In the last quarter of 2025, the CFD industry recorded strong results, especially when it comes to number of active acounts. It is somewhat surprising that the final quarter of the year brought improvement, rather than the slowdown usually seen during the holiday period. What factors could explain this outcome? And, more importantly, what does it tell us about the industry, and how long can this trend continue?

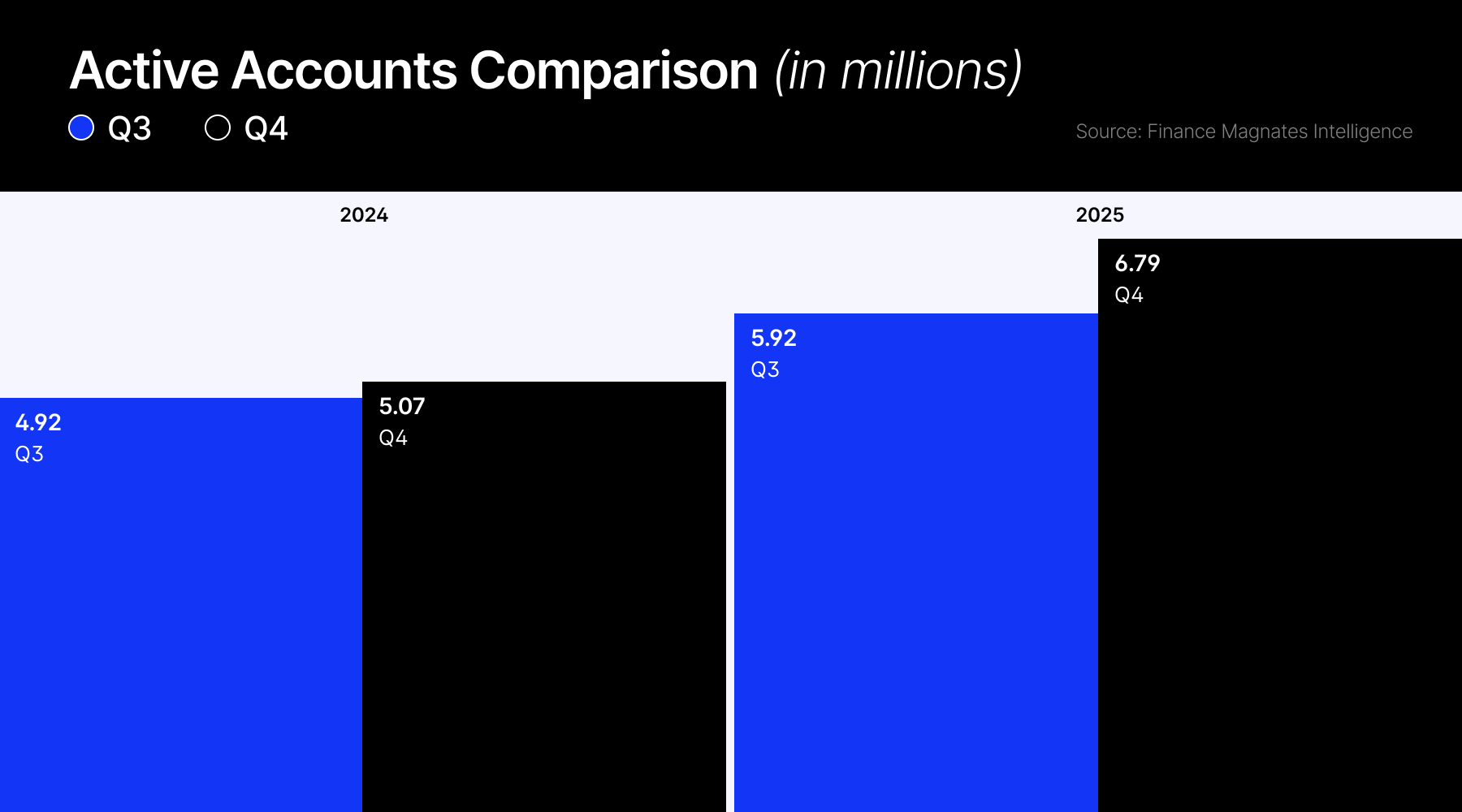

According to the latest Finance Magnates Intelligence Report for Q4 2025, the total number of active accounts in the CFD industry rose to 6.787 million. This is a striking result, given that in the third quarter there were only 5.922 million active accounts. This represents growth of 14.6%.

The situation becomes even more notable when we consider that the final quarters of the year are usually a period of slower activity, as a large part of the industry shifts focus to the holiday season and year-end preparations. If growth does occur, it is typically limited, as seen in 2024, when the number of active accounts increased from 4.919 million in Q3 to 5.067 million in Q4.

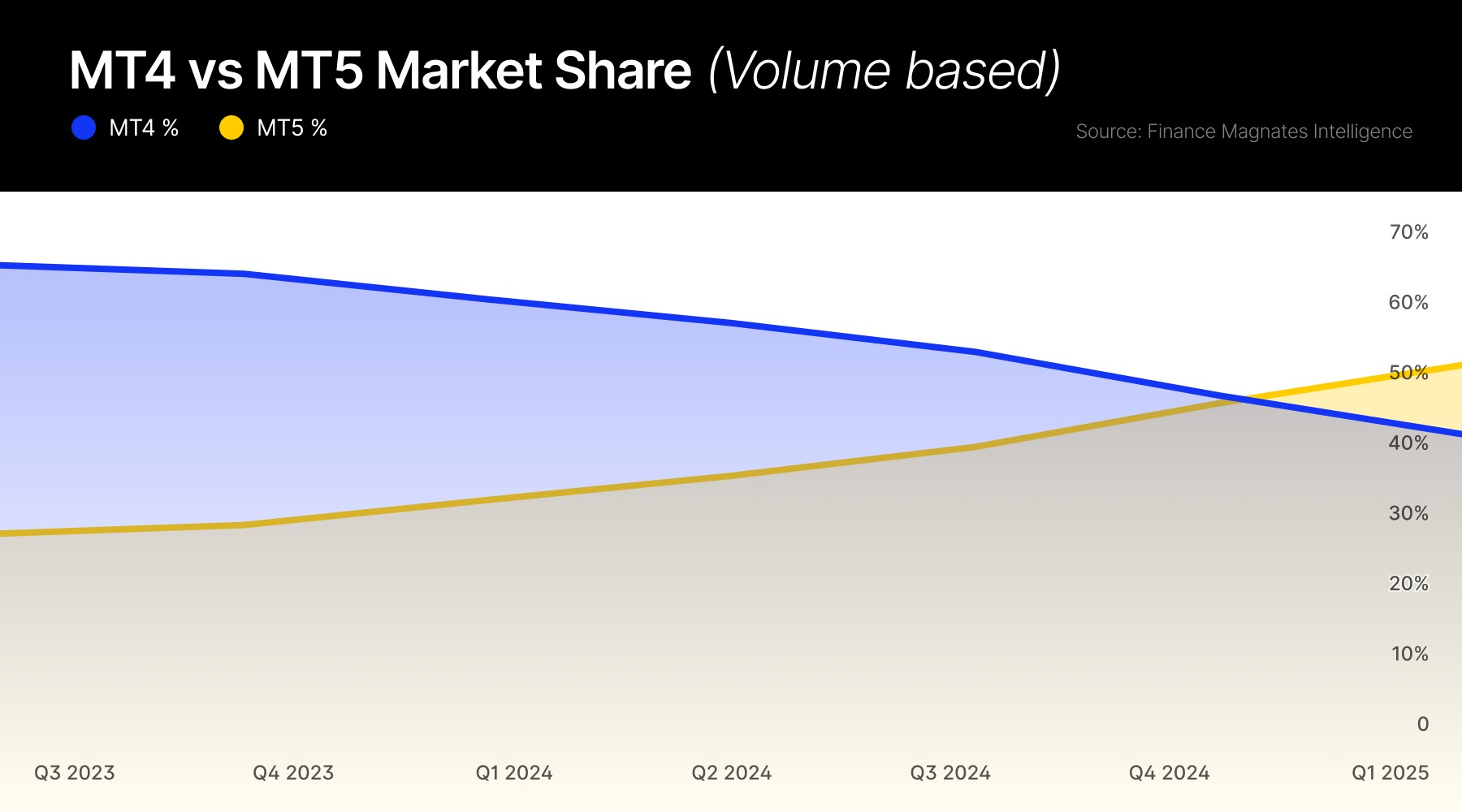

Yet, the whole of 2025 was a record year on several levels. At the beginning of the year, Finance Magnates reported that the MT5 platform had finally overtaken MT4 in terms of retail trading volume share. Around the same time, the industry was also enjoying the recent move past the 5 million active accounts level reached in the end of 2024.

- Exclusive: MT5 Overtakes MT4 in Trading Volume After 15 Years, Signaling the End of an Era

- Eleven CFD Brokers Cross 100,000 Monthly Active Accounts Milestone

- Gold Dominates Trading at Axi as Volatility And Record XAU Price Drive CFD Volumes

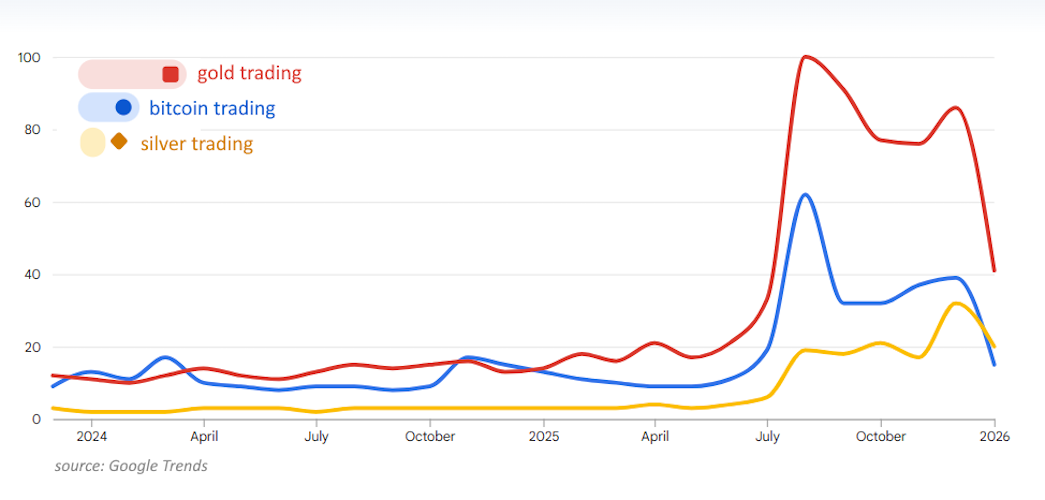

Is this pace of growth sustainable in 2026? The industry is likely to continue expanding, especially as some retail investors appear to be stepping back from the Bitcoin market. Last year also saw a strong rise in the popularity of gold and silver trading. However, the key question is whether growth will remain at the same scale.

What to Expect in 2026?

If both markets experience a correction, which remains a realistic possibility, growth of the client base could slow. This would likely affect the pace of expansion across the CFD industry. Such a period would need to be handled carefully by brokers and marketing teams to keep clients active and engaged, which we hope will be the case. For now, the industry continues to benefit from the strong interest in metals trading, which we can still see at the start of the new year.