Backpack Exchange responded to FTX's claims hours after the bankrupt exchange called the acquisition of its Cyprus entity unauthorised. The latest press release from Backpack emphasised that it has already purchased FTX EU from former insiders, with the transaction “completed and reflected on official publicly available German court records since June 2024.”

A Done Deal?

FTX sold its Cyprus-based FTX EU to “certain former insiders” in February 2024, and the deal was “approved by the FTX bankruptcy court in March 2024 and subsequently closed in May 2024.” Backpack further noted that the FTX bankruptcy estate had already received payments according to the purchase agreement.

“Backpack purchased the same European assets from these same insiders,” the latest retaliatory press release from Backpack stated.

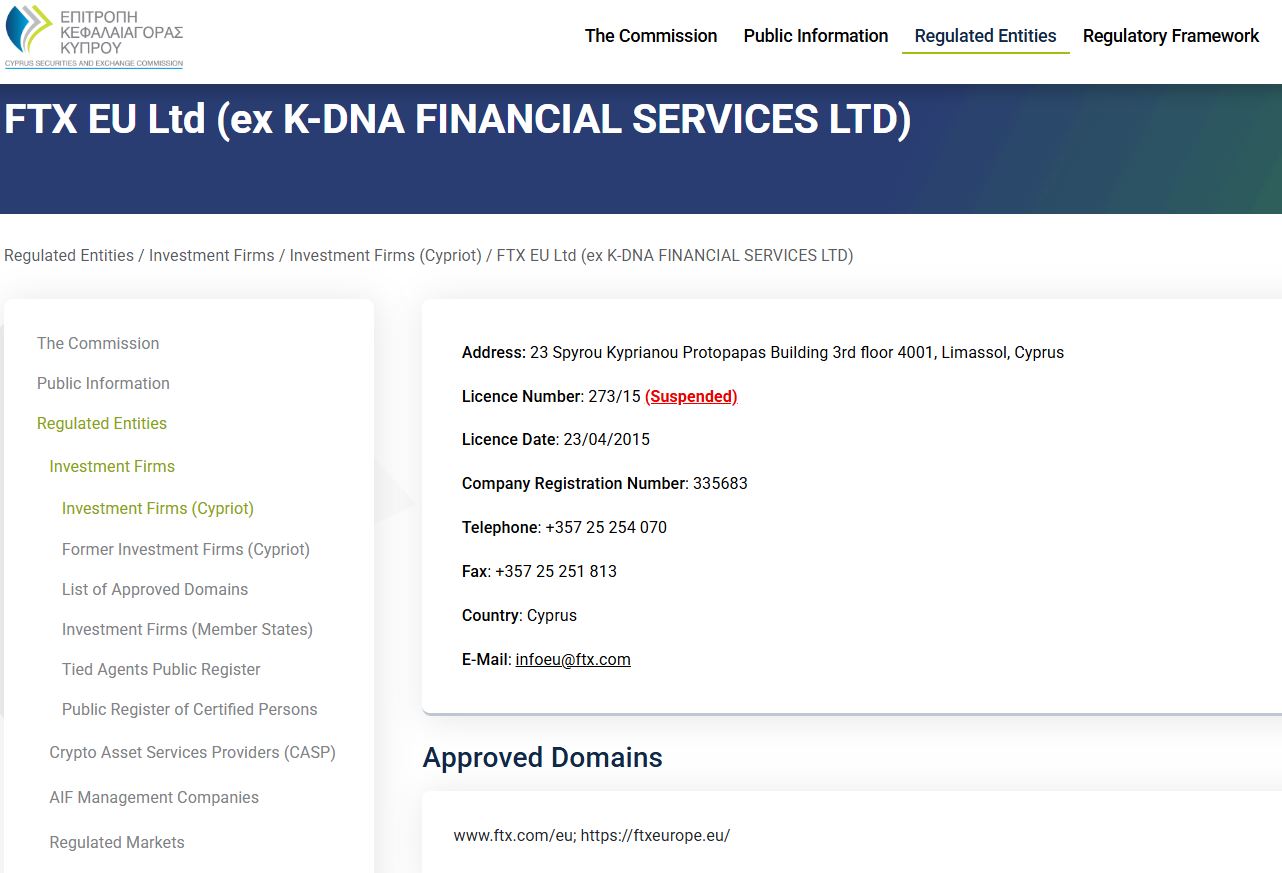

It also pointed out that the Cyprus Securities and Exchange Commission (CySEC), which regulates FTX EU, approved the deal last month after a “lengthy diligence process.”

“Following such approval, the FTX estate is obligated to transfer the shares as set out in the court-approved sales and purchase agreement,” Backpack added.

However, according to FTX's recent claims, “Neither FTX nor the US Bankruptcy Court was made aware of the indirect sale of FTX EU to Backpack prior to this week.”

Backpack also did not mention obtaining approval from the US Bankruptcy Court. However, as the “former insiders” already received that authorisation, it is unclear if another similar approval is required.

Another Brewing Crypto Drama?

Backpack first publicly announced its ownership of FTX EU earlier this week. According to Coindesk, it paid $32.7 million to acquire the Cyprus-regulated entity, enabling it to offer derivatives instruments across the European Economic Area.

In its earlier clarification, FTX also noted that Backpack did not have authorisation to make any distributions to FTX customers or creditors, adding that “FTX EU is solely responsible for the return of any funds it owes to former FTX EU customers.”

However, as Backpack asserted its claim to the ownership of FTX EU, it highlighted: “We look forward to the completion of the transfer so that, like the FTX bankruptcy estate, we can begin to return customer funds to former FTX EU customers.”

“The FTX estate will not be responsible for the repayment of any funds owed by FTX EU to former FTX EU customers,” Backpack added. “FTX EU will be renamed Backpack EU, and Backpack EU will be solely responsible for redistributing former FTX EU customer funds.”