Hungary, a Central European country with a population of over 9.5 million, has introduced strict laws criminalising trading on an “unauthorised crypto-asset exchange service” and imposing jail terms of up to five years for traders and eight years for service providers.

Significant Jail Time for Trading on “Unauthorised” Platforms

According to the country’s criminal code, which came into force on 1 July 2025, people trading on unauthorised crypto exchanges may face a jail term of up to two years if their trading volume is between 5 million and 50 million forints ($14,600 to $145,950). For amounts between 50 million and 500 million forints ($145,950 to $1.46 million), the term can go up to three years.

Traders dealing with over 500 million forints might face a penalty of up to five years in jail.

The criminal law also specifies punishments for providers of unauthorised “crypto-asset exchange service activities.” The penalty for them also depends on the volume handled.

Those who handled up to 50 million forints ($145,950) may face up to three years in prison, while handling up to 500 million forints ($1.46 million) could mean five years. For more than 500 million forints, the penalty goes up to eight years.

The Law Impacts Hungary’s Crypto Scene

Despite the strict laws, the local rules for crypto companies in the country remain unclear. Hungary’s Supervisory Authority for Regulatory Affairs (SZTFH) has 60 days to introduce compliance rules; however, no guidance exists in the meantime.

You may also like: EU Watchdog Wants Crypto Exchanges and Companies Staff to Hit the Books

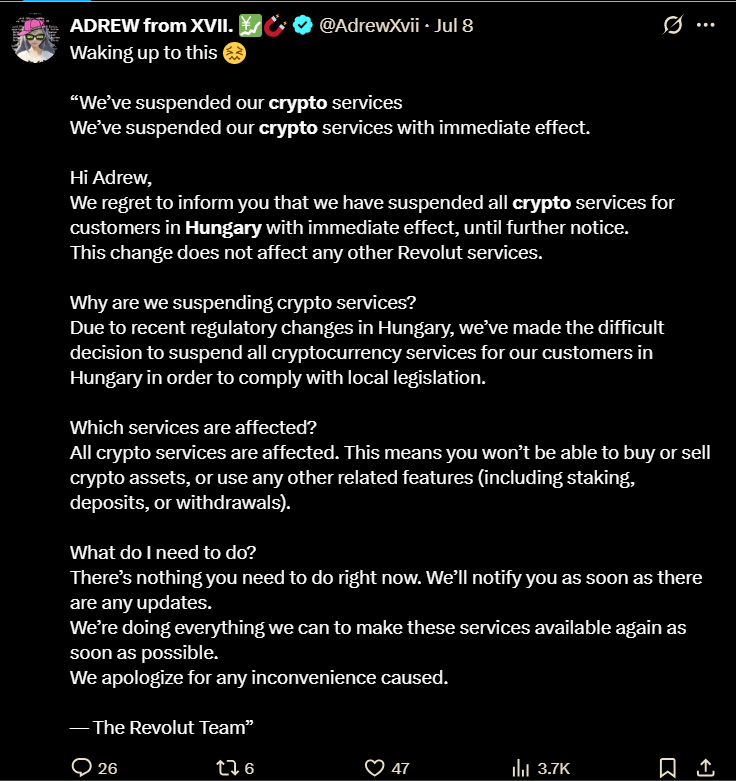

The impact of the criminal law is already visible in Hungary’s crypto industry. British fintech Revolut has withdrawn its services from Hungary due to the new laws, stopping all crypto services. The platform cited the “recently introduced Hungarian legislation” as the reason but has not provided a timeline to bring back its services.

Hungary is part of the European Economic Area. This means the bloc’s Markets in Crypto-Assets Regulation (MiCA) regime also applies in Hungary.

Meanwhile, Hungary is not the only country to introduce jail time for unauthorised crypto service providers. The United States, the United Kingdom, Hong Kong, and South Korea are a few examples that criminalise the offering of unlicensed crypto trading activities, but few go after individual traders.

Recently, Singapore ordered local crypto companies to stop serving overseas clients unless they secure a licence under new rules. Unlicensed firms that continue overseas digital token operations now face a fine of up to SG$250,000 and/or up to three years in prison.