CMC Markets has elevated a company veteran to its top UK financial role, appointing Asia Pacific CFO John Cubbin as its new CFO of its two UK units, FinanceMagnates.com learned. The move draws a line under a nine-month period of leadership uncertainty following the abrupt departure of his predecessor, Albert Soleiman.

According to the UK regulatory registry, Cubbin took over the CFO role at the two Financial Conduct-regulated entity, CMC Markets UK and CMC Spreadbet, on 1 November 2025. Although Soleiman was the Group CFO, it remains unclear if Cubbin will also carry the Group CFO title, which would put him at the top finance role of the entire CMC Markets group.

The Leadership Gap is Filled

The story of the vacancy started back in February with Soleiman's departure. At the time, the publicly-listed broker announced he was stepping down "with immediate effect" and would no longer be a director. However, Soleiman agreed that he would remain for "a period of time" to ensure an orderly handover.

Soleiman, who had only held the Group CFO title since September 2023, ultimately remained with the firm until July, according to his public professional profile on LinkedIn. He has since been appointed CFO at Smarter Web Company, a company outside the retail trading industry.

His departure left CMC Markets without a Group CFO face for the subsequent four months, and nine months in total since the initial announcement. The former Group CFO was also the CEO of the CMC Invest brand, a role quickly filled by the London-listed broker by appointing David Fineberg to it, another internal move.

Earlier this year, Richard Elston, another long-time CMC executive, who played a key role in setting up its institutional business left the broker.

- CMC Markets Pilots Tokenised Share Trade Execution

- Exclusive: Richard Elston Left CMC Markets after 10 Years

- CMC Markets Ditches Banking-Only Payment Model, Integrates Skrill, Neteller Options Globally

Retreat to a Safe Pair of Hands

In turning to Cubbin, it appears that CMC's board is opting for stability and a known quantity. His promotion to the crucial role comes after 15 years of tenure with the company. Having joined the Group in 2013 as a financial controller and has made a solid career with the broker and was promoted to CFO of the key Asia Pacific region in 2022.

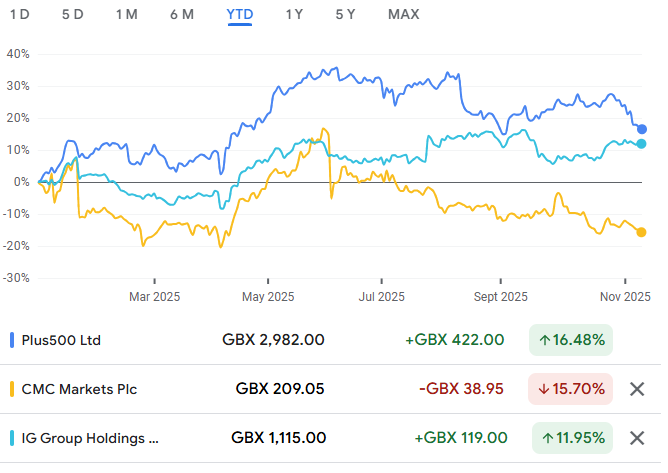

Shares in CMC Markets (LSE: CMCX) have fallen over 15 per cent year-to-date. The stock hit a yearly low of 197.20 pence in April before moving up to 288 pence. As of press time, the shares are trading at 209.45 pence.

In comparison, shares of the other two London-listed CFDs brokers, IG Group and Plus500, jumped by 12 per cent and 16.5 per cent, respectively, year-to-date.

Meanwhile, CMC Markets is also expanding. The broker recently partnered with Westpac in Australia to provide white-label trading platforms for the bank’s retail share trading services. Although the integration work will take roughly 12 months to complete, CMC expects the partnership to boost its Australian customer base by about 40 per cent and increase domestic trading volumes by around 45 per cent.

Australia is already CMC’s top market, strengthened by its previous white-label stockbroking partnership with Australia and New Zealand Banking Group (ANZ).

Although CMC operated retail and institutional divisions for years, it launched a third segment, Decentralised Finance (DeFi) and Web 3.0 capabilities, earlier this year. The broker is also considering launching stock tokenisation services.

FinanceMagnates.com also reported that Apex Group took over a 3 per cent stake in CMC Markets through its Jersey-based trust entity.