Ethereum's price has been in a slump recently, slipping more than 15% in the past week amid bearish momentum in the overall crypto space. Ethereum's current struggles are mainly driven by a return to inflationary supply levels. Since April 2024, the network's supply has been increasing, which is the opposite of the deflationary environment it experienced after the Merger.

Ethereum's Price Outlook

The total supply has risen by 0.37% in the past nine months, reaching 120.4 million ETH, according to data from Ultrasound.money This increased supply, coupled with lower demand, has fueled concerns about the asset's price trajectory.

On the 4-hour chart on TradingView, Ethereum has dropped below the $3,087 support level in a clear downtrend. The critical question for investors now is whether Ethereum can maintain this support level, with failure to hold above the support could lead to further declines.

Additionally, the price is below the 50 and moving averages. However, ETH's Relative Strength Index (RSI) is at the oversold territory of 22, meaning there is a possibility of price reversing before a further downward momentum can be seen.

Ether's price had remained in a consolidation, trading between a low of $3,189 and a high of $3,330 before the price dipped to the current level. On the daily chart, RSI is close to the oversold zone at 32, with the price currently above the 50-moving average.

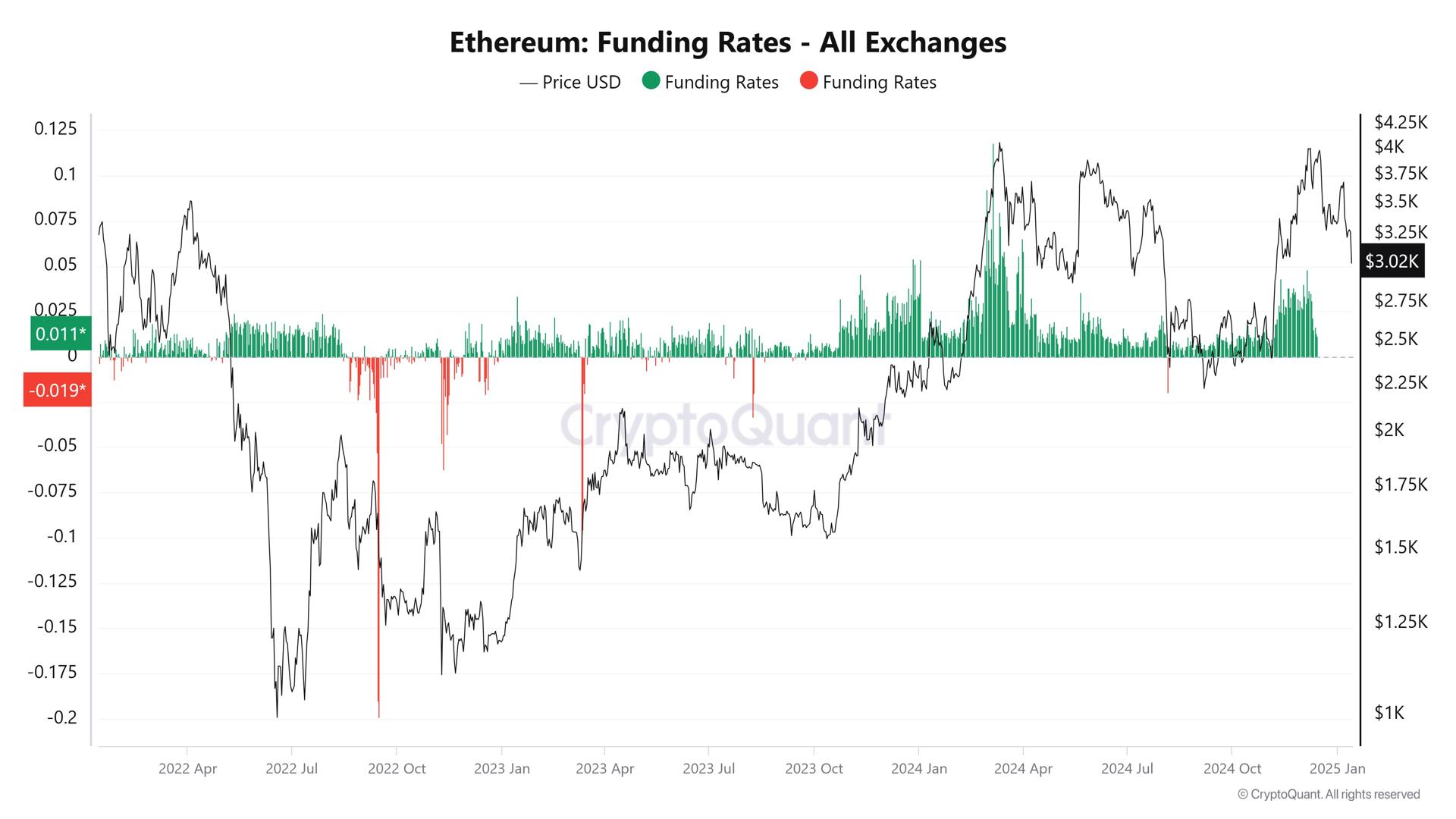

On the longer time chart, price had been on a downward trend on the weekly chart since touching a high of $4,010 in December 2. A notable development is the recent drop in funding rates, which suggests increasing bearish sentiment among traders.

On-Chain Metrics

However, as Ethereum nears the $3,000 support zone, funding rates have begun to show signs of recovery, indicating that some traders are opening long positions in anticipation of a rebound, data from CryptoQuant shows.

If these funding rates continue to recover, it could signal the start of a bullish phase for Ethereum. However, if the recovery falters and the bearish sentiment intensifies, further downside risks remain. Ethereum's price is at a crossroads, with its fate likely tied to whether it can regain momentum.