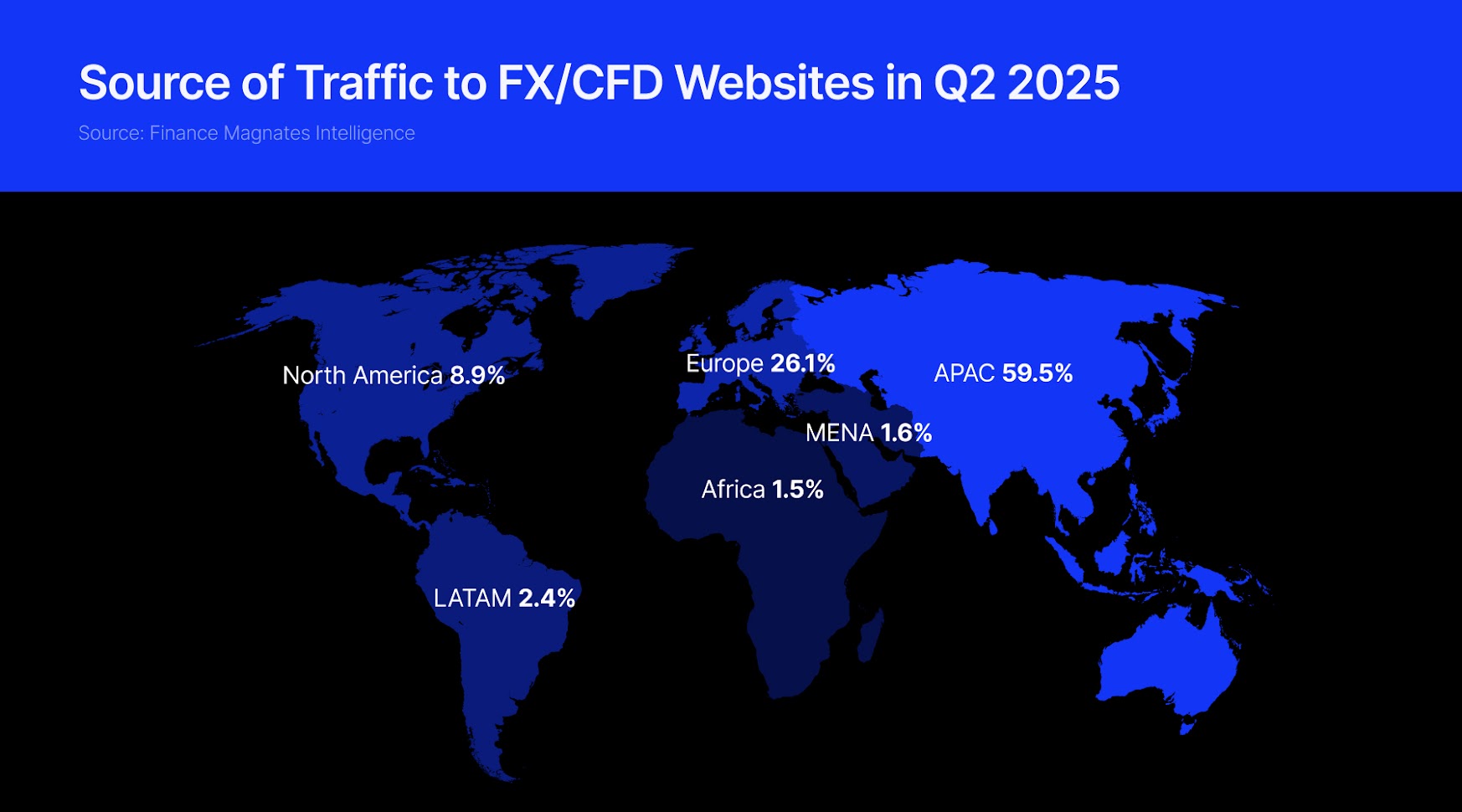

This dramatic growth highlights the significant progress made by the FX/CFD industry over the past decade. Such progress may not be immediately visible when focusing solely on saturated markets like the EU or the UK. However, in recent years, other regions-particularly across Asia-have experienced remarkable expansion.

The same Q2 2025 Intelligence Report includes a “Heat Map” illustrating global interest in retail FX/CFD trading. It clearly shows that the majority of current interest originates in Asia, with India standing out as a key market.

Is There Still Room for Growth?

With rapidly growing economies across Asia and improving standards of living, the trading industry is likely to see continued increases in both deposits and volumes. The only potential challenge lies in future regulatory developments. Should new regulations introduce leverage restrictions, trading volumes may be affected.

Institutional FX Volumes Also on the Rise

While retail FX/CFD trading has surged primarily in Asia, institutional FX trading has shown notable growth in the LATAM region. According to a recent CME press release, Latin American average daily volume (ADV) reached 189,000 contracts in Q2 2025, a 4% increase from 2024. Foreign Exchange and Metals products also hit quarterly records in the region, growing by 30% and 3%, respectively.