The world is embracing a seamless connection now. Consumers have higher expectations as well, especially when it involves making purchases. While the usage of cash keeps declining globally, the boosting economy in emerging markets is driving up the usage of digital wallets and all global alternative payment methods (APMs).

In recent years, with the adaptation and advancement of AI technology, e-commerce has become more and more personalized while enhancing customer satisfaction and encouraging loyalty and adoption among users. By analyzing vast amounts of data, including transaction histories, browsing behavior, and social media interactions, AI algorithms can understand consumers' preferences and offer personalized recommendations and targeted promotions. It helps the boom of global APMs as business is getting more borderless.

The convergence of emerging markets presents a significant opportunity for the expansion of global APMs. By addressing the unique needs and challenges of these markets while leveraging AI's capabilities, we can expect to see greater adoption, improved user experiences, and increased financial inclusion on a global scale.

Emerging Market Opportunities

All emerging markets are experiencing a mega boom in e-commerce, making now the perfect time for businesses to expand and grow into this region. For instance, according to a third-party report, Southeast Asia’s GDP is expected to reach 4.7 trillion dollars by 2025 - and it is one of the largest and fastest-growing emerging markets at the moment. By expanding to SEA, corporates will reach new heights riding with the economic growth as well as digital transformation.

The emerging economies of India and Southeast Asia, including countries like Indonesia, Thailand, Malaysia, Vietnam, and the Philippines, are projected to experience the most robust e-commerce growth in the APAC region throughout the period leading up to 2026. This growth can be attributed to several factors such as increasing mobile penetration, rising disposable incomes, a growing middle class, and favorable policies that encourage digital commerce. As these economies continue to develop and embrace technology, the e-commerce sector is expected to flourish, presenting numerous opportunities for businesses looking to tap into these markets.

The Philippines, Indonesia, India, Malaysia, and Vietnam are all projected to have at least a 15% growth rate while the Philippines ranked top with an 18% annual growth rate until 2026 on e-commerce.

Across the emerging market, digital transformation has reached unprecedented levels in recent years. This trend has been fueled by an influx of young, tech-loving consumers who have embraced e-business and social media as well as a strong start-up sector. There is no doubt the emerging market is being transformed by a digital wave and will continue to grow in the next decade.

Almost every aspect of business and social life is being transformed by this digital boom, from online retail to food delivery services. More and more, the demands for a globally connected payment gateway are increasing among emerging market businesses. In addition to connecting small and medium-sized enterprises with global supply chains, it is also critical to connect them with a trustworthy Asia payment gateway for further industry innovation and closer economic integration.

All-in-one Payment Gateway Services

As the leading payment provider in APAC, Payment Asia has witnessed the transformation of payment methods and adapted to the digital development of the payment industry in the past two decades. With the commitment to reduce transaction costs and maximize profits for our merchants, the company aims to provide the best service with the advancement of technology.

The company has long been known for providing its all-in-one processing service in the region, simplifying the decision-making process, and providing a comprehensive set of services in a single package. This saves time and effort in researching, selecting, and integrating different products or services.

The solution supports a wide range of alternative payment methods, including digital wallets, bank transfers, mobile payments, QR Code payments, and localized payment methods popular in different regions, allowing clients to cater to diverse customer preferences and increase conversion rates.

Paul Tang, COO of Payment Asia, highlights the company’s commitment to providing an all-in-one experience, and continuation of providing customers with the most comprehensive payment solution in the region.

“Our goal is to provide our customers with the best all-in-one experience. Adapting advanced technologies in our daily operation continues to help us to boost efficiency and turn our intentions for ESG into a workable reality.”

Payment Asia is also expanding its range of global APMs. In 2023, processing for regions such as South Korea, India, and South Africa has incubated into our gateway in addition to the aforementioned ASEAN countries. Payment Asia is here to cater to these nations’ growing demand for seamless and secure payment solutions. Japanese solution will soon be offered, and we expect to cover more continents in 2024. A secure and high-quality global payment gateway can definitely enhance the business footprint of our merchants, and subsequently increase opportunities via the utilization of trust-worthy solutions provided by Payment Asia.

Future Tech Integration for Business

The trend of AI in global alternative payments is on the rise, driven by advancements in technology and changing consumer expectations.

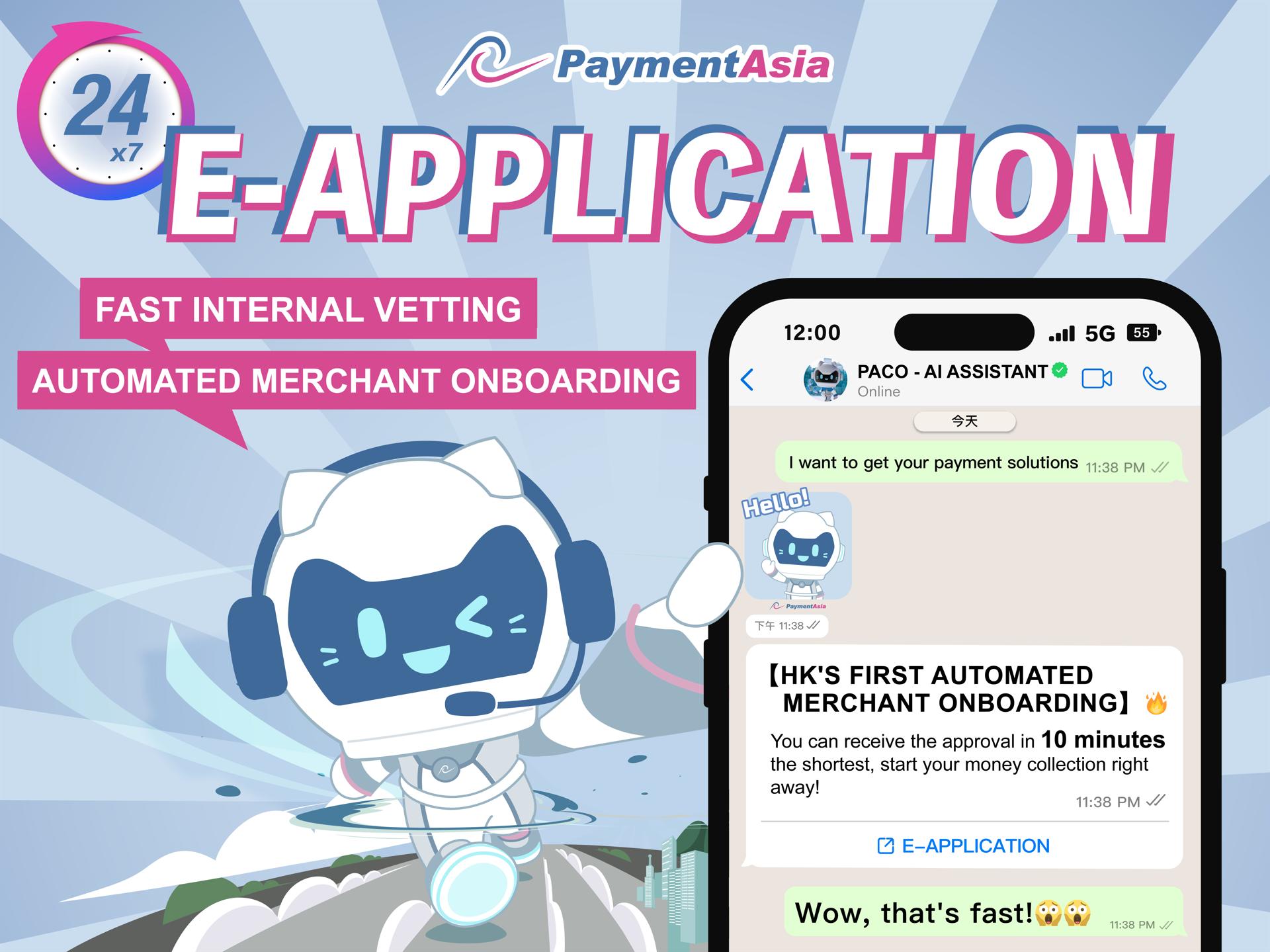

Payment Asia also adapts to the latest technology trends, offering automated merchant onboarding, AI customer service, and an auto accounting system. Furthermore, the future integration of ChatGPT, an AI natural language model, will dramatically enhance customer service by providing accurate responses and improving customer satisfaction. The company is also leveraging AI to enhance operational efficiency and actualize ESG objectives.

The most recent and relevant adaptation is an AI-powered chatbot, or so-called virtual assistant to improve the customer experience by offering personalized and instant support. These AI chatbots can handle all payment-related queries with certain training. Customers can easily find needed information, be directed to the related webpage if needed, and complete their application process. Studies show that using AI chatbots can increase efficiency by at least 15%, simplifying the payment process and reducing friction.

AI is also widely used in compliance processes and risk management. AI enables payment providers to analyze vast amounts of data to assess creditworthiness accurately. AI also plays a significant role in the e-KYC (Electronic Know Your Customer) process, which is used to verify the identity of individuals remotely. AI algorithms can analyze and authenticate identity documents such as passports and ID cards. These algorithms can detect forged or manipulated documents by comparing them against known templates, security features, and databases. Also, facial recognition technology can compare a person's live image or selfie with photos on the provided identity document. This helps ensure that the person presenting the document is the same individual.

With the increasing complexity of fraud and cybersecurity threats, AI is being used to strengthen security measures in alternative payment systems. Machine learning algorithms can detect and prevent fraudulent activities in real time, providing an extra layer of protection for both businesses and consumers.

Payment Asia would like to prioritize ESG values as AI continues to advance, and we can expect further integration of these technologies in global alternative payments. The focus will be on enhancing security, improving user experiences, and leveraging data analytics to deliver personalized and frictionless payment solutions. AI promotes sustainability, as the company reduces environmental impact, improves efficiency, and minimizes paper usage.

In the future, Payment Asia will also explore AI usage via blockchain technology. AI has been utilized to enhance the security and efficiency of blockchain-based payment systems for quite some time and the technique is proven to be ready. Machine learning algorithms can analyze blockchain transactions to identify suspicious activities, detect anomalies, and ensure compliance with regulations. With its commitment to customer satisfaction, Payment Asia hopes to bring more services and tech innovation for years to come.