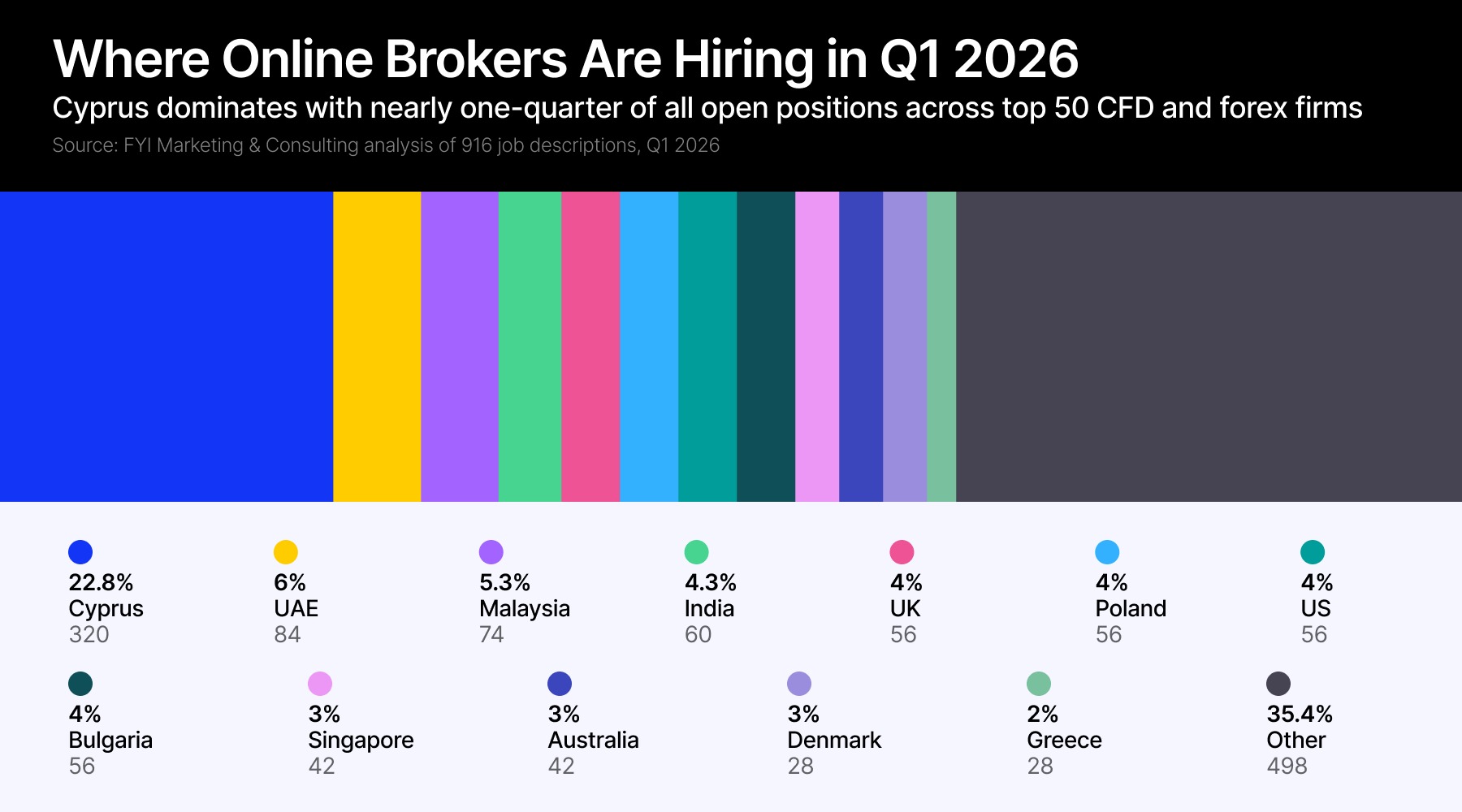

The world's 50 largest online brokers are advertising more than 1,400 open positions globally, with Cyprus capturing the lion's share of hiring activity at 22.8% of all vacancies, according to new data compiled by marketing consultancy FYI.

"Most open positions are currently in Cyprus," said Christian Görgen from marketing agency FYI, who analyzed almost 1000 job descriptions across the sector. "Followed by the UAE, Malaysia and India."

Dubai Momentum Slows as Cyprus Regains Ground

The data challenges recent speculation about Dubai displacing Cyprus as the industry's primary base.

"There has been a lot of discussion recently around whether Cyprus is being replaced by Dubai as the main hub for the FX industry," Görgen said. "From a customer acquisition and growth perspective, that might be happening at the moment. Throughout 2025, many well-established brokers significantly increased headcount in the GCC region and built out strategic, growth-oriented roles."

This trend was also highlighted by FinanceMagnates.com, which analyzed how many brokers are flocking to Dubai, driven in part by licensing approval times that are up to 33% faster.

However, hiring patterns suggest the narrative is shifting. "When looking specifically at current hiring activity in Q1 2026, the picture shifts," Görgen explained. "Our data suggests that recruitment momentum in Dubai has started to slow, while Cyprus has regained importance as a core hiring location. Of the 1,432 open vacancies analyzed, 22.8% are based in Cyprus, making it the single largest hub for open roles at the moment."

"There is no longer a single dominant hub. Instead, different regions are taking on specialized functions: from strategy and product to operations, business development, and local market execution,” Görgen commented for FinanceMagnates.com

IT Dominates as Brokers Prioritize Technology Infrastructure

"IT remains the largest hiring area, accounting for 29% of all open positions globally," Görgen added in his analysis. "This is followed by Marketing, Support, Partnerships, and Sales vacancies."

The emphasis on technology hiring mirrors broader fintech industry trends, where vacancies jumped 30% in 2025 as firms doubled down on infrastructure. Cyber security and IT roles continue to attract talent with some of the highest earnings in financial technology sectors.

- Why Cyprus’ 8% Crypto Tax Comes with a Fly in the Ointment

- Card Fraud Accounts for 94% of Payment Scams in Cyprus, Central Bank Says

- Cyprus Assets Under Management Rise 6% to €10.7B, With Nearly Three-Quarters in Private Equity

The most frequently posted job titles include software engineer, business development manager, and compliance officer. Other high-demand positions include partnerships managers, QA engineers, DevOps engineers, and customer support specialists.

The data shows business development positions are gaining prominence. Görgen's analysis found that partner, business development, and affiliate marketing roles show particularly strong demand across the sector.

Marketing positions appear more fragmented and specialized compared to partnership-focused roles, which tend to be less diversified and more generalized in their requirements.

The hiring push comes as marketing chiefs in the retail trading industry last just 1.5 years on average, creating constant demand for new leadership.

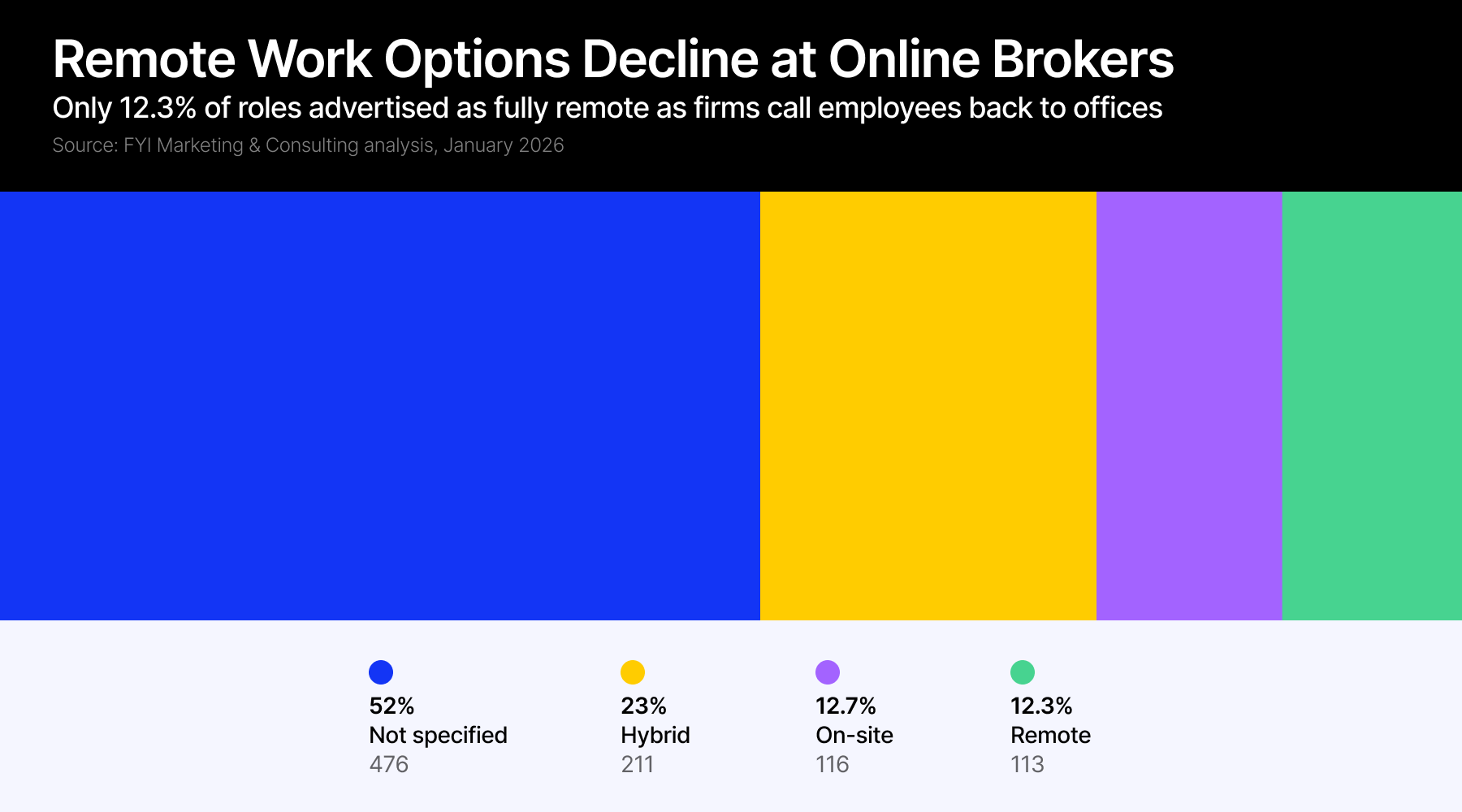

Remote Work Loses Ground as Firms Pull Employees Back

Only 12.3% of advertised roles are fully remote, signaling a clear retreat from pandemic-era work arrangements. Hybrid positions account for 23% of openings, while 12.7% specify on-site work. More than half of job postings don't specify work location.

"Only 12.3% of vacancies are advertised as fully remote," Görgen noted. Remote positions are typically offered when specific language expertise is required and difficult to source in major financial centers.

The shift back to office-based work marks a significant change from post-COVID policies that many financial services firms initially embraced.

HFM and JustMarkets Lead Aggressive Expansion

Among individual firms, Interactive Brokers tops the list with roughly 100 open positions, followed by HFM with a similar number and XM with around 90 vacancies. Capital.com, Swissquote, JustMarkets, CMC Markets, Vantage, and IG round out the top hiring companies.

Two firms stand out for their aggressive hiring outside Europe. HFM currently lists around 100 open roles across all departments, with traffic data indicating primary operations in Indonesia, Japan, Malaysia, South Africa and Kenya.

JustMarkets had 67 open positions at the time of analysis, with traffic patterns pointing mainly to Malaysia and South Africa alongside other emerging markets. However, LinkedIn data shows the firm's median employee tenure stands at just 1.1 years, raising questions about retention as it scales rapidly.

Technology Skills Command Premium as AI Remains Niche

Python, Excel, and SQL emerge as the most in-demand technical skills. Other frequently mentioned tools include AWS, Git, CRM systems, Microsoft Office, Docker, and Kubernetes. Trading platforms MetaTrader 4 and MetaTrader 5 also appear regularly in job requirements.

Despite industry buzz around artificial intelligence, only 56 job descriptions mention AI-related skills or responsibilities. "For most brokers, AI still looks more like a buzzword than a clearly defined, staffed function," according to the analysis.

Search engine optimization roles have largely disappeared from broker hiring plans, with only seven SEO-specific positions in the entire dataset.

"Pure SEO roles are disappearing," he noted. "There are only 7 SEO-related roles in the entire dataset. This may point to a shift toward broader content, GEO/AI, and reputation roles—or a stronger focus on business development instead."

Salary Transparency Remains Rare Across Industry

Only 21 of 916 analyzed job descriptions include any salary range information. Compensation negotiations remain largely private, with firms preferring case-by-case discussions over public disclosure.

Cyprus has solidified its position as the industry's primary employment center, where compliance and legal heads earn six-figure salaries ranging up to €150,000 annually.

Meanwhile, Dubai's FX sales heads command significantly higher compensation, roughly double what their Cyprus counterparts earn

Medical insurance appears in 237 job descriptions as the most common benefit, followed by performance bonuses in 194 postings and competitive salary mentions in 186. Paid time off and education budgets round out the top five benefits.

The generous perks that once characterized forex industry employment have largely disappeared. Exness stands as a notable exception, offering company cars in Cyprus and operating its own gym facilities in Malaysia, where the firm is currently hiring a fitness manager.