CyVers and Station70, two companies specializing in Web3 security, have formed a strategic partnership and launched a transaction security solution tailored for institutions of all sizes. The solution addresses the growing attacks on wallet and transaction signing systems.

Combining Expertise

Announced today (Tuesday), the solution, named Secure Signer, proactively secures institutional transaction signing while protecting against evolving cyber threats. The solution combines Station70’s hosted co-signer-as-a-service with CyVers’ advanced real-time threat detection engine.

The solution offers Fireblocks wallet users a deployment option that simulates and validates transactions for security risks before blockchain execution. According to the companies, the dual-layered security approach enables institutions to gain better control over signing processes while ensuring transactions are legitimate, monitored, and protected without adding operational complexity.

“By combining CyVers’ real-time threat intelligence with Station70’s co-signer technology, we provide institutions with a streamlined path to advanced transaction security,” said Adam Healy, CEO and Co-founder of Station70. “This is more than a product; it’s a step towards restoring institutional confidence and trust in Web3 transaction safety.”

Addressing Critical Security Needs

The need for this solution stems from significant losses suffered by crypto companies due to security breaches. A press release shared with Finance Magnates revealed that users and companies lost over $4 billion in crypto assets in the past two years to access control attacks.

Hacking incidents involving centralised entities increased by 1,000 per cent in 2024, including a $54 million breach at BtcTurk and a $52 million incident at BingX.

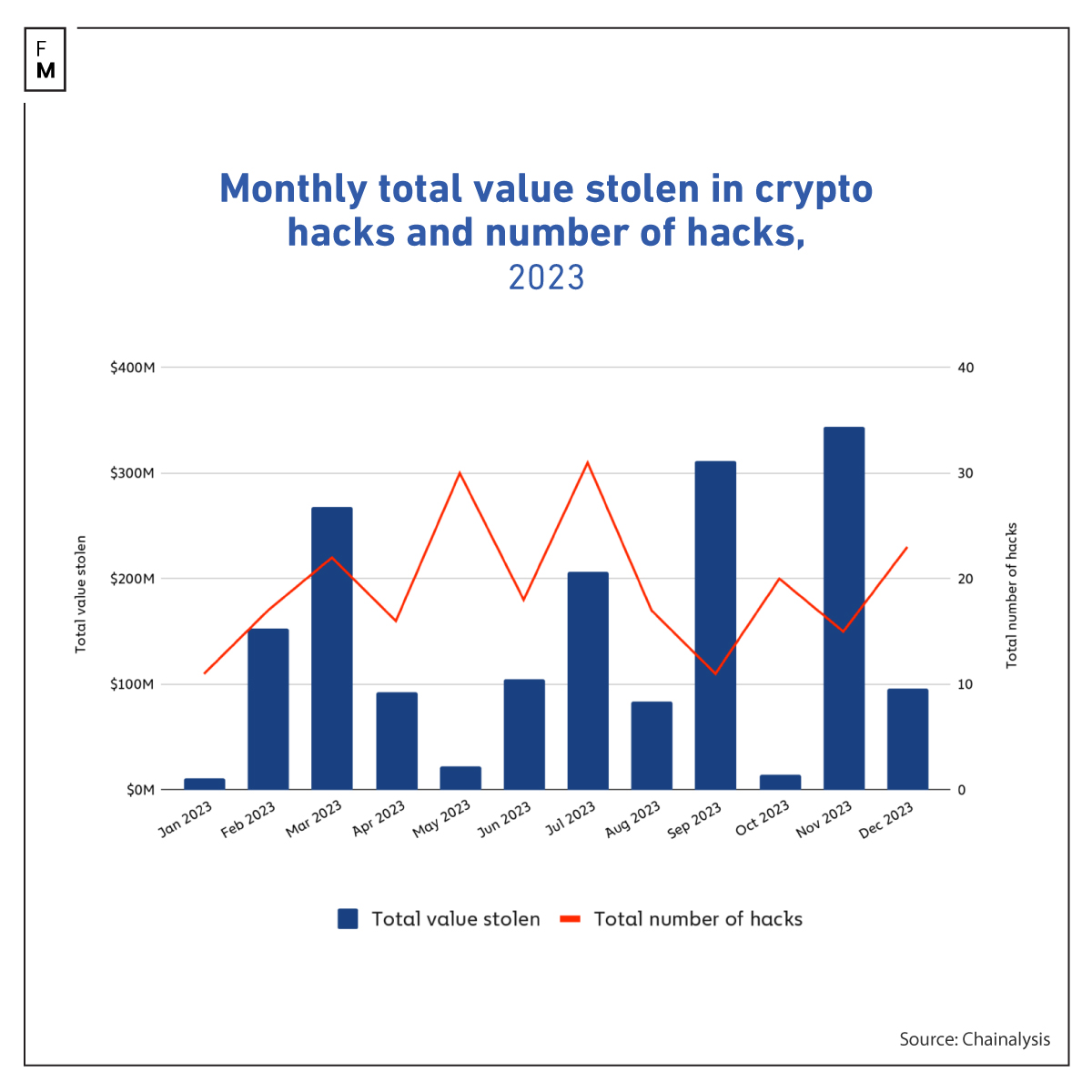

Earlier this year, Finance Magnates reported that funds stolen by hackers from cryptocurrency platforms fell by over 50% in 2023 compared to the previous year. However, the number of individual hacking incidents rose, indicating that hacking remains a significant threat for crypto investors.

In 2022, hackers stole a record $3.7 billion from crypto platforms. But, according to a new report from the blockchain analytics firm Chainalysis, in 2023, that figure dropped to around $1.7 billion, representing a decrease of 54%. The main driver of this drop was a major decline in decentralized finance (DeFi) hacking. After exploding in 2021 and 2022, with over $3 billion stolen each year, funds stolen from DeFi protocols fell by nearly 64% to $1.1 billion in 2023.

“The integration of Station70’s co-signer service with CyVers’ threat detection addresses a critical gap in wallet security,” said Deddy Lavid, CEO of Cyvers. “We’re excited to provide institutions with this unique solution to significantly reduce losses from access control breaches and private key exposures.”