easy-Forex Australia, the Aussie-based unit of parent company Easy-Forex, announced today that the company is sharply expanding its product lineup from 79 to 140 products, specifically heavy on Russian ruble FX pairs. The company is “dishing up” the expansion to coincide with various national holidays this week, with a quirky title to their press-release: “Baklava, malva, goulash and vodka." All in the holiday spirit.

Forex Magnates previously reported on easy-forex's plans to expand its range of precious metals contracts as well as FX pairs in 2014, as the CFD provider outlined its plans. Today, at least a portion of those plans were officially announced and initiated for clients with more on the horizon, as the company "continuously looks to extend its product range."

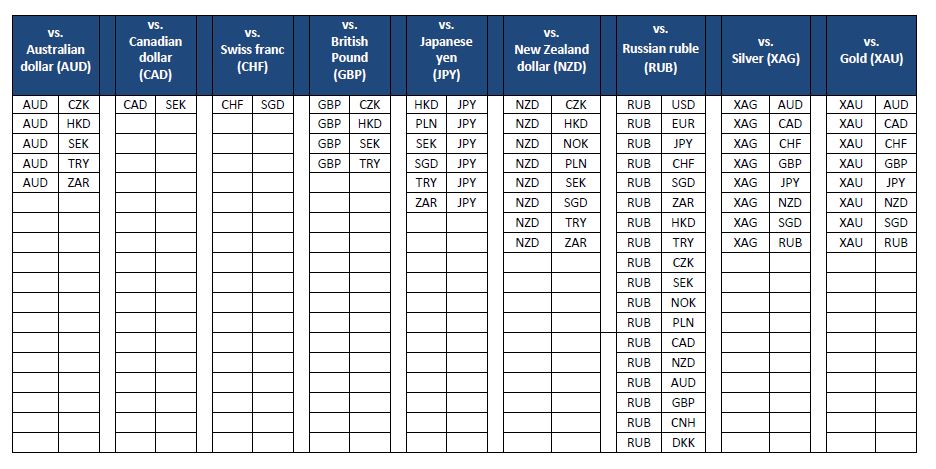

The full list of instruments added is shown below:

Full list of 61 contracts unveiled by easy-forex; 18 focused on RUB crosses

The 61 added instruments mean that easy-forex Australia will now offer 96 currency pairs, 22 metals contracts, 16 equity index contracts, 13 commodity contracts and 26 vanilla option instruments to their Australian client base.

Robert Francis, Managing Director of easy-forex Australia

“The comprehensive offering allows traders to take advantage of market action across the globe with access to a more diverse range of products and a greater potential to maximise their earnings,” says easy-forex Australia. The company’s Managing Director, Robert Francis added, “These added pairs will allow our traders to maximise the forex trading experience to its full potential. We expect pairings with the US dollar, the euro and the yuan to be the most popular and gold the metal of choice for ruble traders."

Takeaways

The most significant element of today’s announced expansion is the addition of 18 Russian ruble pairs, given the ongoing media focus on Russia and its currency due to the ongoing Ukraine conflict sparked earlier this year and the broader ‘frosty’ relations between the U.S and Russia that has led to economic sanctions and threats of trade wars from both countries.

Russian ruble volatility has further been exacerbated by the parallel spike in commodity and metals price uncertainty (and volatility). Markets such as oil, gas and metals have also been affected by the aforementioned factors. Raw materials including oil, gas and metals represent approximately 30% of Russia's gross GDP and 70% of total exports. If prices in these markets move suddenly, Russia's economy does likewise.

The combined effects has left the Russian ruble trading at multi-year lows of 38.77 at the time of writing. The peak in USD/RUB in 2008 was around $36 backed by extensive USD repatriation demand due to Liquidity shortages in international money markets.

The Russian ruble has been declining on a broad basis against all other currencies since June 2014, and with further instability on the horizon due to no resolution in either Ukraine, the Middle East or in US-Russia relations, ruble volatility is likely to have plenty more steam.

With RUB crosses back on speculator watchlists due to its “profit potential,” easy-forex is delivering an extensive set of instruments that suit current market conditions and trends. As far as easy-forex traders are concerned - dinner is served.