Hut 8 (Nasdaq | TSX: HUT), a prominent cryptocurrency mining corporation, has shuttered its Bitcoin mining site in Alberta, Canada. Announced yesterday (Wednesday), the decision aligned with the company’s “ongoing restructuring and optimization initiatives designed to strengthen financial performance.”

“Following a comprehensive analysis, we have determined that the profitability of Drumheller has been impacted significantly by various factors, including elevated energy costs and underlying voltage issues,” Asher Genoot, the CEO of Hut 8, said.

Relocation of Efficient Miners

The company detailed that it will relocate the efficient cryptocurrency miners to the Medicine Hat site in Alberta, Canada, while retiring the old and inefficient miners from operations.

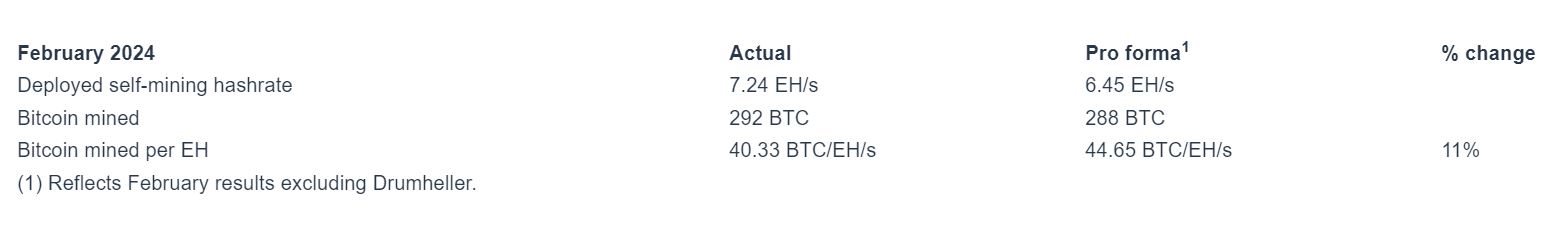

According to Hut 8, the capacity of the efficient miners from the closed site is about 130 PH/s of hash rate, while the capacity of inefficient miners is 38 J/TH. With the relocation, the company expects to enhance its cash flow and reduce its cost of mining Bitcoin. The company estimated the relocation would increase the Bitcoin mined per EH by about 11 percent.

Strengthening the Financials of the Company

The restructuring of operations came when Hut 8 was struggling with its financials. In the third quarter of 2023, the company’s revenue declined 46 percent, which was CA$ 17.0 million, including CAD 4.5 million from its high-performance computing business. Its net loss also doubled after dropping to $9.9 million.

“Our restructuring plan aims to drive maximum value from our assets and position the company for profitable growth. With the nominal lease expense, we will also have a low-cost option to re-energize the site if energy rates in the AESO grid decrease or hash price increases.”

Despite the site's closure with immediate effect, Hut 8 will maintain its lease of the site and retain the option to restart operations if market conditions improve.

Meanwhile, Hut 8 recently changed its leadership with the appointment of Asher Genoot, who succeeded Jaime Leverton as the Chief Executive Officer.