Cryptocurrency Solana (SOL) experienced an astonishing surge in its stablecoin market, driven by an unlikely catalyst, TRUMP, a memecoin tied to former U.S. President Donald Trump.

This meme-driven frenzy has propelled Solana's total stablecoin supply to an unprecedented $10 billion, doubling in just a few weeks. As the TRUMP coin gained traction on Solana's decentralized exchanges (DEX), it sparked a wave of liquidity inflows, Coindesk reported.

Solana Stablecoin Market

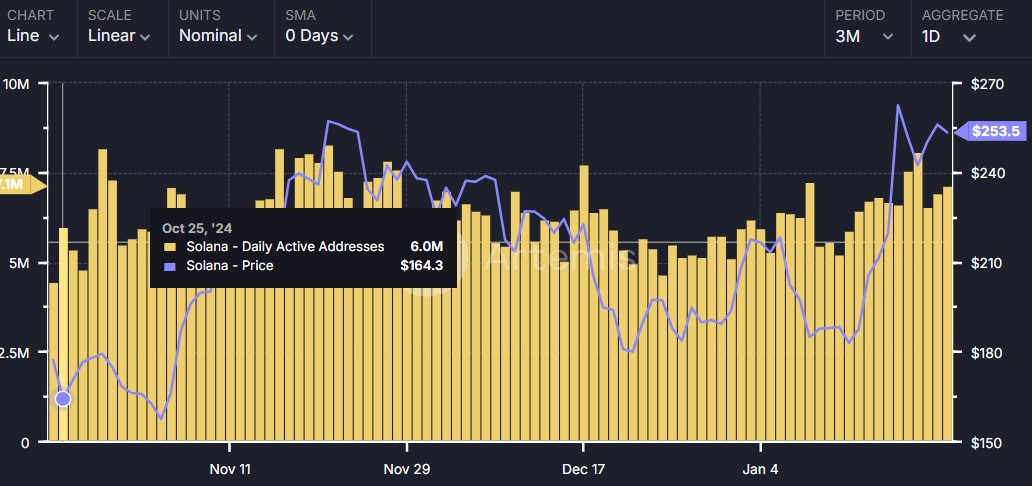

Solana, a high-speed blockchain known for its low-cost transactions, has recently become the focal point of a massive increase in stablecoin liquidity.

Data from Artemis Terminal shows that Solana's total stablecoin supply has skyrocketed to $10.5 billion, marking a twofold increase since the start of January. Leading the charge is Circle's USDC, which experienced its circulation surpassing $8 billion, adding over $4 billion in just this month alone.

Meanwhile, Tether's USDT supply reportedly more than doubled, reaching $2 billion from a mere $917 million. Stablecoins like USDC and USDT are essential to the cryptocurrency ecosystem, providing liquidity for trading on decentralized platforms.

With these tokens now flowing in greater volumes, Solana's blockchain has become a thriving hub for crypto trading. The tipping point for this meteoric rise came with the January 17 launch of TRUMP coin, a memecoin tied to Donald Trump, on Solana's decentralized exchange Meteora.

Impact of TRUMP Memecoin

While it initially traded against USDC, the excitement around the token quickly translated into massive demand for Solana's stablecoin. The TRUMP coin's introduction came at a time when Solana's ecosystem was already seeing heightened activity following crypto-friendly developments.

However, the memecoin created a frenzy of its own, igniting record trading volumes across DEXs and pushing Solana into the limelight. As a result of this increase in on-chain trading activity, Solana-based decentralized exchanges set a new daily volume record of $25 billion.

This represents 74% of the total DEX trading volume across all blockchains, a significant milestone for the network. The surge in activity also extended to Solana's native token, SOL, which outperformed the broader market with a 20% gain, far outpacing Bitcoin's 2% rise.