A couple of days ago Finance Magnates brought you exclusively the news that Binary.com is preparing for an ICO token offering. Today we can share some details on the matter after receiving some additional information from the company.

Binary.com will offer a total of 10 million digital tokens for sale via its ICO, which will be available through an open auction. The brokerage plans to give the buyers two options - either receive Payments which equate to shareholder dividends or convert their tokens into ordinary shares in the company.

Commenting to Finance Magnates, the CEO of the company, Jean-Yves Sireau, said: “The next step for a company of our size is naturally to go public by means of an Initial Public Offering (IPO). However, an IPO in itself is a cumbersome process that’s remained relatively unchanged for decades. Some would say it’s ripe for disruption.”

“By opting for the ICO route –– a kind of ‘IPO on the Blockchain ’ –– we can go beyond the limitations of a traditional IPO. We get a wider reach of potential investors, lower costs of trading, and an immutable audit trail of transactions on the blockchain. Through the ICO, we can also establish our trading services among the cryptocurrency community, which is a prime target demographic for our platform,” adds Sireau.

Key Financials

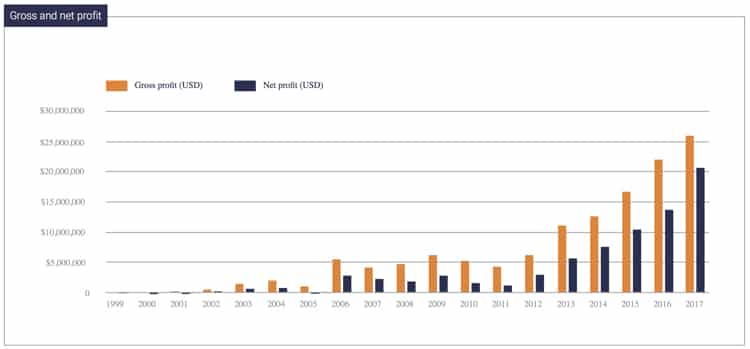

Since being established in 2000 as BetOnMarkets.com, the company has been registering consistent growth with the past three years being particularly successful for Binary.com. According to the details in the documents provided along with the ICO, the company’s net profits for 2017 are expected to surpass $20 million with the trading volumes exceeding $900 million.

Net profits for 2015 surpassed the $10 million mark, with the number reaching to just below $14 million last year.

Binary.com gross and net profits

The company’s turnover was over $750 million in 2015, and almost $850 million last year. Shareholders received close to $14 million in dividend payments last year and $12 million in 2016. The documents show that expectations for this year are around $13 million.

The firm states that this year the number of active clients that are using its platform surpassed 100,000. The number is materially higher than last year when the company’s clients reached close to 80,000.

The total number of transactions Binary.com clients executed reached almost 140 million in 2015 and dipped only slightly last year. The company expects it to rebound this year.

Binary.com to List Token on Lykke

In the run up to the ICO, Binary.com enhanced its existing cashier system to support cryptocurrency denominated accounts. Clients of the company will be able to deposit, trade, and withdraw funds in Bitcoin, Litecoin, with support for Bitcoin Cash and Ethereum incoming.

Last year the company branched out into forex and CFDs with the launch of MetaTrader 5. The company has added support for several digital currencies to its newest product.

Binary.com's tokens will be listed on the widely popular Lykke exchange after the ICO.