As many as 119 brokerage platforms gained authorisation last year from the controversial regulator on the Comoros island of Mwali, Finance Magnates RU first reported. Some of them include popular contracts for differences (CFDs) brands such as RoboForex and HF Markets.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

Popular Names Carry the ‘Mwali’ Tag

RoboForex currently runs its offshore operations under its entity regulated in Belize. It picked up the Comoros licence a few weeks before the end of 2024.

Read more: RoboMarkets Obtains Full Brokerage Licence from Dubai’s SCA

Another popular brand that obtained a Comoros licence is Alpari, which secured it in April 2023 and now operates solely under it. Other known brands that received the licence in 2023 were Octa Markets, AMarkets, BDSwiss and TIO Markets.

Significant demand for the questionable Comoros licence also came from prop firms registering as brokerages. FundedNext is likely the only prop firm that started offering brokerage services under the Comoros licence, while others appear to have secured it mainly to gain access to MetaTrader licences.

Controversial, Yet in Demand

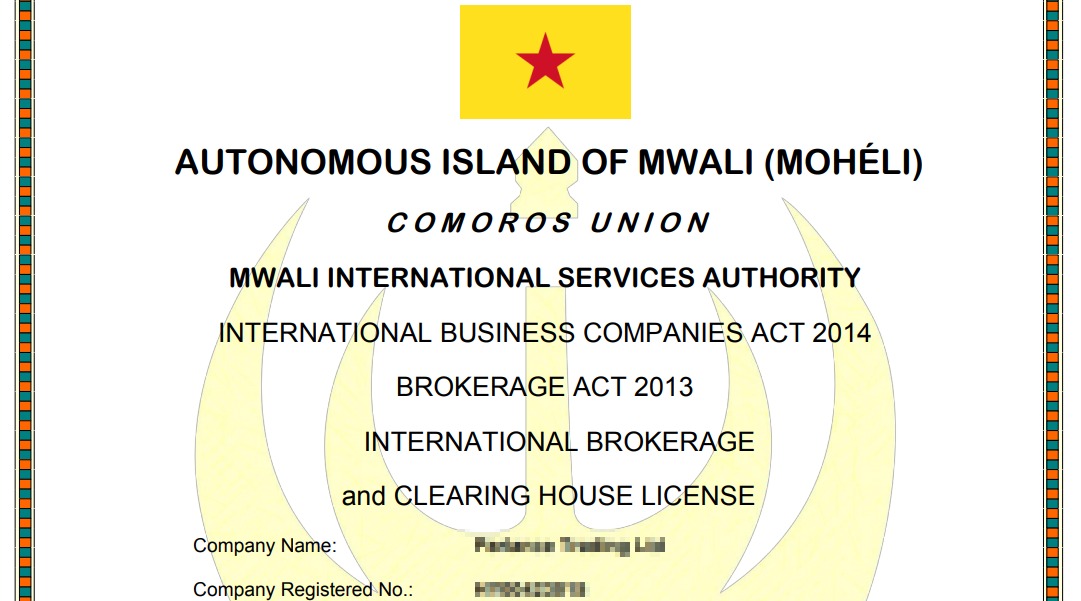

The Union of the Comoros consists of three small islands in the Indian Ocean between Madagascar and Mozambique. Mohéli, also known as Mwali, is an autonomously governed island that forms part of the Union.

The brokerage licence offered by the Mwali International Services Authority has gained traction over the past couple of years as more companies obtained it.

According to the register of the controversial regulator, it had issued licences to a total of 258 brokerage firms by the end of 2024, most of which were granted in 2023 and 2024. Before 2023, only 18 legal entities were listed.

Some of the supposed advantages offered by Mwali include a territorial tax system, meaning only incomes generated from the island are taxed there.

Other factors pushing brokers towards the questionable jurisdiction may include the tightening of rules in other offshore countries. Vanuatu, once a popular offshore hub, has toughened its requirements and now mandates brokers to have a physical presence on the island.

Read more stories on FinanceMagnates.com: