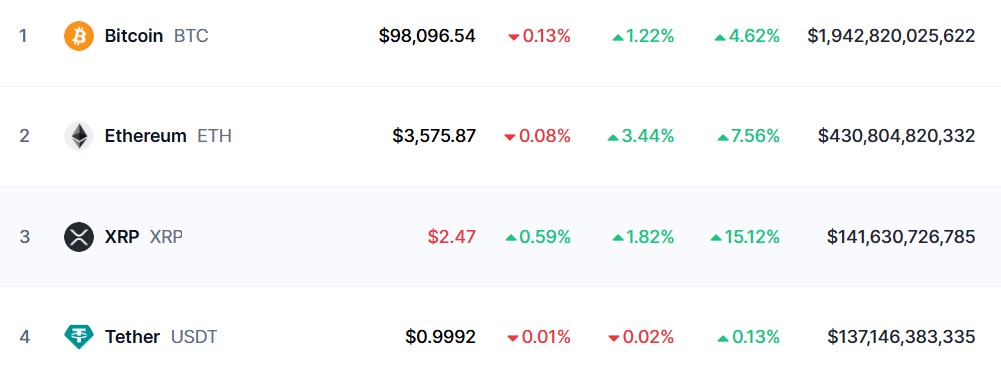

XRP has started the new year on a positive note, now ranking third on market capitalization. The cross-border payment-focused cryptocurrency has now overtaken Tether's USDT to become the third-largest cryptocurrency with a market cap of more than $141 billion.

This achievement follows a significant rally driven by favorable market conditions, increased investor interest, and shifting regulatory landscapes. Data from CoinMarketCap currently shows that the token is trading at $2.46. It has increased 2% and 15% in the past day and week, respectively.

Market Capitalization Soars

XRP's market capitalization surpassed Tether's capitalization, which was slightly above $137.4 billion at press time. This shift coincides with the rollout of the European Union's Markets in Crypto-Assets Regulation (MiCA), which imposes stricter rules on stablecoin issuers.

MiCA mandates full reserves and licenses for issuers operating in the EU, prompting concerns about compliance among key players like Tether. Notably, Coinbase Europe announced that it would delist USDT in December over MiCA compliance concerns, a factor that could have negatively affected the price of the stablecoin.

Looking at the broader timeframe, XRP has shown a fluctuation in price on the monthly chart. Over the past year, XRP has delivered a strong performance, rising more than 400% between November and December and peaking at $2.7. The price increase was driven by events such as Donald Trump's pro-crypto presidential election victory and speculation around an XRP exchange-traded fund (ETF).

Recently, WisdomTree became the fourth company to file for a spot in XRP ETF, joining other major issuers like Bitwise and 21Shares. Ripple Labs also strengthened XRP's momentum with the launch of Ripple USD (RLUSD), a stablecoin aimed at facilitating cross-border enterprise payments.

A Message from Ripple Labs' CEO

Meanwhile, the new year started with a massive XRP transfer of 500 million tokens worth over $1 billion, tracked by blockchain analytics firm Whale Alert. Ripple's CEO Brad Garlinghouse expressed optimism for 2025, citing “momentum and increased focus on real-world utility.”

Technically, XRP is in a clear uptrend, currently trading above the 50 and 200 moving averages. The price is approaching the $2.6 resistance level after bouncing off the $1.98 support level. The Relative Strength Index (RSI) is at 61, meaning the price could rise further before any change in trend can be seen.

With the regulatory climate becoming potentially more favorable, particularly after SEC Chair Gary Gensler's resignation, XRP appears well-positioned to soar as high as $10 in 2025. ETF approvals and broader adoption of Ripple's payment solutions may continue to propel its market performance.