Ahead of the US market open this Thursday, New Jersey-based online brokerage operator GAIN Capital Holdings Inc., listed on the NYSE under ticker symbol GCAP, has released its 2016 first quarter (Q1) results, according to an official company press release, and shortly before the company's earnings call that will take place 8am EST.

GAIN reported net revenue of $115.6 million, up from $93 million when compared to Q1 2015 on a year-over-year basis and up from $102.8 million during Q4 2015, while adjusted EBITDA was $31.7 million for Q1 and higher from $19.8 million over the same period last year. The company's EBITDA metrics have been improving, as explained by the company's CFO during the conference call.

Net income also rose to $8.4 million from $5.5 million YoY, yet was nearly half as much as the prior quarter, down from the $15.5 million reported for Q4 2015, comparing quarter-over-quarter (QoQ). Meanwhile, the company’s adjusted net income was $16.9 million and higher YoY, compared to the adjusted net income of $10.8 million reported for Q1 2015. This resulted in adjusted earnings per share (EPS) of $0.35 (up from $0.24 YoY and from $0.32 MoM), and $0.17 on a diluted basis.

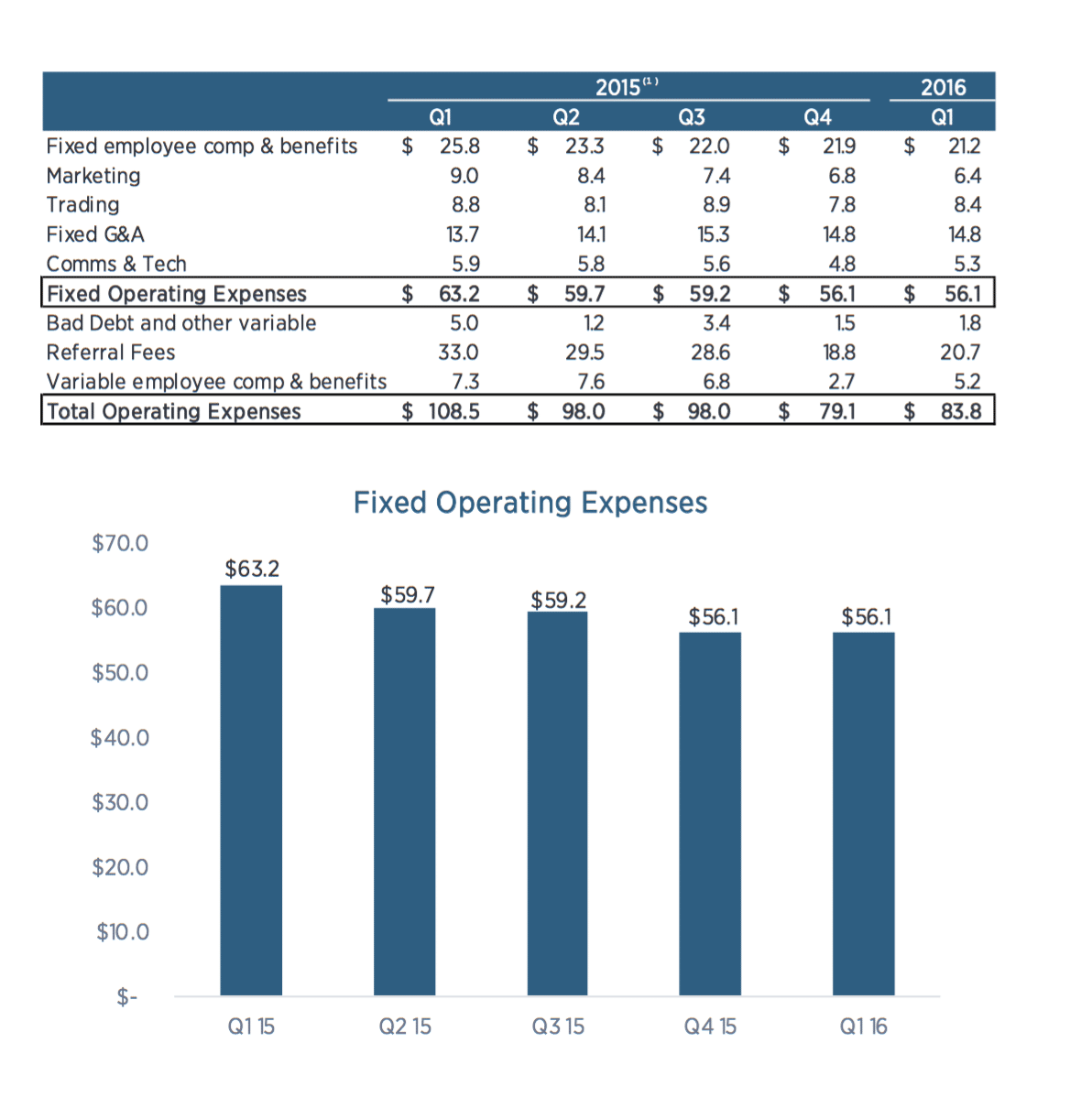

Net revenue for the quarter was $115.6 million, up from $93.0 million in the first quarter of 2015, and adjusted EBITDA was $31.7 million, up from $19.8 million in the first quarter of 2015. Operating expenses also rose from $73.2 million in the prior year period to $83.8 million during Q1 2015, yet the company will focus on cost reductions, according to comments made by management in the update.

Cost savings come into focus

Commenting in the press release, GAIN Capital CEO Glenn Stevens said: "Our performance this quarter reflects the strength of GAIN's business and operating model and demonstrates the earnings power of the company. For the trailing twelve months ended March 31, 2016, GAIN delivered over $92 million of adjusted EBITDA."

Mr. Stevens added: "The first quarter of 2016 represents the third consecutive quarter that GAIN has delivered more than $20 million of adjusted EBITDA," and concluded, "Our financial results highlight our ability to capture synergies from acquisitions and reduce our overall costs. Operating margins should continue to improve as we deliver approximately $45 million in run-rate cost synergies by Q4 2016 from the City Index integration and focus on overall cost reductions."

In response to questions during the conference call, the firm's institutional business was brought up and parts of it such as those related to the prime of prime (PoP) segment was explained by the firms CEO as having been migrated over to the City Index platform and subsequently seeing a pullback in some customer volumes on the new platform.

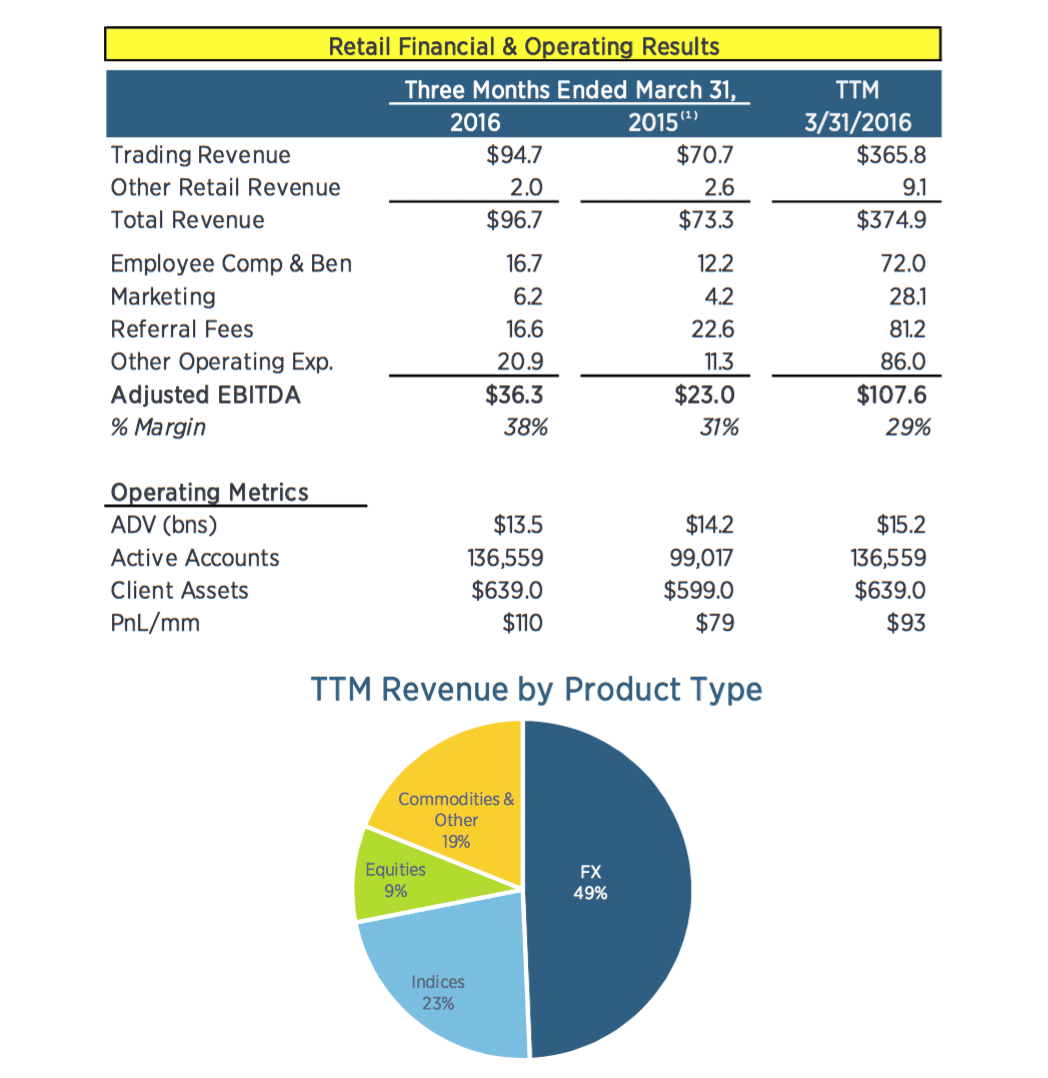

GAIN's average daily Retail Trading volume was $13.5 billion in the first quarter of 2016, down 5% from $14.2 billion in the first quarter of 2015. Furthermore, the average daily trading volume on the ECN and for the Swap Dealer was $8.3 billion and $2.9 billion, respectively, in the first quarter of 2016. In addition, average daily futures contracts were 38,275 in the first quarter of 2016. The company is continuing to implement cost savings synergies and expects those efforts to continue towards the end of 2016, as explained by the company's CFO during the conference call. An excerpt from the slide of the presentation used in the conference call related to recent operating costs can be seen below.

Source: GAIN Capital

April trading metrics

The company also included April retail operating metrics which showed that the average daily volume for GAIN’s OTC trading reached $12.2 billion, and was higher by 5% from the prior month, yet down 30.2% YoY. OTC trading volume totaled $255.8 billion, lower by 4.1% from March 2016 and down 33.4% from April 2015, according to the press release.

The number of active OTC accounts, defined as having placed a trading in the trailing twelve month period, reached 140,286 in April, up by 2.7% from March - yet lower by 4.4% YoY. GAIN reported that for April its ECN average daily volume reached $7.8 billion, which was higher by 5.7% MoM and up 1.7% YoY, yet lower than the Q1 average of $8.3 billion. However, the ECN overall volume for the month was $163.2 billion, lower by 3.5% from March 2016 and down 2.9% YoY, indicating a difference in the number of trading days compared to the prior month - despite the higher ADV.

The ADV from the company's swap dealer business in April was of $3.3 billion, an increase of 18.6% from March 2016 and 0.3% from April 2015. Swap dealer total volumes reached $69.7 billion last month, higher by 8.3% from March 2016, while lower by 4.3% compared to the same month last year.

The company's futures trading volumes were also included in the April trading metrics, and ADV in that segment was 36,488 contracts during the month, higher by 2.6% from March 2016 and up 12.3% when compared YoY. The total number of futures contracts traded in April were reported as 766,254 and lower by 2.1% from March 2016 yet up by 12.3% YoY. In addition, the number of active futures accounts at the end of April were 8,931, higher by 0.5% from March 2016 and up 3.5% YoY.

Source: GAIN Capital Q1 2016 earnings