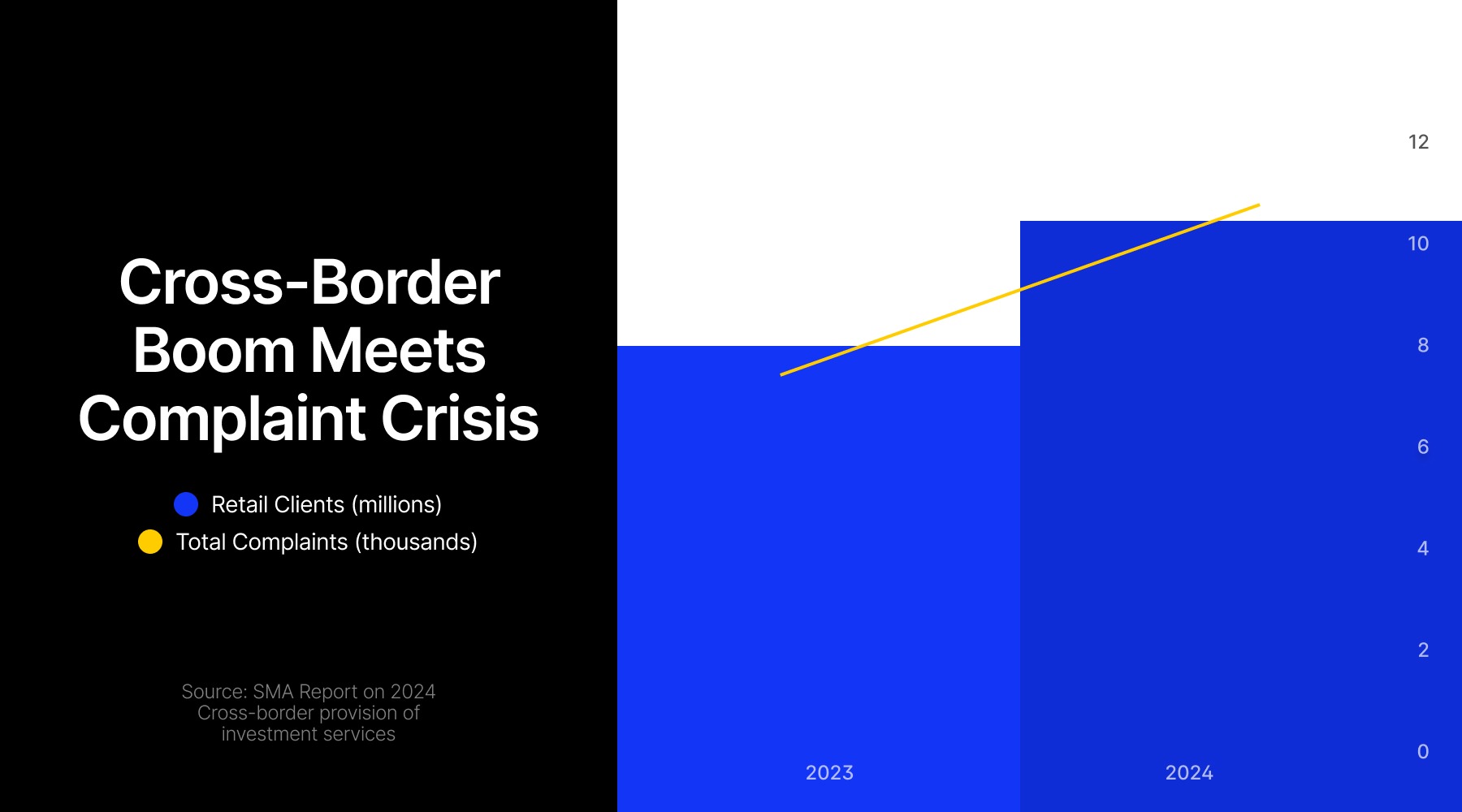

The number of retail clients using cross-border investment services in Europe climbed to about 10.5 million in 2024, even as complaints from those clients jumped by 46%, according to new data from the European Securities and Markets Authority (ESMA).

EU’s Cross-Border Market Adds Millions Of Clients

ESMA’s latest annual review of passported activity shows firms operating under the “freedom to provide services” regime served roughly 10.5 million retail clients in 2024, up from 8 million a year earlier, a 32% increase in cross‑border clients. The analysis covers investment firms and credit institutions providing services into other EU/EEA countries without using branches, and only includes firms that have more than 50 retail clients in a given host market.

In total, 370 firms across 30 EU/EEA jurisdictions met that threshold in 2024, down from 386 in 2023, marking a 4% drop in the number of active providers. On average, each firm served about 28,000 cross‑border retail clients, up from 20,000 the previous year, underlining how activity is consolidating into fewer, larger players.

- CFD Providers Face Reporting Changes in 15 Months as ESMA Finalizes Derivatives Rules

- EU Moves Closer to T+1 as ESMA Finalizes Settlement Rules; Retail Traders Could Gain

- EU Watchdog Warns Tokenized Stocks Could Mislead Investors: Report

It is worth noting that the 10.5 million counts only clients receiving investment services from firms in other member states, not clients trading with firms in their home country. For example, a German trader using a German broker is excluded, but a German trader using a Cyprus-based broker is included.

CFDs were held by about 1.4 million cross‑border retail clients in 2024, around 11% of the total, while crypto‑assets within the MiCA perimeter were held by nearly 1 million cross‑border clients, or about 7%. Overall, shares were the most common product, with 4.6 million clients, roughly 36% of the total.

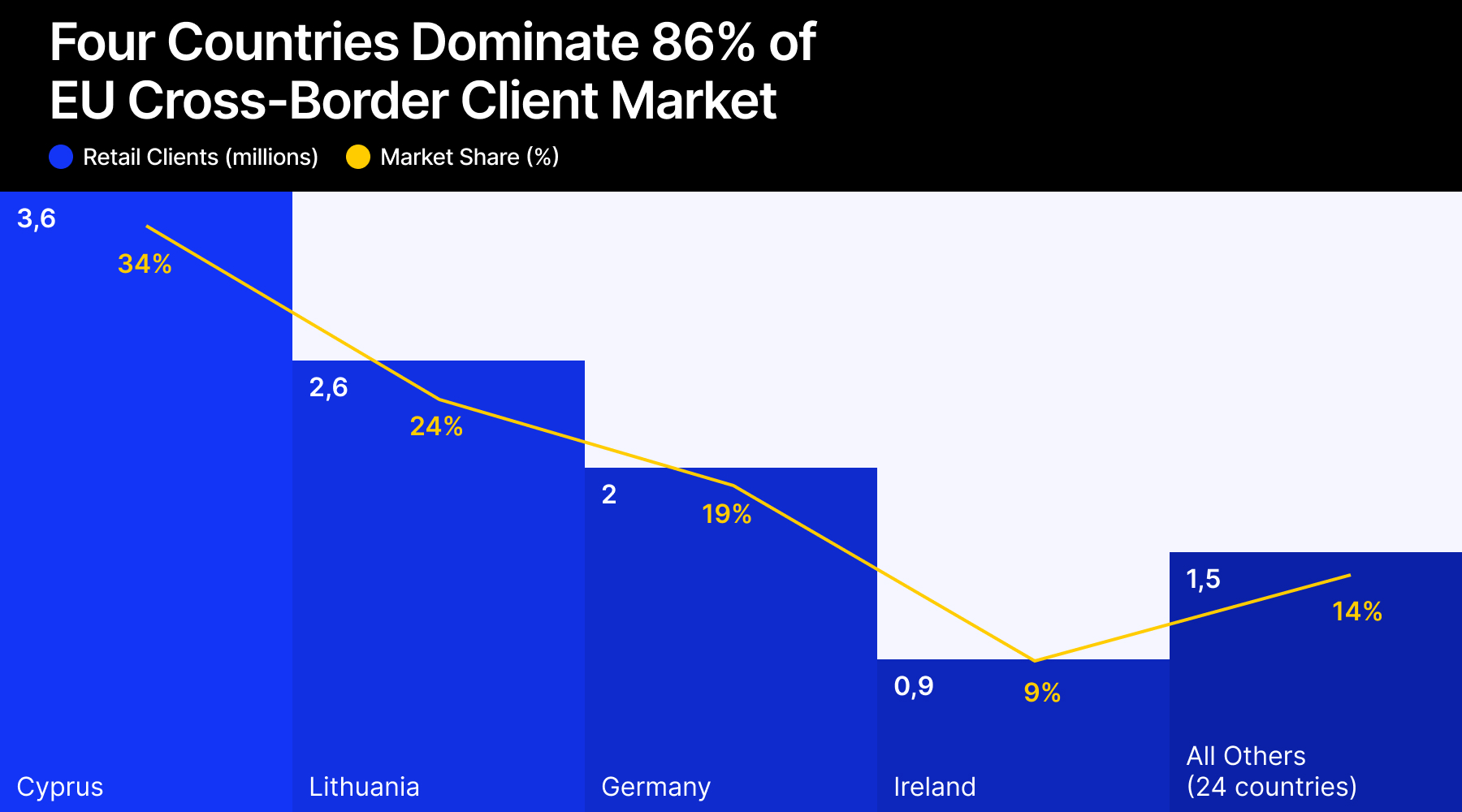

Cyprus Dominate Supply

On the supply side, ESMA ’s data point to a highly concentrated market. Firms based in Cyprus, Lithuania, Germany and Ireland together accounted for about 86% of all cross‑border retail clients, around 9 million of the 10.5 million total.

Cyprus‑based firms, 79 in total, reported servicing about 3.6 million cross‑border retail clients, or roughly a third of the EU/EEA total. Lithuanian firms followed with about 2.6 million clients, up sharply from 1 million in 2023, while German firms served around 2 million clients and Irish firms about 939,000. All other firms – 235 entities spread across 24 member states – jointly reported about 1.46 million cross‑border retail clients.

Investment firms made up the majority of providers, accounting for 59% of the 370 firms, with credit institutions representing the remaining 41%. Cyprus hosted the largest pool of investment firms, while France and Germany were home to the biggest numbers of credit institutions active cross‑border.

Germany, France, Spain, Italy Are Key Destinations

On the demand side, a small group of large markets attracted most of the incoming activity. Germany, France, Spain and Italy together accounted for about 52% of all retail clients receiving cross‑border investment services.

Roughly 1.62 million Germany‑based clients received services from 187 foreign firms, broadly in line with 2023 levels. France, Spain and Italy together added about 3.9 million cross‑border retail clients in 2024, up by 1.3 million year‑on‑year and representing around 37% of the total client base.

On average, firms in each home member states provided services into 17.5 other EU/EEA countries, underscoring the breadth of passporting links. In some cases, individual firms based in Austria, Cyprus, Ireland and Lithuania reported providing services to retail clients in all 29 other member states.

Complaints Jump 46% But Look Less Extreme In Relative Terms

ESMA recorded 10,968 complaints from cross‑border retail clients in 2024, up from 7,507 in 2023, a 46% rise in absolute numbers. Given the strong growth in the client base, the average number of complaints per 100,000 retail clients increased more moderately, from 94 to 104, equivalent to a 9.6% rise.

Germany‑based firms received the largest share of complaints, accounting for about 45% of the EU/EEA total, or 4,936 complaints in 2024 compared with 2,595 a year earlier. Firms in Lithuania and Ireland each accounted for about 14% of complaints, while Cyprus‑based firms were linked to about 10% and Dutch firms about 6%.

From the host‑country perspective, clients in Austria, Spain and Italy filed the highest numbers of complaints about cross‑border services, together making up about 46% of all complaints lodged by retail clients. Austrian clients stood out in relative terms, with 1,909 complaints from about 248,000 clients – roughly 7,674 complaints per million clients, around 656% above the EU/EEA average of 1,015 per million.

ESMA cautioned that the complaint definition – “a statement of dissatisfaction by the client” – is broad and may be interpreted differently across firms and jurisdictions.

The exercise is part of ESMA’s broader push to monitor how cross‑border business affects retail investors and how home and host supervisors coordinate oversight. The regulator plans to repeat the data collection in 2026, continuing its focus on firm behavior, complaint patterns and concentrations in specific products and jurisdictions.