Following their public launch last month at the Forex Magnates London Summit Innovation Stage, Exgate has announced their first post-launch partnership collaboration with Bitreserve and JSC Caufex. The combined firms are introducing real-time settlement clearing and custody services for contracts for differences (CFDs) that are based on leveraged digital currency tradable instruments. With the combined technologies, brokers and trading venues will be able to provide leveraged CFD trading with clearing and straight-through processing (STP) of digital currencies taking place with Exgate’s technology and using Bitreserve and JSC Caufex for clearing, settlement and regulation of trades.

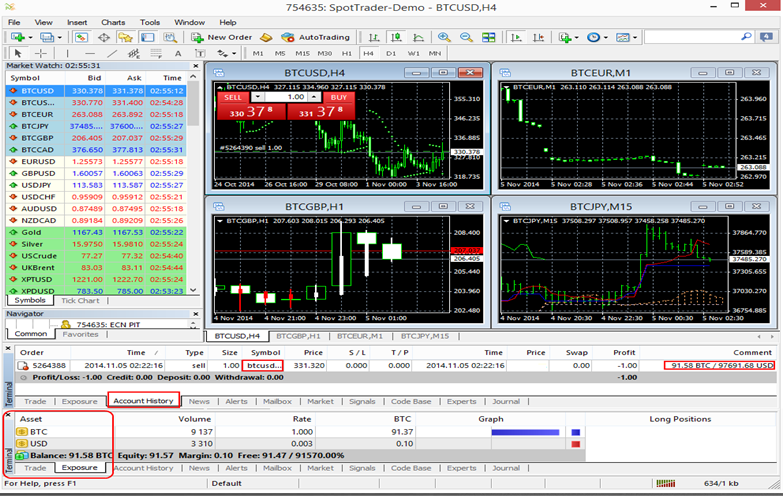

A provider of bitcoin and digital currency trading solutions to the online brokerage industry, Exgate’s products include MetaTrader 4 white labeling, integrated bitcoin wallets for deposit and withdrawals without the need for a payment processor and risk management tools. A bitcoin trading technology provider, Exgate, connects to JSC Caufex’s electronic derivatives and commodity exchange for Liquidity of bitcoins and other Cryptocurrencies . A regulated exchange, in addition to clearing technology and liquidity lines, JSC Caufex also brings compliance and licensing arrangements to the partnership under its regulatory umbrella.

Under the terms of the new deal, Bitreserve becomes the exclusive bitcoin clearing system for JSC Caufex’s new cryptocurrency-trading offering in its electronic derivatives and commodities exchange. With Bitreserve, clearing members will be able to store funds denominated in fiat currencies or gold to remove bitcoin volatility risk, but which will be transferable to cryptocurrencies for settlement of trades.

According to the firms, the combined solution provides a “true end-to end STP solution addressing the major deficiencies that currently exist in the forex markets, derivative and cryptocurrency financial world." The solution is being marketed as a turnkey solution for market makers, asset managers, traders and brokers to provide them with a regulated entity for account deposits, leveraged bitcoin trading and cross participation settlement.

In terms of innovation, cross participant clearing and settlement may be the most important part of the partnership. The central clearing system allows for greater transparency of traders which could provide a solution to traders and financial firms that have been hesitant to engage in bitcoin trading due to the funding risks involved with lesser known counterparties.

Commenting on the news, CEO of Exgate Gregory Mazzeo stated, “This partnership is a major step towards bringing cryptocurrencies into the mainstream financial world. The combination of Exgate, CAUFEX and Bitreserve’s technological and clearing capabilities for digital instruments will enable the ability to offer exchange derived pricing and liquidity with a standardized settlement date for cryptocurrency transactions in a truly transparent and wrapped environment. A true game changer for the crypto world.”

Carl Weir of Partnering and Business Development, Financial Markets at Bitreserve added, “Partnering with Exgate represents a seamless merging of institutional and cryptocurrencies transactions into a safe, secure, and transparent environment. This will not only allow institutions to achieve full transparency in multiple asset classes, but also allow seamless near-zero cost clearing, and real-time settlement; the latter three being expected pillars of trading that was near unattainable, until now. This partnering is an industry first.”