Crypto has come a long way over the past decade, and if you had to define where in its history we are right now, one possible answer would be that we’ve entered a validation phase. By which, what’s meant is that major names from traditional finance and fintech are not only acknowledging the value of crypto but are actively moving to incorporate it into their products and portfolios.

This was apparent when BlackRock (along with several competitors) filed with the SEC to launch a spot Bitcoin ETF, with CEO Larry Fink last month publicly stating, “If we can create more tokenization of assets and securities–that’s what bitcoin is–it could revolutionize finance,” while he also spoke of crypto as “digitizing gold,” statements that would have been unthinkable not so long ago (Fink described Bitcoin as an “index of money laundering” in 2017.)

And, this validation and mainstreaming of crypto is clear when we take a look at PayPal, and the launch this month of its new stablecoin, PayPal USD (PYUSD).

What Is PYUSD?

A stablecoin refers to a crypto token that is pegged to a real-world physical currency, most commonly, and in PayPal’s case, the US dollar. From the crypto world, stablecoins are, arguably, the product with the most obvious immediate utility: a USD stablecoin can simply be treated in exactly the same way as an actual dollar, but it exists on a blockchain.

PayPal’s product, PYUSD, is fully backed by physical assets, dollar deposits, US Treasuries, and cash equivalents, meaning that for every PYUSD issued, equivalent value exists in the real world. PYUSD is issued by the blockchain infrastructure firm, Paxos, which formerly minted Binance stablecoin BUSD, and issues its own stablecoin, Paxos Standard, and PYUSD is an ERC-20 token, which is a fungible token on the Ethereum blockchain.

PYUSD can be bought through PayPal, but it can also be transferred to external, self-custody crypto wallets such as MetaMask, creating a firm link between the crypto or Web3 ecosystem, and the standard payment networks of which PayPal is a component, and integration with Venmo is also planned.

Regarding this connection between traditional assets and digital currencies, Dan Schulman, the current President and CEO of PayPal, has stated that: “The shift toward digital currencies requires a stable instrument that is both digitally native and easily connected to fiat currency like the U.S. dollar.”

How Does PYUSD Compare to Similar Products?

One factor running in favor of PYUSD is the perception of PayPal as stable, secure, and regulatorily compliant. PayPal was issued with a BitLicense by the New York State Department of Financial Services in 2022 and will publish a PYUSD Reserve Report starting from September this year, confirming that its stablecoin is fully backed by reserve assets.

Jose Fernandez da Ponte, the Senior Vice President of Blockchain, Crypto, and Digital Currencies at PayPal, has stated: “Paxos is the official issuer, receiving approval from the New York Department of Financial Security. Given New York’s stringent mandates related to KYC and anti-money laundering, we’ve ensured the requisite controls are firmly in place.”

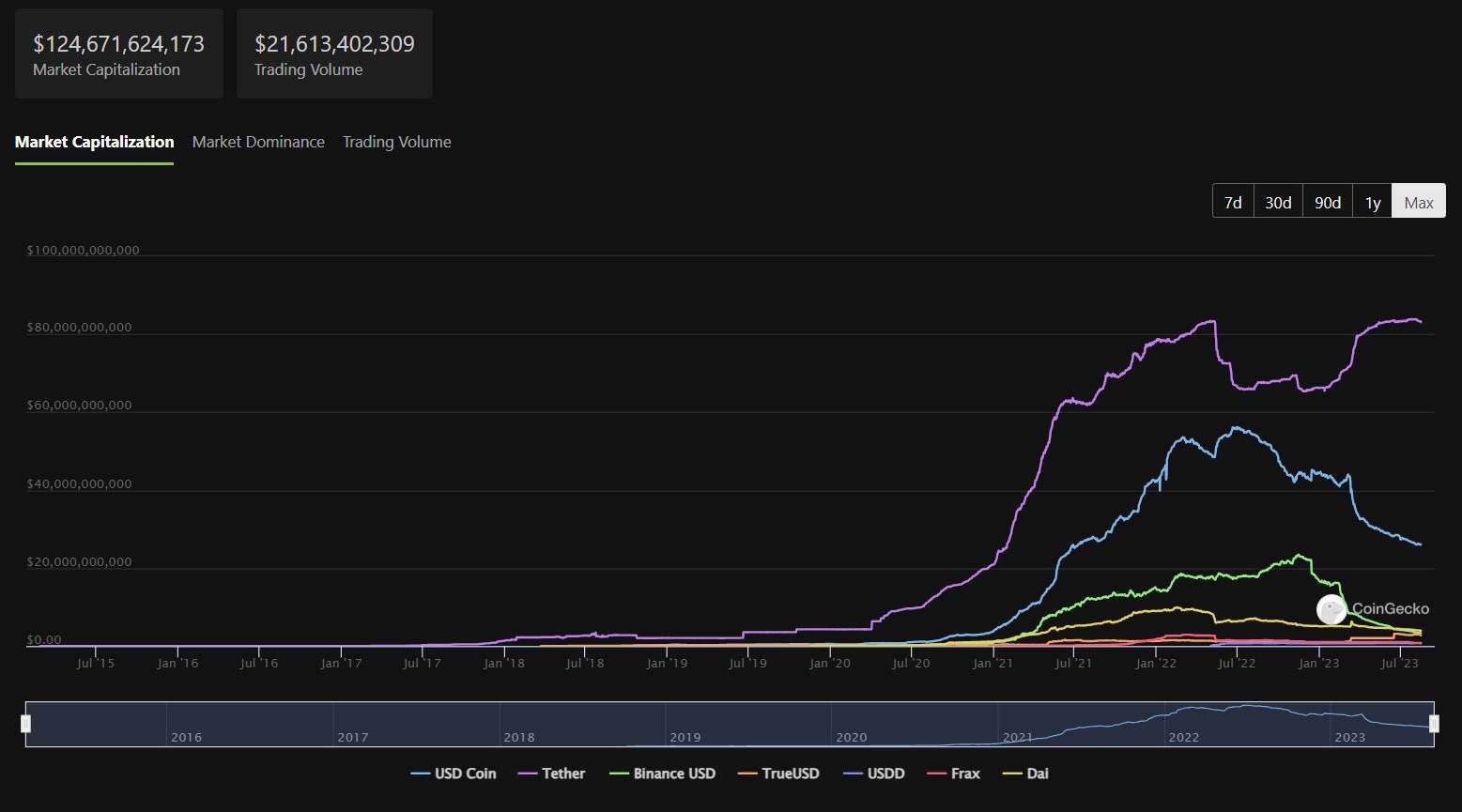

PYUSD’s primary competitors are Tether and USDC. Tether has the greater market cap of the two, and both, like PYUSD, are asset-backed. There are also decentralized stablecoins, such as DAI and Curve USD, both of which are issued by DeFi protocols (MakerDAO and Curve Finance, respectively), and are collateralized with crypto assets deposited into smart contracts.

PayPal’s Cryptocurrencies Hub

Following the launch of PYUSD, PayPal has announced plans for the launch of a service called the Cryptocurrencies Hub. This will be linked to users' regular accounts and will focus on buying and selling crypto assets, as well as conversion between PYUSD and crypto assets.

This appears to tie in with another statement made by Da Ponte, in which he said: “I think DeFi will be part of the first wave in the sense that we want to go where crypto users are using stablecoins today, and DeFi is a use case for that.”

DeFi has for some time functioned as an independent financial ecosystem, operating on its own terms, and detached from conventional rails. However, it seems that centralized platforms may now be looking at ways to connect.

New President and CEO

A further development relating to PayPal’s crypto push is that from the end of September, Alex Chriss will take over from Dan Schulman as the President and CEO. Chriss is currently the Executive VP and General Manager of the Small Business and Self-Employed Group at technology platform Intuit, which is well-known for products, such as QuickBooks, TurboTax and Mailchimp.

It's an honor to join this iconic tech company and work alongside the incredible @PayPal team! 🚀 https://t.co/T0a8sp5TIm

— Alex Chriss (@acce) August 14, 2023

Chriss oversaw the acquisition of Mailchimp in a deal in 2021 valued at $12 billion, and the division of which he is in charge is responsible for around half of Intuit’s revenue. Furthermore, Chriss came out on top of the selection process in which there were eight other candidates.

What’s curious is that Chriss’ role at Intuit is connected with the growth of small businesses, which hints at an emphasis on regrowth at PayPal, the company laid off around 7% of its workforce in February, and in this case, that may relate to the expansion of crypto-related services and the integration of digital assets.