Crypto exchange BingX has launched BingX TradFi, a new feature offering futures tied to traditional assets. The move reflects a broader industry shift toward building one-stop financial platforms rather than single-purpose trading venues.

With this latest expansion, BingX joins an increasingly competitive push by crypto platforms to move beyond digital assets and into multi-asset trading. Crypto-native platforms are leveraging their existing infrastructure and user bases to offer exposure to forex, commodities, and equities without requiring users to open separate brokerage accounts.

This trend is becoming more visible across the industry. Rival exchange Bitget has rolled out its own TradFi trading suite following a private beta, while Binance has introduced regulated perpetual contracts on commodities such as gold and silver. In each case, exchanges are positioning these products as a bridge between crypto trading environments and traditional asset classes.

BingX is launching with futures linked to more than 50 underlying assets, including commodities such as cocoa and soybeans, and is offering leverage of up to 500x, according to company disclosures. The exchange has also highlighted demand from the Middle East and North Africa (MENA) region, where access to global markets through conventional brokerage channels can be limited or costly.

- BingX Announces Pre-Launch Futures for Early Trading on Unlisted Tokens

- BingX Integrates Apple Pay and Google Pay to Expand Crypto Payment Options

- Crypto Exchange BingX Expands Chelsea FC Deal, Becomes Training Kit Sponsor

“In today’s dynamic markets, BingX TradFi is designed to broaden access to global assets,” said Vivien Lin, Chief Product Officer at BingX.

Why Crypto Exchanges Are Moving Into Multi-Asset Trading

Operational convenience sits at the core of this strategy. Crypto platforms use stablecoin settlement, continuous trading hours, and familiar derivatives interfaces to attract retail traders seeking global market access without the typical constraints of traditional brokers.

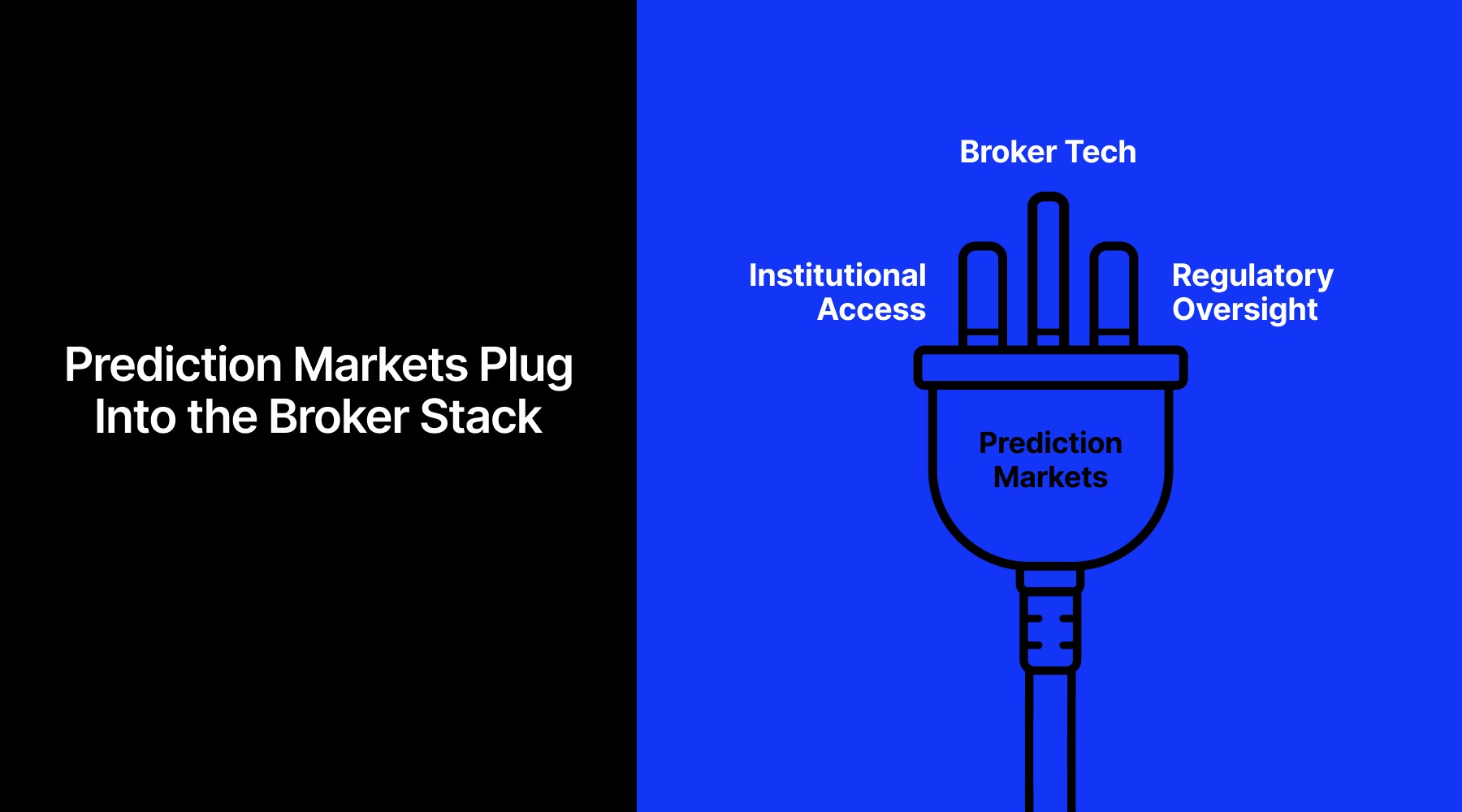

However, this expansion reflects convergence at the product level rather than full regulatory alignment with traditional brokerage models. Even as crypto exchanges add products that resemble those offered by licensed brokers, key differences remain.

These platforms operate under different regulatory frameworks, and the level of investor protection varies widely by jurisdiction. Taken together, the near-simultaneous launches by BingX, Bitget, and Binance underline a broader strategic shift.

Having built scale in crypto derivatives, exchanges are now testing how far their platforms can extend into traditional markets — not by replacing brokers outright, but by reshaping how retail traders access multi-asset exposure in a 24/7, crypto-native environment.