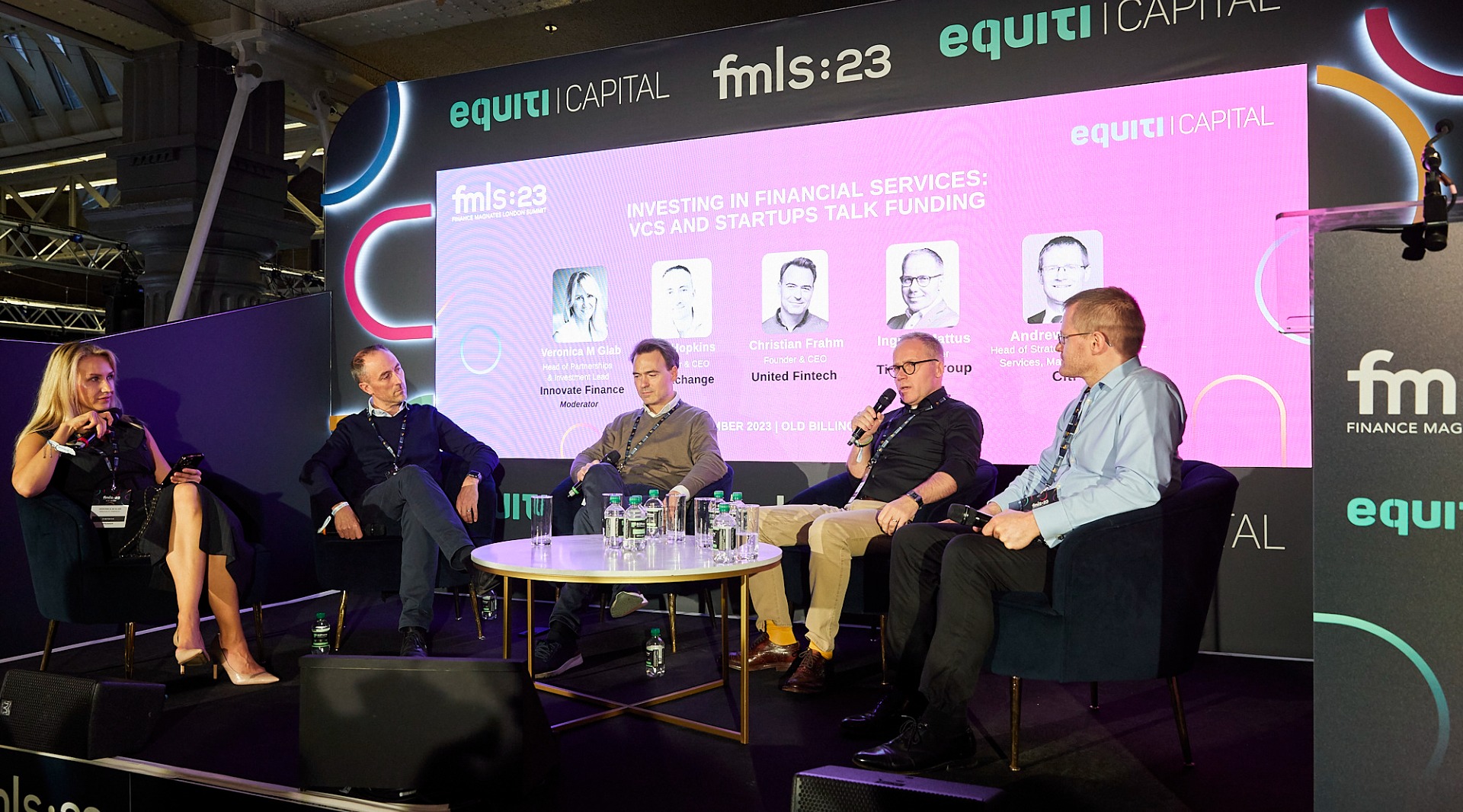

The financial services industry is undergoing a period of significant change, and the startup landscape within it is no exception. In a panel discussion at Finance Magnates London Summit (FMLS:23), moderated by Veronica M Glab, the Head of Partnerships & Investment Lead at Innovate Finance, industry experts came together to share their insights on the current funding climate, what they look for in potential investments, and advice for founders navigating this new environment.

A Shifting Landscape

The most immediate change noted by the panelists is the altered funding landscape. Andrew Murray, the Head of Strategic Investments (Services, Markets & Banking) at Citi, stated: "We're seeing a flight to quality." Investors are now prioritizing stability and long-term viability over rapid, unsustainable growth.

In this new environment, investors are placing a premium on strong business fundamentals. As Ingmar Mattus, the Co-Founder at Tickmill Group, put it: "Investors are looking for startups with a clear path to profitability, a strong team, and a differentiated value proposition." This emphasis on substance over hype is a significant shift from the pre-pandemic era, where high-growth potential often trumped other considerations.

Christian Frahm, the Founder & CEO at United Fintech, emphasized the critical importance of customer focus: "Founders need to be laser-focused on solving a real problem for their customers. It's all about understanding their needs and providing a solution that delivers tangible value." This customer-centric approach is essential for building sustainable businesses that can weather the ups and downs of the market.

In a market where caution reigns, founders are advised to steer clear of overhyped promises and unrealistic claims. As Mattso cautioned: "Don't overhype your product or service. Investors can see through empty promises, and they'll be looking for startups with a grounded understanding of their own strengths and limitations."

Guy Hopkins, the Founder & CEO at FairXchange, said: “We are fortunate to have an investor, United Fintech, and that we are able to focus on engineering and growth without worrying about funding.”

Building for the Long Haul

Finally, the panelists reminded everyone that building a successful startup takes time and effort. Fram offered this sobering advice: "Focus on the customer and get to the market as quickly as possible, but remember, this is a marathon, not a sprint. Be prepared for the long haul, and don't expect to get rich quick."

In conclusion, the current funding landscape presents both challenges and opportunities for startups in the financial services space. By focusing on strong fundamentals, prioritizing customer needs, avoiding hype, and embracing a long-term perspective, founders can increase their chances of success in this evolving market. The insights shared by the panelists in this discussion provide valuable guidance for company executives looking to invest in or support the next generation of financial services startups.