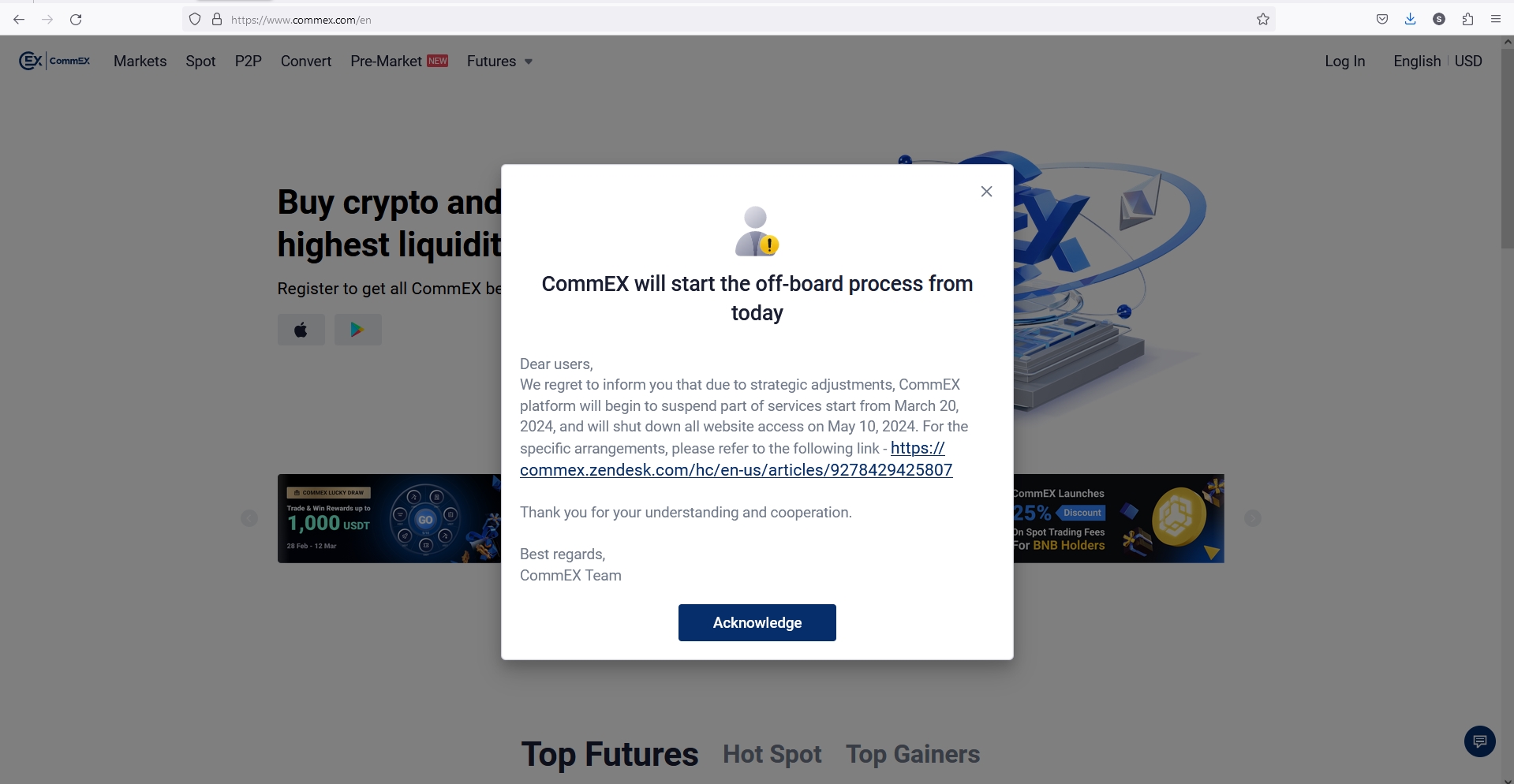

In an unexpected twist, it has been revealed that CommEX, a relatively unknown crypto platform, is preparing to suspend its services gradually, commencing on March 20, 2024, and culminating in a complete shutdown of website access by May 10, 2024. This announcement comes after CommEX had acquired the business of Binance earlier, marking a notable shift in the digital landscape.

Uncertainty Looms over Users

The decision to wind down operations has been attributed to "strategic adjustments," leaving users uncertain about the future of their digital engagements on the platform. Prior to this development, CommEX had made headlines for its acquisition of Binance's business, a move that had attracted attention within the cryptocurrency community.

Despite its relatively recent acquisition of Binance's business, CommEX finds itself in the spotlight as it navigates the process of offboarding its users and shutting down its services. However, details surrounding CommEX, including its ownership and operational framework, remain scant. According to information available on the platform's "Terms of Use" page, CommEX is operated by CommEX Holding Limited, a company registered in Seychelles.

Binance's Withdrawal from the Russian Market and Transition to CommEX

Earlier, Binance confirmed its complete withdrawal from the Russian market, executing an agreement to transfer its entire business operations in Russia to the cryptocurrency exchange platform known as CommEX. The announcement of this exit had been made by Binance on September 27, 2023.

To emphasize the exchange's focus on ensuring a seamless transition for its existing Russian user base, Binance initiated an off-boarding process that extended over the course of one year. In a statement, Binance mentioned: "All assets of existing Russian users are safe and securely protected.” Binance reassured its users about the safety of their holdings throughout the transition period.

Meanwhile, a federal court in Nigeria has granted an interim order requiring Binance, a cryptocurrency exchange platform, to disclose information on all Nigerian users to the Economic and Financial Crimes Commission (EFCC). The order was issued in response to an ex parte motion by the EFCC's lawyer, with Justice Emeka Nwite ruling in favor of the request. This directive aims to assist the EFCC in investigating potential cases of money laundering and terrorism financing involving cryptocurrencies on Binance's platform.