PFSOFT has announced the launch of a major upgrade to its benchmark Protrader Trading Platform . The leading technology firm that has been servicing the financial services industry for over a decade has added what it calls 'key improvements' in the fragmented world of trading platforms.

Platform providers have constantly been enhancing their capabilities as traders develop their trading strategies, behaviour and requirements. PFSOFT’s team has been working with users and specialists for over 24 months in a bid to outpace competitors.

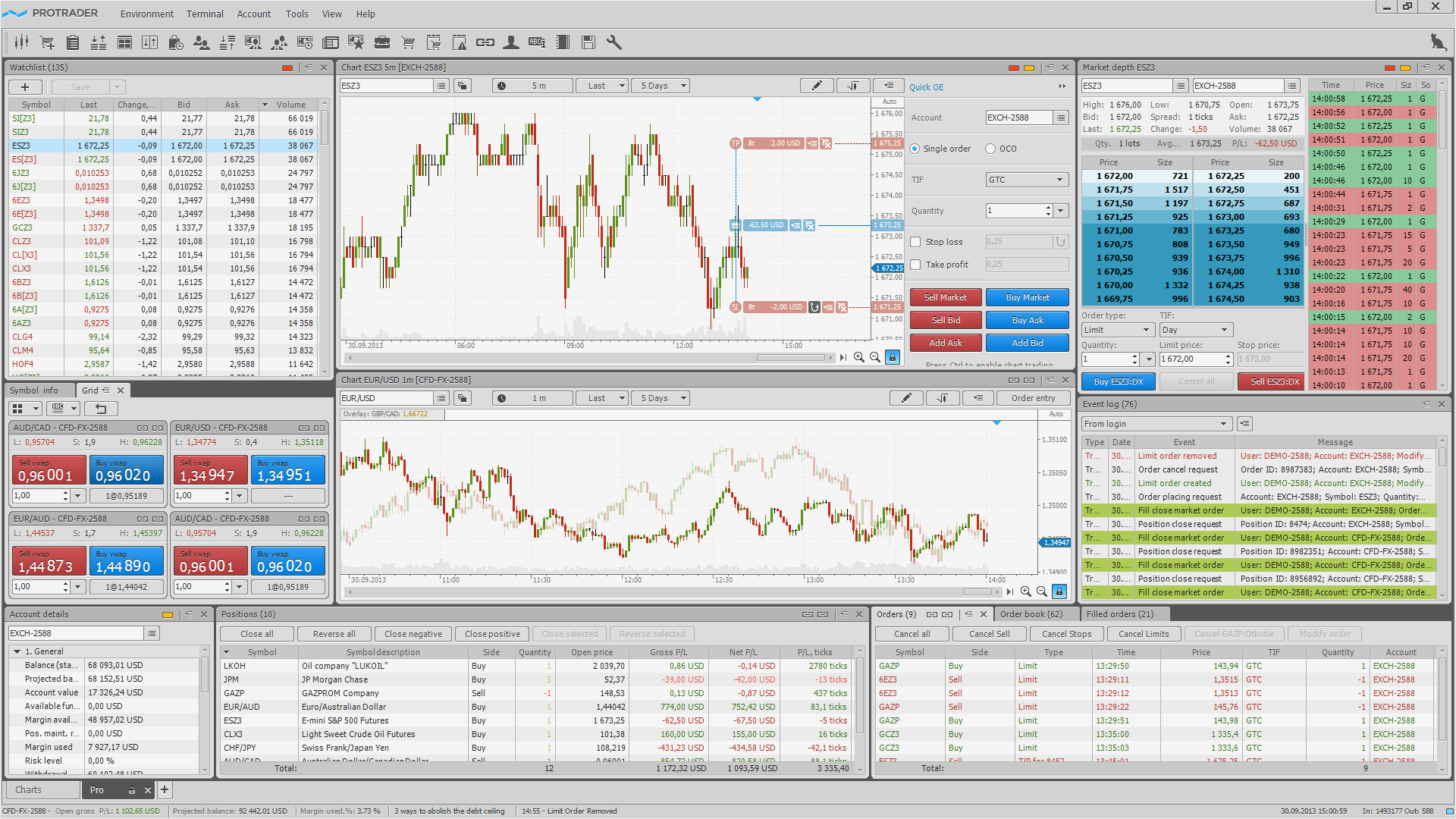

The firm has focused on three essentials that it believes are paramount qualities for a platform to have; enhanced usability, speed and new functionality and tools.

“I come across several trading platforms with innovative and unique features, however learning and understanding the full suite of functionality is time consuming”, said Nauman Tahir, an introducing broker from Pakistan. This is a common hurdle firms face when promoting a ‘new’ platform to traders. PFSOFT has been working to eradicate this in the current upgrade. Both from a design and UI experience the firm has simplified the usability of the platform, thus making it easy, quick and stress free to navigate and take heed of the main functionality on the platform.

With the arms race in full swing speed was another crucial element the firm has worked on. A spokesperson for the firm commented to Forex Magnates: “We cut latency to 3 times what it was earlier.”

Apart from direct latency affecting trade execution, the firm has improved speed for its web version by building its desktop in 64-bit enabling end-users to use their hardware capabilities more.

A new or improved platform is nothing without functionality that adds value so the traders can optimize the terminal. In Protrader 3 users will benefit from a range of tools. “We've added some new front-end tools for analysis and trading. On the server side we expanded functionality to strengthen the multi-asset capabilities of our solution. In addition, we added a new set of powerful Risk Management rules," explained the company spokesperson.

The Protrader concept of intuitive design packed with robust back and middle office capability has been the driving force behind the platform's success, despite the platform monopoly taking preference over the last six years. With a continued focus on solutions for both traders and brokers the firm maintains its position as a provider of value.

Bogumil Nurkiewicz, CEO at Infini Capital Group Ltd, praised the platform in a comment to Forex Magnates: "It's a great pleasure for me to look at the Protrader 3 platform in its current form, knowing that it was built based on the requirements of end- users (front-end), but also brokers or banks with huge requirements, not only functional but also related to integration and security layer. Looking from the perspective of more than five years of collaboration with PFSoft and two implementations at large banks, I can confidently say that this product is the crowning of a proactive approach to the requirements of all users of the platform. "

Daniel Carter Managing Director, Velocity Trade South Africa, reviewed the new functionality and was particularly impressed with the layout tools, he said: “"Regarding the new features, we really like the way panels automatically snap into place when launched. The black and white color schemes both look great, although I personally prefer black. The user interface feels a great deal more responsive now, and it is a lot easier to familiarize yourself with all the trading features in comparison to PT2, where a lot of great features could be overlooked because of the complicated design. It's a big win for PFSOFT."