The share prices of banks in the United States rebounded on Tuesday, improving after plummeting earlier on Monday. The stocks had plunged a day ago over fear of the possible contagion effects of the collapse of Silicon Valley Bank (SVB) and two other American lenders in the country’s banking industry.

Finance Magnates reports that SVB’s collapse cast a shadow on bank stock prices in the country on Monday, with the regional lender, First Republic Bank leading the pack as its shares slumped by over 60% to $28 a share at one point during the market. Other banks and financial services companies saw their stock prices plummet: Western Alliance Bancorp 64% to $18, KeyCorp 37% to 11%, and PacWest Bankcorp 30% to $7.

In addition, other bank stocks declined significantly: Zions Bancorporation 25% to $30, Charles Schwab 11% to $52 and Bank of America 3% to $29, among others.

US Bank Stocks Shake Off SVB Fears

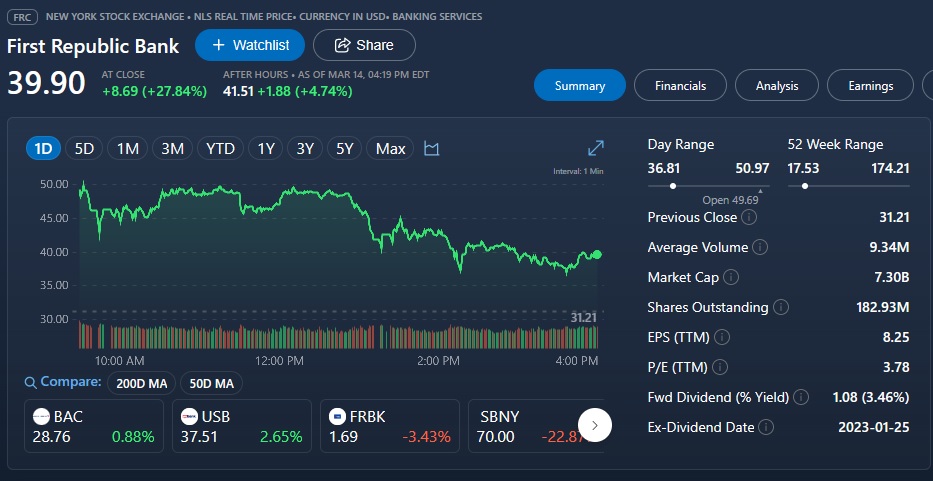

However, the market changed on Tuesday, as the sell-off frenzy slowed down with investors returning to the markets, suggesting that they are beginning to shake off the fear from the effects of SVB. At the time of filing this report, the shares of First Republic Bank and Western Alliance Bancorp, which saw some of the biggest declines yesterday, improved 28% to $40 a share and 14% to $30, respectively.

The shares of other banks also shot up: PacWest Bancorp 34% to $35, KeyCorp 7% to $12, Zions Bancorporation 4% to $31, Charles Schwab 9% to $57 and Bank of America 0.88% to $29 a share, among others.

SVB collapsed last Friday, precipitated by the inability to halt a bank run and its failed attempt to salvage the situation with extra funding. On Sunday, the bank, which targeted early-stage technologies companies, went into receivership of the Federal Deposit Insurance Corporation.

In their bid to forestall a contagion, New York regulators on Sunday shut down Signature Bank in order to “protect dispositors.” Speaking to Finance Magnates on Monday, Lars Holst, the Founder and CEO of digital broker GCEX, expressed surprise at Signature Bank’s fallout. Furthermore, the CEO expects the successors of the failed banks to emerge from the United Arab Emirates.