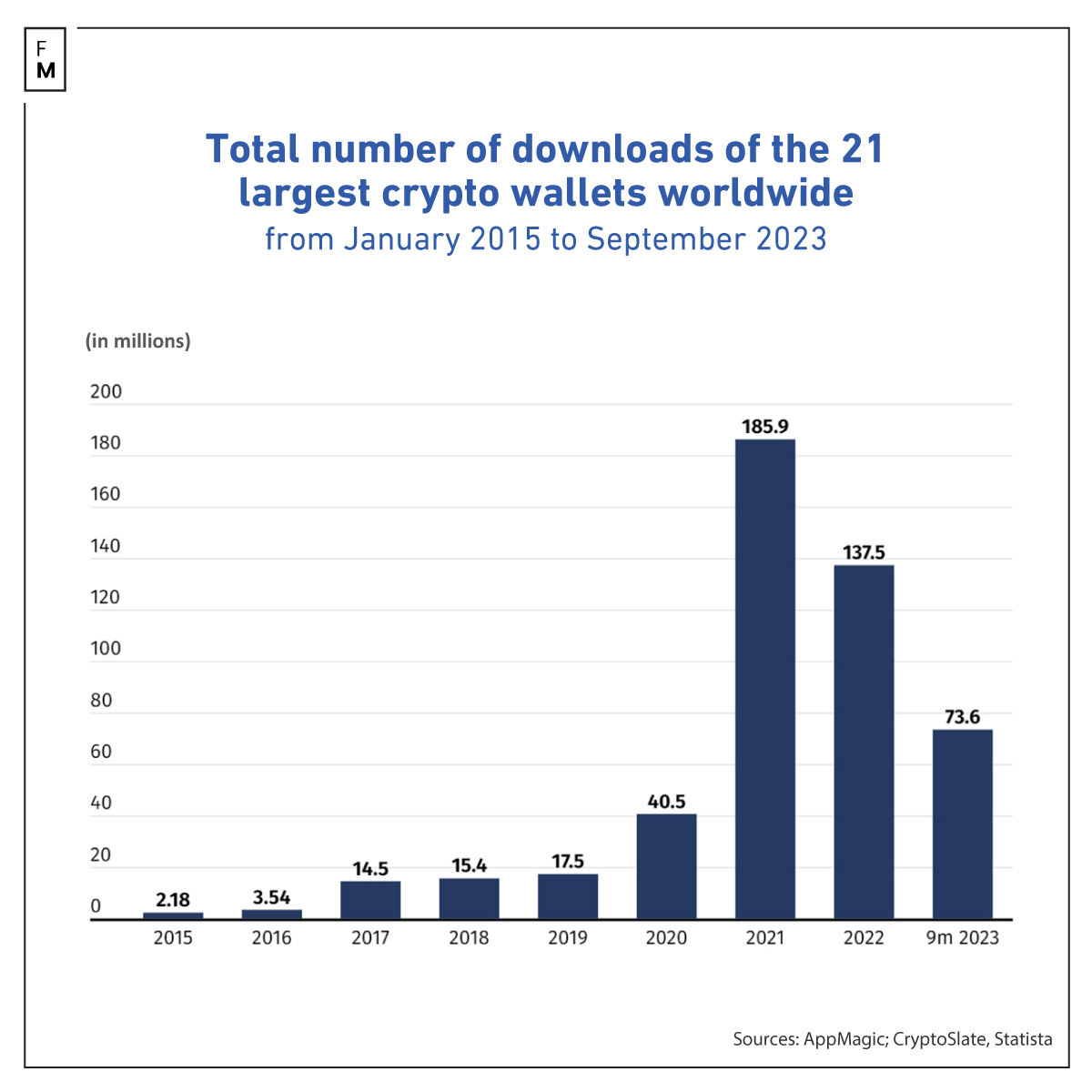

In a year marked by the resurgence of cryptocurrencies, the global interest in cryptocurrency storage applications has experienced a notable decline. Recent data reveals that cryptocurrency wallets witnessed a total of 73.6 million downloads in the first nine months of this year, reflecting a decrease of 32% compared to the same period last year.

Declining Interest in Crypto Wallets

This drop in downloads marks the second consecutive year of declining interest in crypto wallets. The number of cryptocurrency wallet downloads has now fallen significantly below the peak levels observed during the crypto market's boom in 2021. The immense growth of the cryptocurrency market, coupled with Bitcoin's price rally throughout 2021, led to a surge in cryptocurrency wallet users.

According to data from Statista, AppMagic, and CryptoSlate, global users downloaded nearly 186 million cryptocurrency wallets in 2021, setting a new record high in the market's history. This number is even more astonishing when compared to the figures from a few years prior.

The statistics show that the total number of downloads in 2021 was 4.5 times higher than in 2020 when there were approximately 40 million downloads. It was also ten times higher than in 2019, when the number of downloads stood at 17.5 million.

However, following this historic high in 2021, the trend took a downturn. Between January and December 2022, the monthly downloads more than halved, plummeting from 16.8 million to 7.8 million. This caused the annual download figure to decrease 26% year-on-year, totaling 137.5 million downloads.

73.6 Million Crypto Wallet Downloads in 2023: A Significant Decrease

The decline continued into 2023, with people worldwide downloading 73.6 million cryptocurrency wallet apps in the first nine months. It included prominent platforms like Coinbase, Blockchain.com, Metamask, Trust, and Binance, among others. This number was substantially lower than the 109.7 million downloads reported in the same period in the previous year.

Furthermore, the monthly download figures exhibit a sharp decline in the popularity of crypto wallets. After hovering around nine million between January and May this year, the total number of downloads dipped to approximately seven million in June and July.

However, the decline reached a critical point in September, with statistics revealing a mere 5.8 million crypto wallet downloads during that month, marking the lowest number in the past three years.

Despite this downward trend, it's worth noting that the overall number of cryptocurrency wallet downloaded remains substantial. Statistics indicate that since January 2015, people worldwide have downloaded more than 490 million applications that facilitate cryptocurrency storage.