The US Securities and Exchange Commission (SEC) is currently reviewing multiple filings related to the potential listing of Dogecoin-based exchange-traded funds (ETFs).

NYSE Arca has filed a 19b-4 seeking approval to list Bitwise’s Dogecoin ETF, with Coinbase Custody managing the Dogecoin holdings and Bank of New York Mellon overseeing the cash assets. The ETF aims to track the market value of Dogecoin using the CF Dogecoin-Dollar Settlement Price.

Bitwise, Grayscale Lead Dogecoin ETF Applications

This filing follows Bitwise's earlier submission of an S-1 to the SEC. Alongside Bitwise, other firms such as Grayscale and Rex Shares have also sought approval for a Dogecoin ETF, with Grayscale’s application further along in the SEC's review process, as Coinstats reported.

According to Polymarket, the probability of approval for a Dogecoin ETF has risen to 67%, and Bloomberg analysts predict a 75% chance of approval by 2025.

Market Volatility Continues Despite ETF Approval

Despite growing optimism surrounding the potential approval, Dogecoin’s market performance has recently been marked by a nearly 16% price drop and a 17% decline in trading volume, reflecting the inherent volatility of meme coins.

However, market sentiment remains positive, with analysts noting that the development of a regulated Dogecoin ETF may signal broader regulatory acceptance of cryptocurrencies in traditional markets.

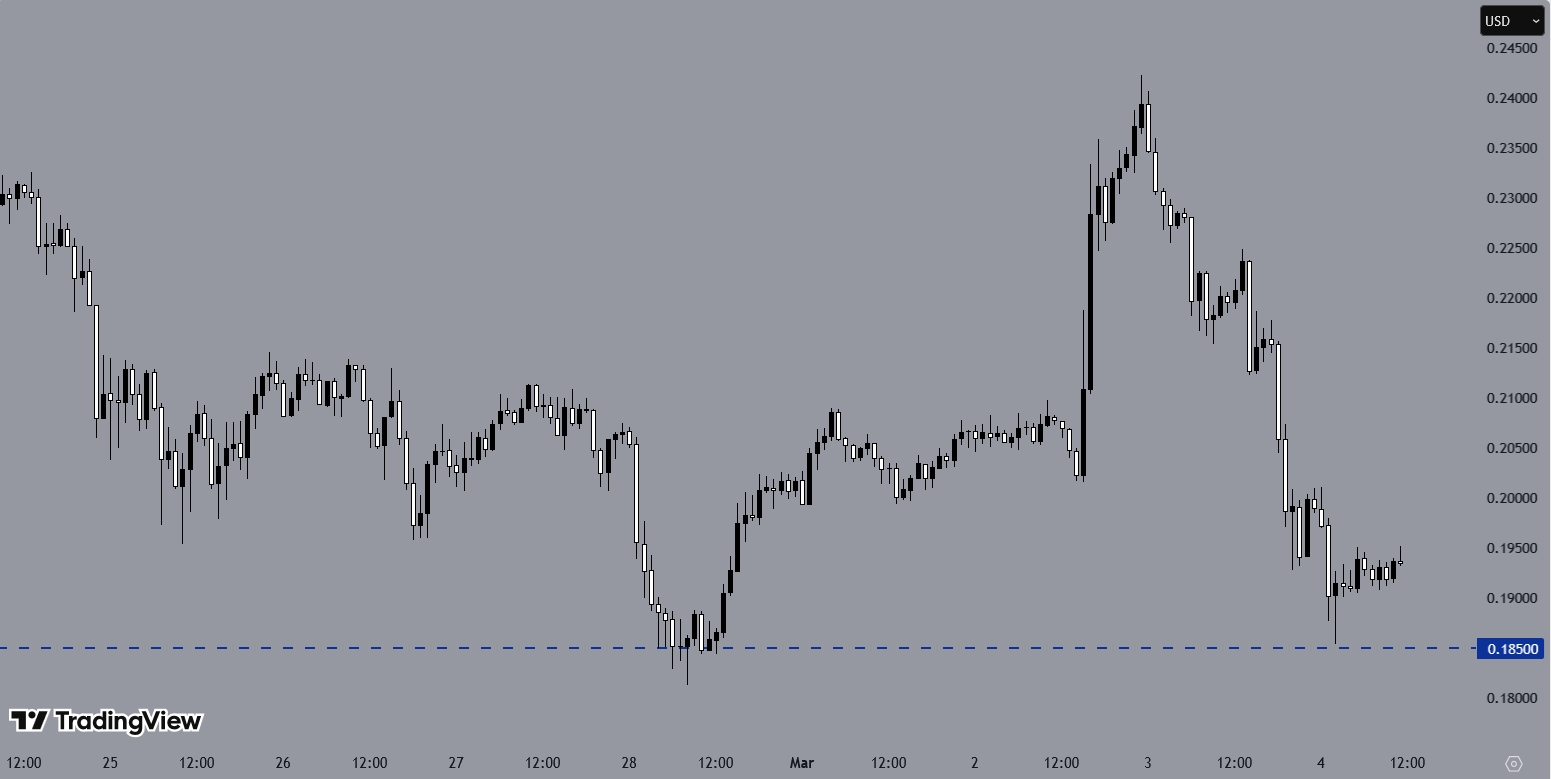

DOGEUSD Bearish Move Pauses at Support

The DOGEUSD H1 chart reveals a significant bearish move after a period of bullish momentum. The price faced rejection at 0.24000, forming a bearish engulfing candle. Since then, it has been moving lower, finding support at 0.18500.

Currently, the cryptocurrency is trading around this level. Buyers may wait for a potential bounce at 0.18500, followed by a strong bullish reversal pattern to enter long positions. Conversely, sellers may look for a breach of this level, followed by a breakout confirmation, to go short and push the price further down.

DOGEUSD Bearish Move Pauses at Support

The DOGEUSD H1 chart reveals a significant bearish move after a period of bullish momentum. The price faced rejection at 0.24000, forming a bearish engulfing candle. Since then, it has been moving lower, finding support at 0.18500.

Currently, the cryptocurrency is trading around this level. Buyers may wait for a potential bounce at 0.18500, followed by a strong bullish reversal pattern to enter long positions. Conversely, sellers may look for a breach of this level, followed by a breakout confirmation, to go short and push the price further down.