At the end of October, PayPal gained official approval from the Financial Conduct Authority (FCA) in the UK, to offer certain crypto services. At first glance, this looks like a positive development if you happen to think crypto adoption is a positive thing. However, on looking at the details of the FCA’s position, it becomes less apparent whether PayPal is being granted meaningful permissions, or whether the permissions on offer serve only to define certain inherent restrictions.

On top of that, the Bank of England this week released proposals relating to the integration of stablecoin payments through a plan for regulation, which again, looks like a step towards crypto adoption, but with the caveat that terms and conditions apply.

This is all coming in the wake of suggestions earlier this year from British politicians (including the Prime Minister himself) that the UK should become a hub of crypto and web3 activity, and so it’s worth reflecting on what that is actually shaping up to look like so far.

What Does FCA Approval Mean for PayPal?

PayPal can now be found on the FCA’s list of registered cryptocurrency firms, meaning it’s compliant with anti-money laundering regulations, but is restricted from onboarding new crypto customers, and existing customers can only hold and sell crypto, while PayPal is unable to expand its crypto service offerings.

From the perspective of individuals looking to interact freely with crypto, this means that PayPal is a highly limited option, or indeed, not an option at all for new users, and that crypto-native decentralized applications remain the most viable solution.

PayPal and Crypto

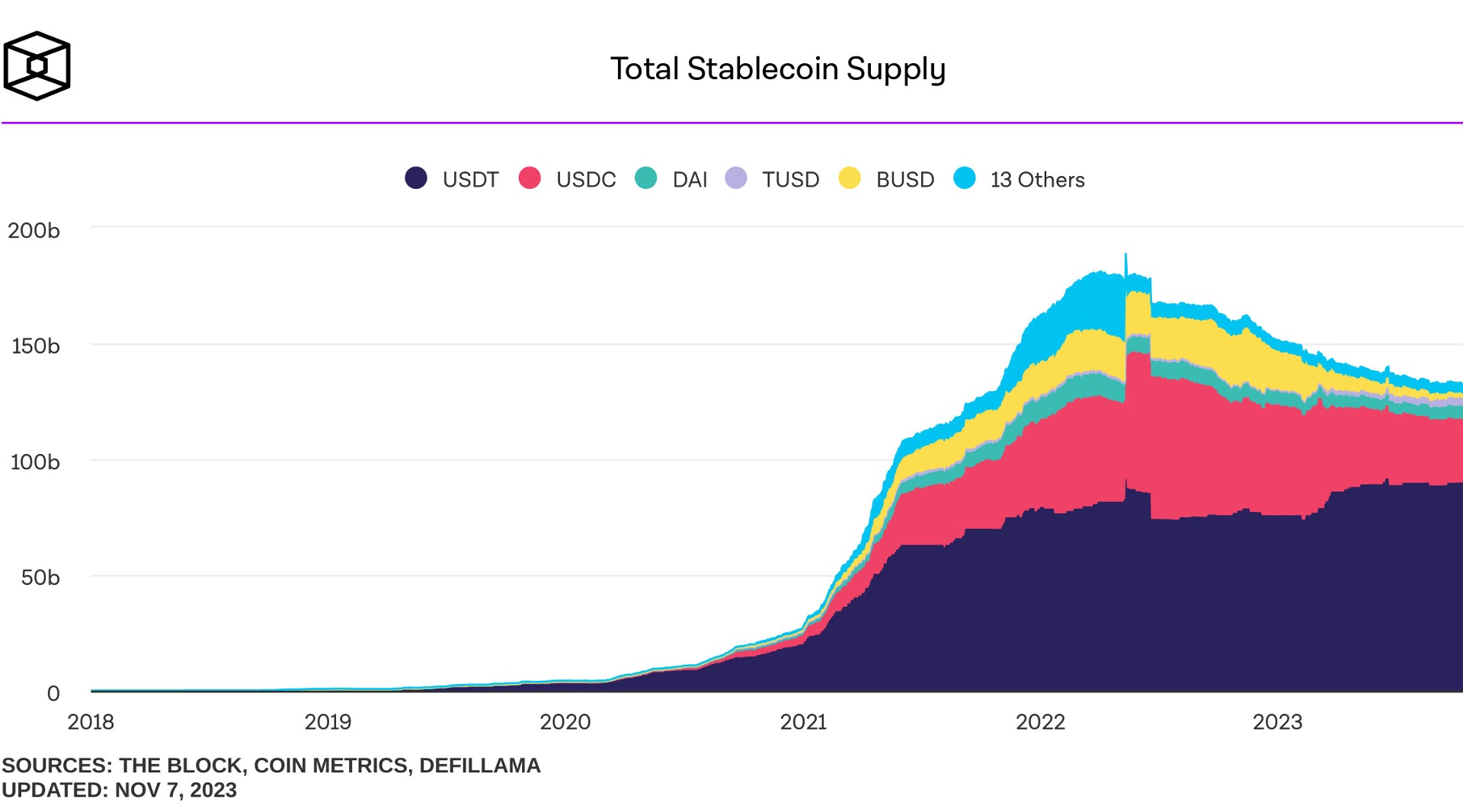

In August this year, PayPal took what looked like a hugely significant step when it launched its own dollar-backed stablecoin, PayPal USD (PYUSD), which was fully backed, and appeared to mark the moment when crypto products started to be produced by traditional finance and payments companies.

In the same month, PayPal also announced that a new CEO was incoming, with Alex Chriss to take over the position from Dan Schulman, a change that became effective in September, and suggested the possibility of new directions for the platform.

However, PYUSD has subsequently run into potential complications in the US with–perhaps unsurprisingly, considering the agency's continuing hostility towards crypto–the SEC, which at the beginning of November issued a subpoena to PayPal requesting publicly unspecified documents.

Stablecoins in the UK

Returning to the UK, the Bank of England this week published a proposed regulatory regime which deals specifically with stablecoins and the systemic payments systems they enable. It’s focused on GBP-pegged stablecoins, and sets out its plans alongside a discussion paper from the FCA, and a letter from the Prudential Regulation Authority (PRA).

We have published a Discussion Paper setting out the Bank’s proposed regulatory regime for systemic payment systems using stablecoins and related service providers: https://t.co/xtlbDN4Fqd

— Bank of England (@bankofengland) November 6, 2023

Share your views on the regime by Tuesday, 6 February 2024: https://t.co/AiICZomiDn pic.twitter.com/lEkz25EPer

Critically, the Bank of England’s possible framework emphasizes the innovative nature of stablecoins and recognizes their utility, while making clear its position that,

“As a new form of privately issued money, issuers of stablecoins used in systemic payment systems should meet standards that are at least equivalent to those that apply to commercial banks.”

Additionally, points where the proposed regime is explicitly at odds with the decentralized and non-permissioned nature of crypto are made apparent when it's stated that,

“We recognise the benefits that new forms of ledgers can bring for payments. However, some existing stablecoin payment chains using public permissionless ledgers do not have centralised governance arrangements. In order to be used at systemic scale, any such payment system would have to assure us that a legal entity or natural person could be held accountable and responsible for end-to-end risk management in the payment system and compliance with regulation.”

What appears to be emerging, then, is formal permission for a new kind of money that takes on some characteristics of a CBDC–in that it is fiat-pegged, heavily regulated, and not decentralized–but which is privately issued.

Regulators Draw Distinctions

It seems that in both the UK and the US, a familiar routine is playing out that close followers of crypto will by now have become accustomed to. Even as crypto-native companies push on with development, traditional finance and payments companies move towards crypto integration, and while senior politicians (in some regions) express interest in crypto and web3, regulatory bodies and central banks emphasize the need for restrictions, and pivot away from money-like digital assets which are on public blockchains and that are truly decentralized.

However, while this may at times be frustrating for crypto advocates, it’s a far cry from just a few years ago, when crypto was dismissed by many as an unserious sector, and when regulation wasn’t discussed because it wasn’t expected to become a necessity.

By that measure, the current situation is a step forward, and the direction of movement remains towards the greater adoption and integration of crypto. However, as distinctions are drawn between centralized assets and public blockchains, it becomes apparent that certain core aspects of the crypto world–tokens exchanged without third parties on public networks–may by their nature always fall outside the bounds of closely-controlled oversight.