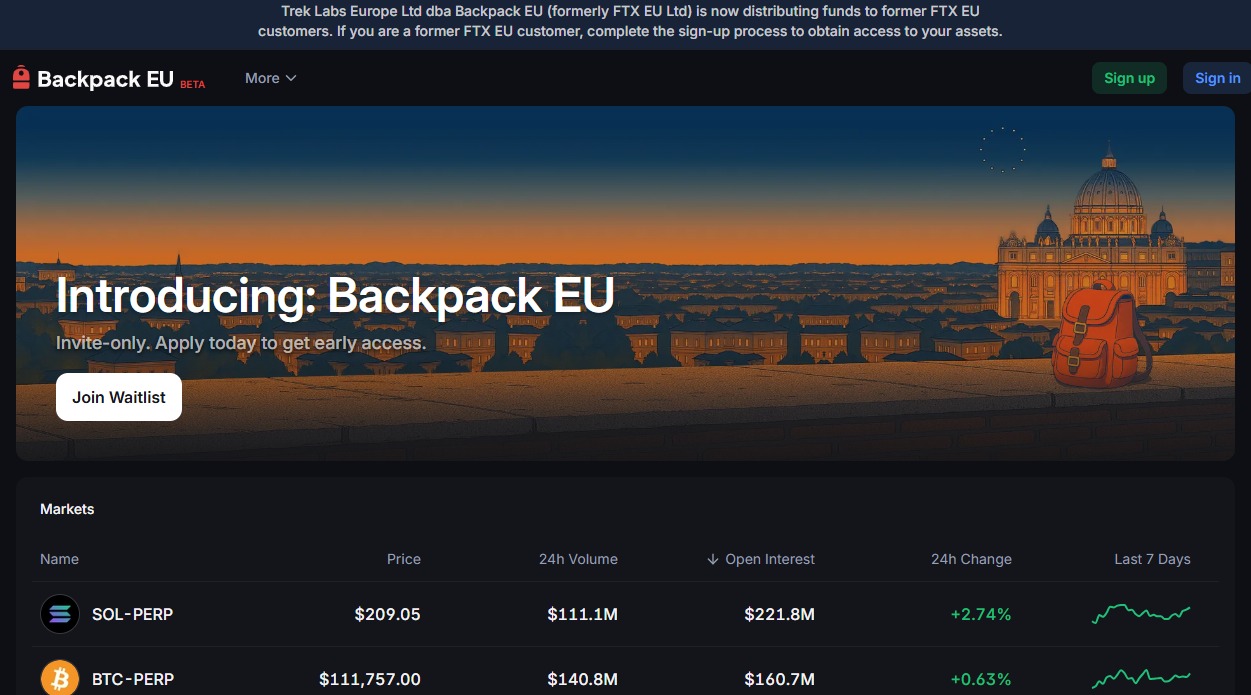

Backpack Exchange, which acquired the European unit of the now-collapsed FTX, has launched perpetual futures trading in the European Union “after fulfilling [its] promise to refund former FTX EU customers.”

The Platform Is Still in Beta

The services remain in Beta, and prospective customers must sign up for the waitlist at Backpack EU.

“We enter into the EU at a time when global regulators are providing clearer compliance frameworks, institutions are embracing crypto, and yet traders lack the regulated venues to meet the moment,” said Armani Ferrante, CEO of Backpack.

“We look forward to welcoming EU users to our platform and serving them in the years to come,” he added.

The exchange lists 40 trading pairs of perpetual futures, each with 10x leverage.

Read more: FTX EU (Now Trek Labs) Paid €200K in Latest CySEC Settlement

Perpetual futures differ from traditional futures contracts in one key way: they have no expiry date. While standard futures settle on a set date, perpetuals can be held indefinitely and instead use a funding rate mechanism—regular payments between long and short traders—to keep prices in line with the spot market.

This structure, popularised in crypto trading, allows continuous speculation and leverage without the need to roll over contracts.

Acquiring the Distressed FTX EU

Backpack EU announced its acquisition of FTX’s EU unit, which operated under a licence from the Cyprus Securities and Exchange Commission (CySEC), in early 2025. Reports valued the deal at $32.7 million.

Following the acquisition, Backpack also became liable for returning the funds of distressed FTX customers under the EU entity. FinanceMagnates.com reported earlier that the new owner began distributing claims to affected FTX EU customers in early 2025.

The latest announcement further emphasised that Backpack has been processing FTX EU customer claims since 2025.

Meanwhile, other major crypto brands have also entered Europe to offer perpetuals. Kraken, which obtained a MiFID II licence after acquiring a Cyprus broker, launched crypto derivatives in May. Coinbase also acquired a Cyprus-regulated broker but has yet to launch any product under its European licence.