Admirals Group AS has released its unaudited financial results for the first half of 2025. The period saw lower client trading activity across the Group’s core European markets.

Net Income Drops, Admirals Posts Loss

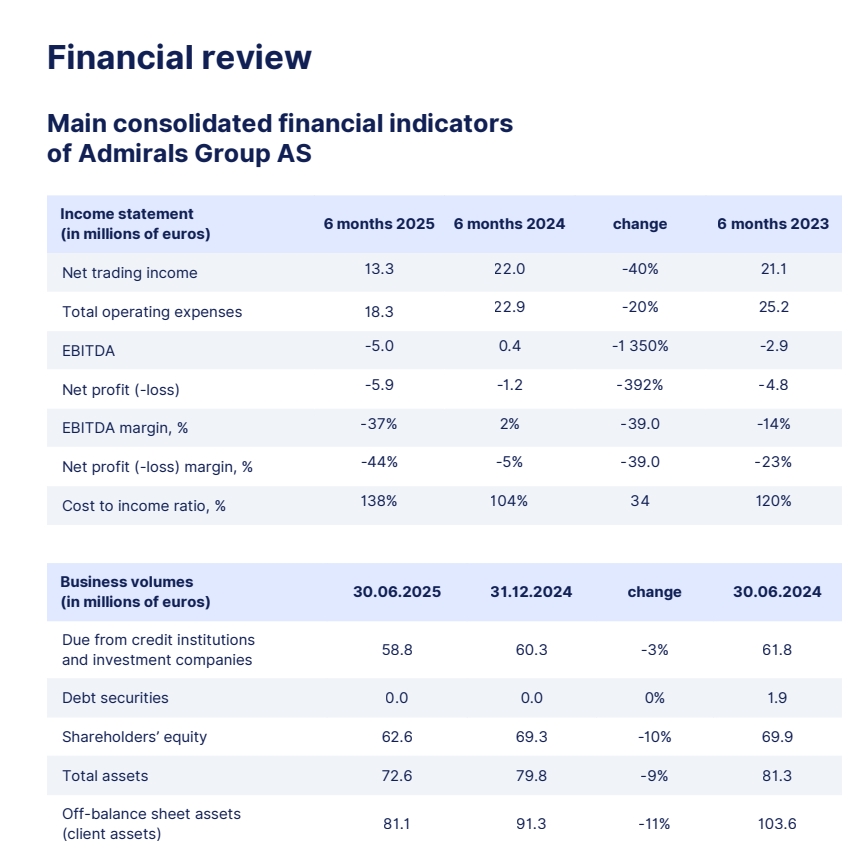

Net trading income fell to EUR 13.3 million, down from EUR 22.0 million in the same period last year. Operating expenses declined by 20% to EUR 18.3 million, compared with EUR 22.9 million in H1 2024. The Group reported a net loss of EUR 5.9 million, wider than the EUR 1.2 million loss recorded in the previous year.

The number of active clients was 23,190. Admirals is focused on rebuilding and expanding its client base following a temporary strategic pause in 2024.

EU Client Onboarding Restarts After Suspension

Last year, Admirals voluntarily suspended onboarding of new European clients at Admirals Europe Ltd., in line with recommendations from the CySEC regulator. The suspension aimed to ensure regulatory compliance and maintain client trust.

You may find it interesting at FinanceMagnates.com: Admirals UK Migrated EU-Resident Clients Out; 2024 Trading Volume Took a Hit.

Client onboarding resumed in March 2025 after the required measures were implemented. User acquisition efforts intensified in the second quarter of 2025, as the Group sought to re-establish its presence in the EU market.

Admirals Sells Australian Unit to PU Prime

Meanwhile, Admirals has sold its Australian unit to PU Prime, a forex and CFDs broker. The acquisition gives PU Prime an Australian Financial Services (AFS) licence. The Australian entity was renamed PU Prime Trading, according to the ASIC registry.

Admirals announced the sale last December to a non-related party, stating it would streamline operations, optimise geographic focus, and contribute positively to the group’s net profit. PU Prime, previously operating from offshore locations, has yet to onboard Australian clients under the new licence. Admirals remains licensed in multiple countries, including the UK, Cyprus, and South Africa.