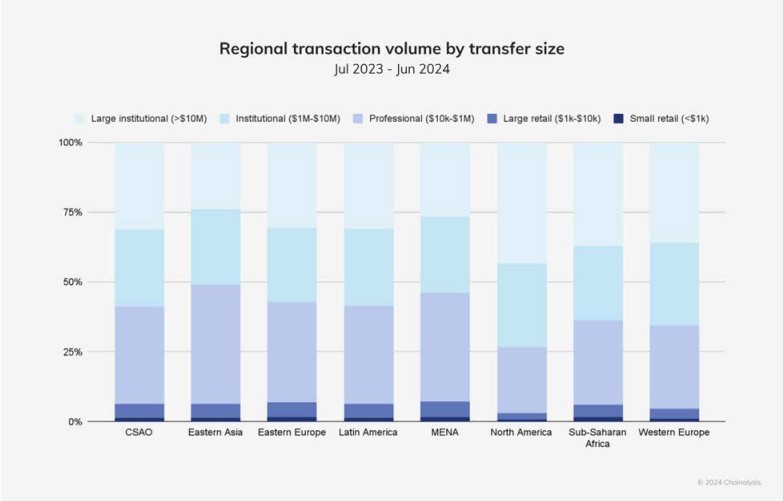

Institutional investment is reshaping the crypto landscape in established markets while emerging regions are becoming hubs for retail adoption. This is according to Chainalysis' report, which indicated that crypto has become more mainstream than ever, with varied economic forces driving its growth.

Central & Southern Asia

The 2024 Global Crypto Adoption Index revealed that Central & Southern Asia and Oceania (CSAO) lead the world in crypto adoption. The region boasts seven of the top 20 countries, showcasing high levels of activity across centralized services and decentralized finance (DeFi) protocols.

This rapid uptake is reportedly driven by a combination of retail and institutional interest, as well as a need for more accessible financial tools in emerging markets. Interestingly, crypto adoption in the CSAO region is primarily focused on using local exchanges and services to facilitate everyday transactions, which explains the high on-chain value of retail-sized transfers.

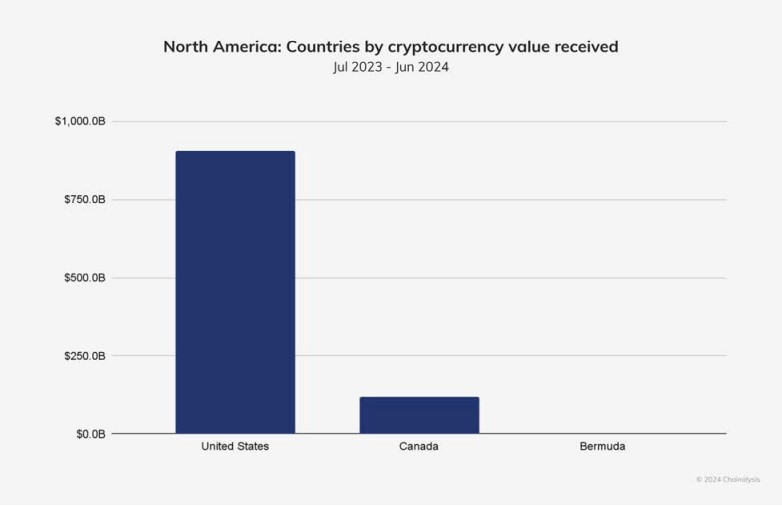

While CSAO leads in broad-based adoption, North America, particularly the United States, remains the largest crypto market in terms of sheer transaction volume. Over $1.3 trillion in on-chain value flowed through North American markets from July 2023 to June 2024. This is largely fueled by institutional players, with about 70% of transactions exceeding $1 million.

The US is emerging as a key pillar in global crypto, buoyed by the landmark launch of Bitcoin exchange-traded products (ETPs) in early 2024. These ETPs, backed by institutions like BlackRock and Fidelity, have attracted both retail and institutional investors, setting records for inflows and driving up the price of Bitcoin to new highs.

Bull Run Fueled by ETFs

Crypto activity surged between late 2023 and early 2024, with the total value of crypto transactions surpassing the 2021 bull market peak. The US Bitcoin ETF’s approval triggered significant institutional inflows, boosting Bitcoin’s price and contributing to a global bull run.

However, adoption patterns varied across regions, with high-income countries seeing a pullback while emerging markets experienced strong growth.

Stablecoins also played a critical role, especially in lower-income regions like Sub-Saharan Africa and Latin America. Here, stablecoins provided a hedge against inflation and currency volatility, becoming a lifeline for retail users looking for faster, more reliable financial tools.

While crypto adoption soared globally, the US market faces challenges, particularly in the realm of stablecoin regulation. In 2024, stablecoin usage shifted away from US-regulated platforms, reflecting delays in domestic regulatory clarity. This gap has allowed other regions, such as Europe and Singapore, to attract stablecoin projects under more favorable legal frameworks.