Stablecoin issuer Tether plans to propose board candidates and governance changes at Italian football club Juventus. The company holds a 10.7% stake in the club, according to a Reuters report.

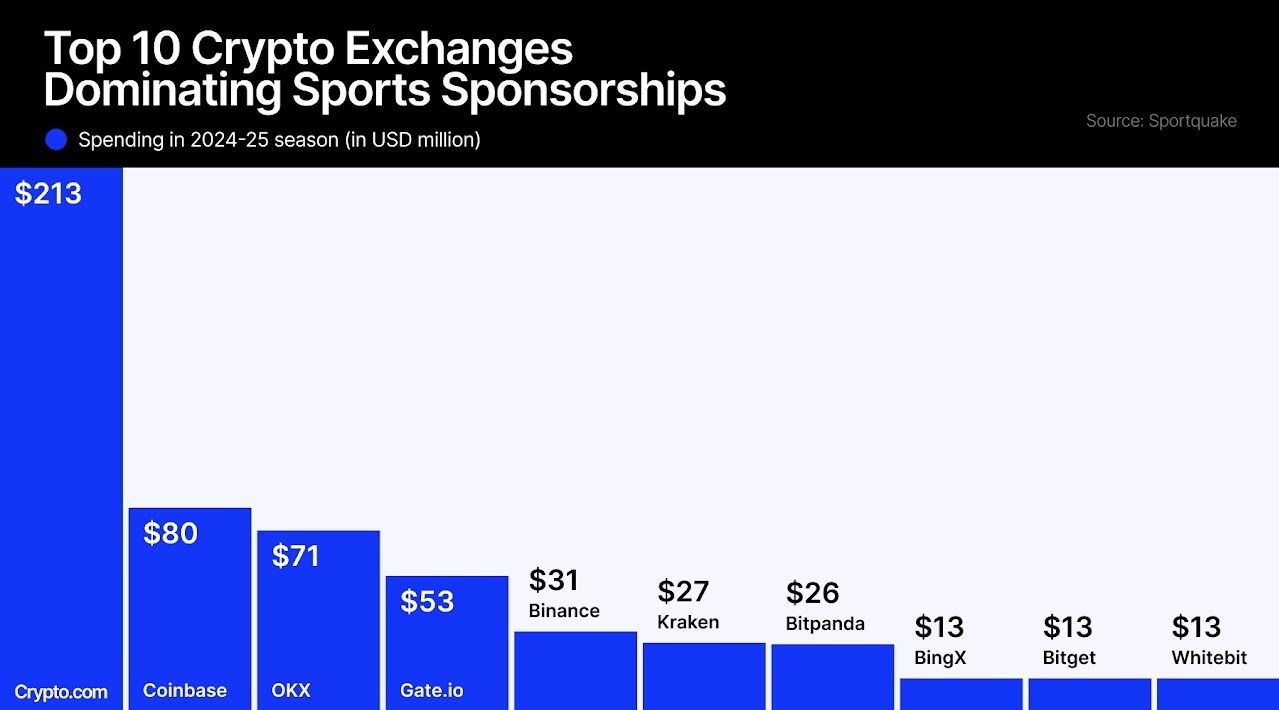

The move comes amid a growing trend of football clubs partnering with crypto firms. Newcastle United signed with BYDFi, several Premier League teams work with Crypto.com and Gate.io, and Kraken appears on the jerseys of multiple European clubs, reflecting the expanding role of digital assets in sports sponsorship and club investment.

Stablecoin Firm Contributes $129 Million Juventus

The proposals are expected ahead of a Nov. 7 shareholder meeting. Tether will also contribute about $129 million as part of a capital increase in Juventus.

Digital assets meet tradfi in London at the fmls25

The company first invested in the club in February and increased its stake to over 10% by April, citing a commitment to long-term collaboration, according to CEO Paolo Ardoino.

Club Leadership Faces Controversy, Resignations Follow

Juventus’ board has faced controversy in recent years. In November 2022, all board members resigned following allegations of financial fraud linked to players’ salaries. Former board Chair Andrea Agnelli and two other executives accepted plea deals with Italian authorities in September, receiving suspended sentences.

- Billions in Stablecoins, Football Sponsorships and the Fight Over Prediction Markets

- CFTC to Allow Stablecoins as Collateral in Derivatives Markets

- Tether Launches USA₮ Stablecoin, Names Former Trump Crypto Adviser as CEO

Tether Seeks $500B Valuation Amid Scrutiny

Separately, Tether is reportedly seeking $15–20 billion in fresh capital, targeting a potential $500 billion valuation. The company, which issues the largest stablecoin USDt, currently has around $100 billion in circulation and earns revenue from interest on reserves backing its tokens.

Tether’s reserve disclosures have raised questions, and it settled a $41 million regulatory case in 2021. The firm remains significant in crypto liquidity . Its capital-raising plans and $500 billion valuation reflect market expectations rather than traditional fundamentals and illustrate the role of stablecoins in funding strategies.