PayPal is changing its leadership after a disappointing quarter that rattled investors and showed how quickly the online payments boom has cooled.

The company will replace Chief Executive Officer Alex Chriss and hand the reins to HP Inc. chief Enrique Lores, as slowing checkout growth, softer US retail spending and a weaker earnings outlook weighed on the stock and raised fresh questions over PayPal’s ability to reignite momentum.

PayPal announced that Jamie Miller, the company’s chief financial officer, will serve as interim CEO until Lores takes over on March 1.

Weak Results and Leadership Shake-Up Hit PayPal Stock

The decision follows a period in which management struggled to convert rising payment volumes into stronger profit and to meet the targets it had set for investors.

- PayPal Applies to Establish Bank Targeting US Retail and Small Business Lending

- SEC Ends PayPal's Stablecoin (PYUSD) Investigation With No Enforcement Action

- Crypto.com Enables PayPal Payments for Crypto Purchases in EU

Newly appointed board chair David Dorman signaled frustration with the pace of change at the company. “While some progress has been made in a number of areas over the last two years, the pace of change and execution was not in line with the Board's expectations,” the company explained.

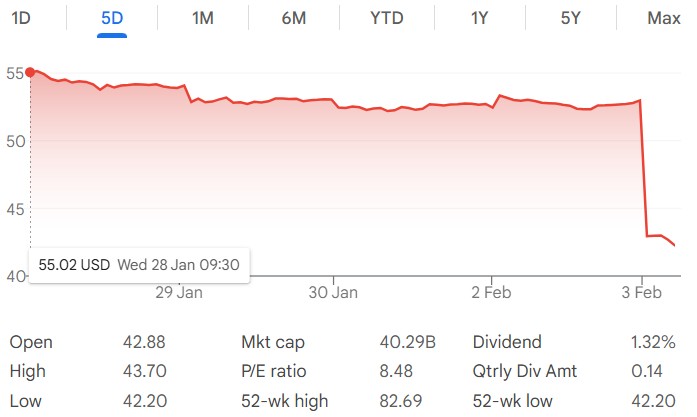

Investors reacted sharply to the announcement and the numbers. PayPal’s shares was down nearly 20% at press time, dropping to $42.30 after the company reported quarterly profit and revenue that fell short of analysts’ estimates.

The latest quarter exposed how macroeconomic pressures and changing consumer behavior weigh on PayPal’s core business. The company pointed to weakness in US retail spending as a drag on performance, alongside international headwinds that hit transaction volumes and margins.

Continue reading: Crypto.com Enables PayPal Payments for Crypto Purchases in EU

Miller had already warned in October that macroeconomic conditions could make the company’s longer-term targets harder to reach. Since then, the environment has not improved enough to offset the structural challenges of monetizing payments amid rising costs and intense competition.

Profitability Under Pressure and Guidance Reset

The financials highlighted a squeeze on profitability. Fourth-quarter earnings per share increased 3% to $1.23, with total revenue rising 4% to $8.9 billion, both below analyst expectations for the three-month period.

The company also reported full-year earnings per share of $5.31, missing its own guidance range of $5.35 to $5.39 issued in October.

Despite the disappointing earnings, PayPal continued to pursue strategic initiatives aimed at broadening its revenue base. During the quarter, the company applied to become a US bank with the Federal Deposit Insurance Corp. and the Utah Department of Financial Institutions. It already holds a banking license in Europe.