Scanning through FXCM’s Q2 2012 report, here are some important notes we found.

- Retail revenues from markup are shrinking due to larger clients discounted pricing

- FXCM re-launches Dealing Desk offering in Australia and plans to offer it worldwide

- Decreases in referral broker fees by 13.7% when compared to Q2 2011

Retail revenues from markup are shrinking due to larger clients discounted pricing

Retail trading for the quarter dropped by 16.7% to $77.9 million. This occurred even though trading volumes only decreased by 7.4%. Causing the accelerated drop in revenue was a 10% drop in markup levels that FXCM was receiving on trades. The decrease in markup was reflected in its overall contribution to Retail Trading Revenues. Markup revenues dropped to 71% of overall Retail Trading Revenue from 79%. Other revenues such as payment for order flow from Liquidity providers plus CFD gains have become more important to the overall units revenues.

When questioned about the drop per/million markup, Jaclyn Klein, Vice President of Corporate Communications at FXCM referred us to FXCM’s conference call where the broker said “that our customer mix in the quarter shifted towards the larger clients with discounted pricing, which brought down our $$/MM.”

FXCM re-launches Dealing Desk offering in Australia and plans to offer it worldwide

In its company description, FXCM added these comments:

“The Company intends to launch an offering to its smaller retail clients to trade with a dealing desk, or principal model. In the principal model offering, the Company will earn revenue from: (i) the difference between the retail bid/offer spread and wholesale bid/offer spread for trades the Company has chosen to hedge, (ii) the entire retail bid/offer spread in trades where the Company’s customers’ trades have naturally offset each other, and (iii) net gains or losses, if any, where the Company has not hedged the customer trade”

These quotes appeared to indicate that FXCM was preparing to offer a Dealing Desk model to smaller size accounts. We asked FXCM for specifics as to how the new dealing desk offering would work and whether it would be offered worldwide. Jaclyn Klein clarified for us that the broker would now also offer a dealing desk option, and that it would be offered worldwide in the coming weeks. Mrs. Klein felt it important to point out that FXCM will NEVER switch any clients forex execution type from No Dealing Desk to dealing desk without prior consent.

Jaclyn added that the dealing desk option is already being marketed on the company’s Australian website www.forextrading.com.au. Klein also added that “FXCM always has, and still does, believe that a No Dealing Desk execution is the right execution for the best overall trading experience. However, FXCM also believes in quality customer service and a fully customizable trading experience. FXCM is committed to offering as many options as possible, and the new Dealing Desk execution offering will be another option for clients to take advantage of and use to tailor their trading strategies.” (In the Australian website, FXCM details as to how a dealing desk works and comparisons to its NDD model)

FXCM’s rational behind the dealing desk product is to offer clients a tighter spread offering. According to details that exist on the Australian website, trades will continue to be executed at market, with no re-quotes. Interestingly though, FXCM makes it clear on their website that clients found trying to abuse the dealing desk prices (IE arbitrage) will be switched to NDD execution.

In its July Metrics Slideshow (see below), FXCM added that narrowed spreads “dominates new client acquisition.” As such, they stated that “We believe that by introducing a narrow spread, principal model offering our competitive advantages in brand, scale, financial strength, platform and customer service will enable us to capture a significant portion of these small accounts.”

Decreases in referral broker fees by 13.7% when compared to Q2 2011

FXCM was also seeing a drop in Payments to its referring brokers. They attributed the drop in business to a regulatory change that took place in Asia. The drop in Asian fees was first seen in Q1 but accelerated in Q2.

July Metrics

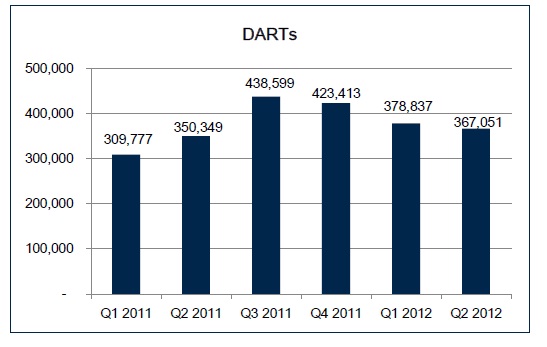

In addition to the 10Q, FXCM also released its July Metrics slideshow analysis for its recent quarter. The figures showed that DARTs fell for the 3rd quarter in a row, after peaking in Q3 2011.

This trend is continuing as July figures are below Q2’s. Also, although total active accounts and customer cash balances are steadily increasing, it hasn’t been followed by an increase in retail trading volumes.

On the positive side, FXCM’s institutional business segment has been steadily versus last year’s figures. Also, July’s figure of $60 billion in volume puts the division well in place to shatter its previous quarterly high of $143 billion in Q4 2011.

FXCM also added that second quarter purchase Lucid Markets added $3.9 million in revenues for the quarter. Lucid would have added $24.0 million in revenues and $4.2 million ($0.06/share) net income if it had been part of FXCM for the entire quarter.

FXCM also added that it was continuing to pursue M&A deals and growing its institutional market business.